SFDR:

ESAs PROPOSE A NEW CLASSIFICATION SYSTEM

EXTERNAL ARTICLE

Estimated reading time: 2 min.

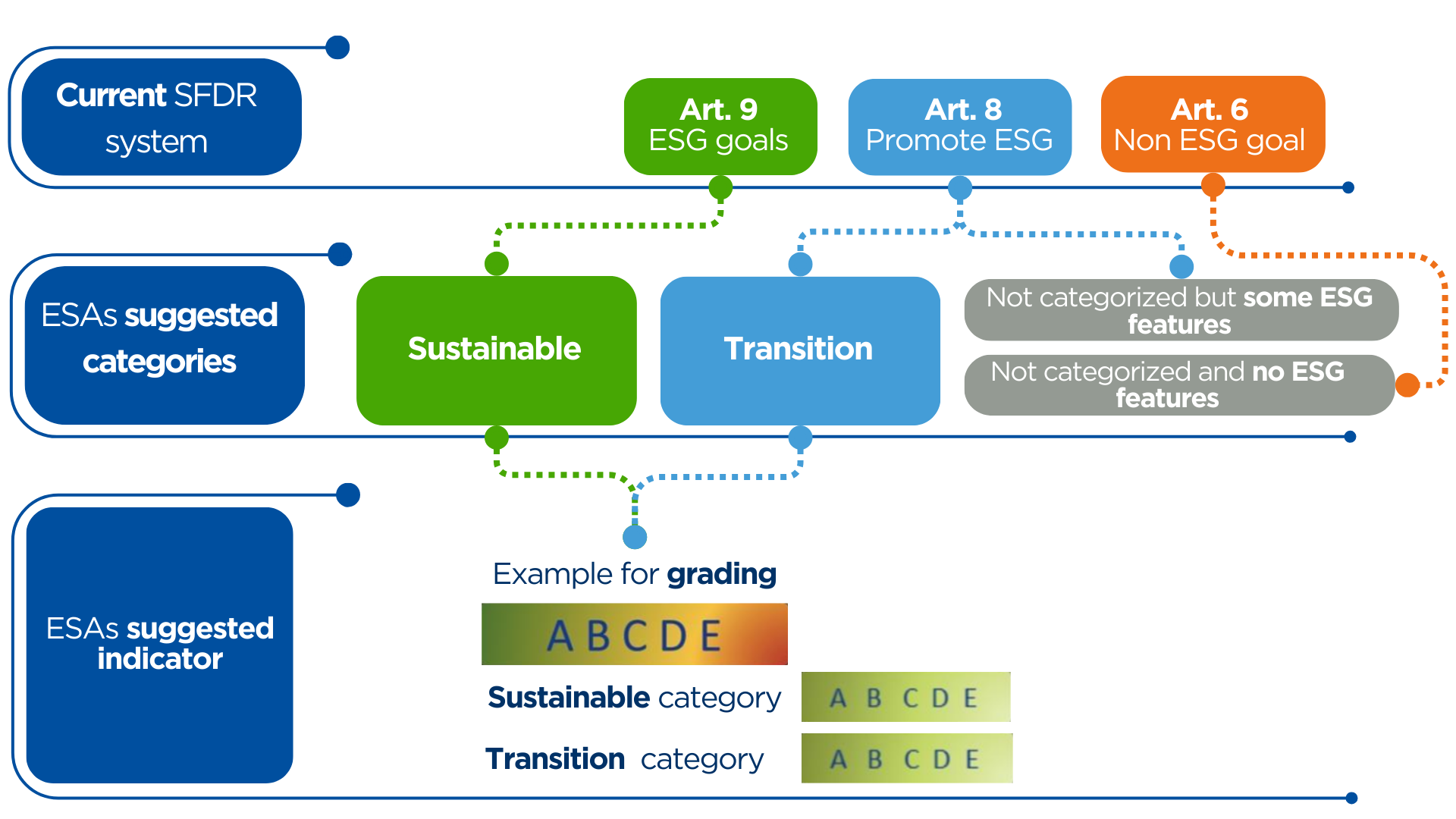

Since its adoption in 2019, the Sustainable Finance Disclosure Regulation (SFDR) has aimed to improve transparency around the sustainability objectives of financial products. The framework was later expanded with amendments in 2020 and detailed Regulatory Technical Standards (RTS) in 2022. In 2023, the European Commission (EC) launched a consultation process to gather feedback on its effectiveness.

At the end of December 2023, the European Supervisory Authorities (ESAs) published their response, calling for significant changes to the system in line with stakeholder views. Their proposals focus on simplifying classifications and making sustainability claims more reliable and comparable.

KEY UPDATES IN THE SFDR FRAMEWORK

The ESAs recommend a revised system built on two streamlined categories:

- Sustainability category: for products that make a substantial contribution to sustainable development objectives, defined by specific and measurable criteria.

- Transition category: for products moving towards sustainability but not yet meeting the full requirements of the Sustainability category. These are assessed on their ongoing efforts to strengthen environmental and social characteristics.

In addition, the ESAs propose a grading system to evaluate and communicate the degree of alignment between financial products and sustainability goals. This new indicator would make sustainability credentials easier to compare and understand for investors.

IMPLICATIONS FOR THE FINANCIAL INDUSTRY

For financial actors—including asset managers, insurance companies, pension funds, and financial advisors—the proposed changes carry practical consequences:

Overall, the new framework aims to align investor information with real, measurable sustainability outcomes.

LOOKING AHEAD

The ESAs’ proposals mark a step towards greater clarity, transparency, and consistency in sustainable finance regulation. However, further guidance from the European Commission will be needed to define detailed thresholds, methodologies, and implementation timelines.

For the financial sector, the transition will require balancing compliance with innovation, ensuring that products can both meet regulatory standards and address investors’ growing demand for credible sustainability.

FROM DISCLOSURE TO TRANSPARENCY

The suggested overhaul of the SFDR reflects a broader trend: shifting from complex disclosure requirements to clearer, outcome-oriented classifications. By introducing simplified categories and a new grading system, the ESAs aim to provide investors with reliable information and strengthen trust in sustainable finance.

EXPLORE MORE ARTICLES

COMMON QUESTIONS ABOUT THIS TOPIC

Title

What is the SFDR and why was it introduced?

The SFDR requires financial market participants and advisers to disclose how they integrate sustainability risks and consider adverse sustainability impacts in their investment decisions and products. Its goal is to enhance transparency and help end-investors compare sustainability-related information.

Title

Who is subject to the SFDR disclosure requirements?

It applies to asset managers, insurers, pension providers, investment firms and other financial market participants operating or marketing products in the EU — covering both entity-level and product-level disclosures.

Title

What are the main product-classification categories under SFDR?

Products are classified into three key articles: Article 6 (no sustainability objective), Article 8 (promotes environmental or social characteristics) and Article 9 (sustainable investment objective). Each category triggers specific disclosure requirements.

Title

What are the key disclosure obligations under SFDR?

Financial market participants must publish on their website their sustainability-risk policy, a statement on principal adverse impacts (PAIs), integrate sustainability risks into remuneration policy (entity level), and provide pre-contractual and periodic product disclosures regarding sustainability characteristics or objectives.

Title

When did the main SFDR requirements come into force and what ongoing changes exist?

The core SFDR provisions became effective from 10 March 2021, with detailed technical standards applying from 1 January 2023. The framework is under review and further amendments are expected to improve usability and transparency.