AMDIS

The solution for asset management

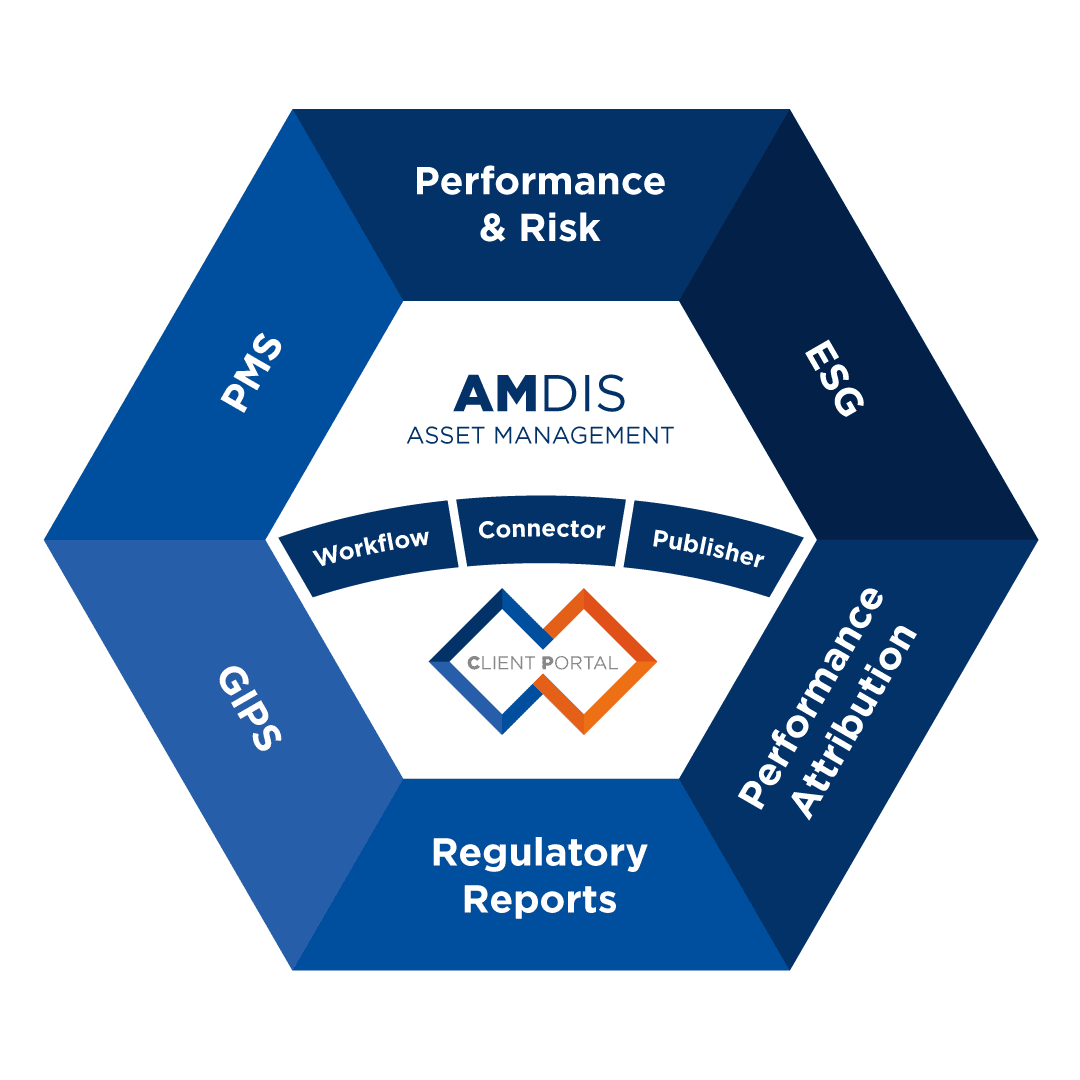

Designed for asset managers, the AMDIS solution centralizes analytics, portfolio steering, regulatory reporting, and client communication into one integrated platform.

With a modular, building-block approach, AMDIS covers the entire investment cycle—portfolio management, performance and risk analytics, attribution, ESG integration, GIPS® compliance, regulatory reports, and more.

Gain efficiency, transparency, and control while staying agile in a fast-changing regulatory and market environment.

EXPLORE THE AMDIS MODULES

Build your own solution with a full suite of integrated modules—each designed to address a specific part of the investment process while working seamlessly together.

Informative Card

Informative Card

Informative Card