EU TAXONOMY REGULATION

Fundamental driver to navigate the transition to a low-carbon, resilient and resource-efficient economy

EXTERNAL ARTICLE

Estimated reading time: 3 min.

A cornerstone of the EU Sustainable Finance Framework, the Taxonomy Regulation establishes a legally binding classification system for environmentally sustainable activities.

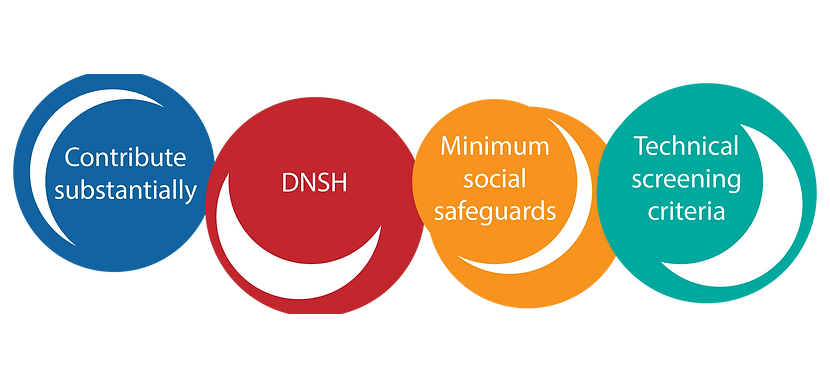

Its goal is to channel investments towards projects and companies that make a substantial contribution to environmental objectives, while avoiding significant harm to others and respecting minimum social safeguards.

In this article, you will discover:

FROM POLICY TO PRACTICE: THE EU's GREEN OBJECTIVES

Like the United Nations and OECD, the European Union has created its own ESG framework, aligned with the Paris Agreement, the Sustainable Development Goals (SDGs), and the EU Green Deal.

Its main goals are to:

- Identify green activities

- Harmonize green labels

- Prevent greenwashing

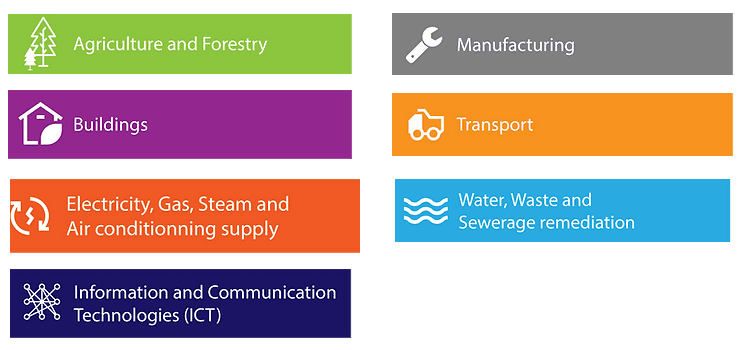

The EU Taxonomy defines six environmental objectives:

Climate change mitigation

Climate change adaptation

Sustainable use and protection of water and marine resources

Transition to a circular economy

Pollution prevention and control

Protection and restoration of biodiversity and ecosystems

Finance is seen as a critical driver of transformation for both European and global industries.

HOW THE EU TAXONOMY WAS BUILT: A PARTICIPATIVE APPROACH

To develop the taxonomy, the European Commission set up a Technical Expert Group (TEG) made up of 35 members from civil society, academia, business, and the financial sector, plus observers from EU and international public bodies.

Public consultations ensured transparency, allowing stakeholders to provide feedback.

The implementation was planned in two stages:

- Stage 1: apply the taxonomy to the first two climate objectives (mitigation & adaptation)

- Stage 2: extend it to all six objectives

WHO MUST COMPLY: THE THREE KEY USER GROUPS

The EU Taxonomy applies to:

PREPARING FOR THE FUTURE OF SUSTAINABLE FINANCE

The EU Taxonomy is more than a compliance requirement — it is a strategic tool for directing capital flows towards activities that truly contribute to environmental goals.

Understanding its objectives, methodology, and obligations is key to ensuring readiness and leveraging the opportunities of sustainable finance.

EXPLORE MORE ARTICLES

COMMON QUESTIONS ABOUT THIS TOPIC

Title

What is the EU Taxonomy and why was it created?

The EU Taxonomy is a legally-binding classification system establishing what economic activities can be considered environmentally sustainable — aiming to channel investment into green activities and prevent greenwashing.

Title

Which environmental objectives does the Taxonomy cover?

It covers six objectives: 1) Climate change mitigation, 2) Climate change adaptation, 3) Sustainable use and protection of water and marine resources, 4) Transition to a circular economy, 5) Pollution prevention and control, and 6) Protection and restoration of biodiversity and ecosystems.

Title

Who must comply with the EU Taxonomy and how is it implemented?

Three main groups apply: (i) EU & Member States (defining green labels, incentives); (ii) Financial market participants (disclosing under Sustainable Finance Disclosure Regulation – SFDR); (iii) Large companies (e.g., > 500 employees) under Corporate Sustainability Reporting Directive (CSRD)-related disclosures.

Title

What are the key criteria for an activity to be taxonomy-aligned?

An activity must: (a) substantially contribute to at least one environmental objective; (b) do no significant harm (DNSH) to the other objectives; and (c) comply with minimum social safeguards.

Title

How should investment portfolios be assessed for Taxonomy alignment?

For portfolios: identify relevant activities in held companies, assess each company’s turnover/capex/opex alignment, aggregate those to derive a portfolio-level alignment percentage (taxonomy-eligible vs taxonomy-aligned) and consider strategic implications for transition risk.