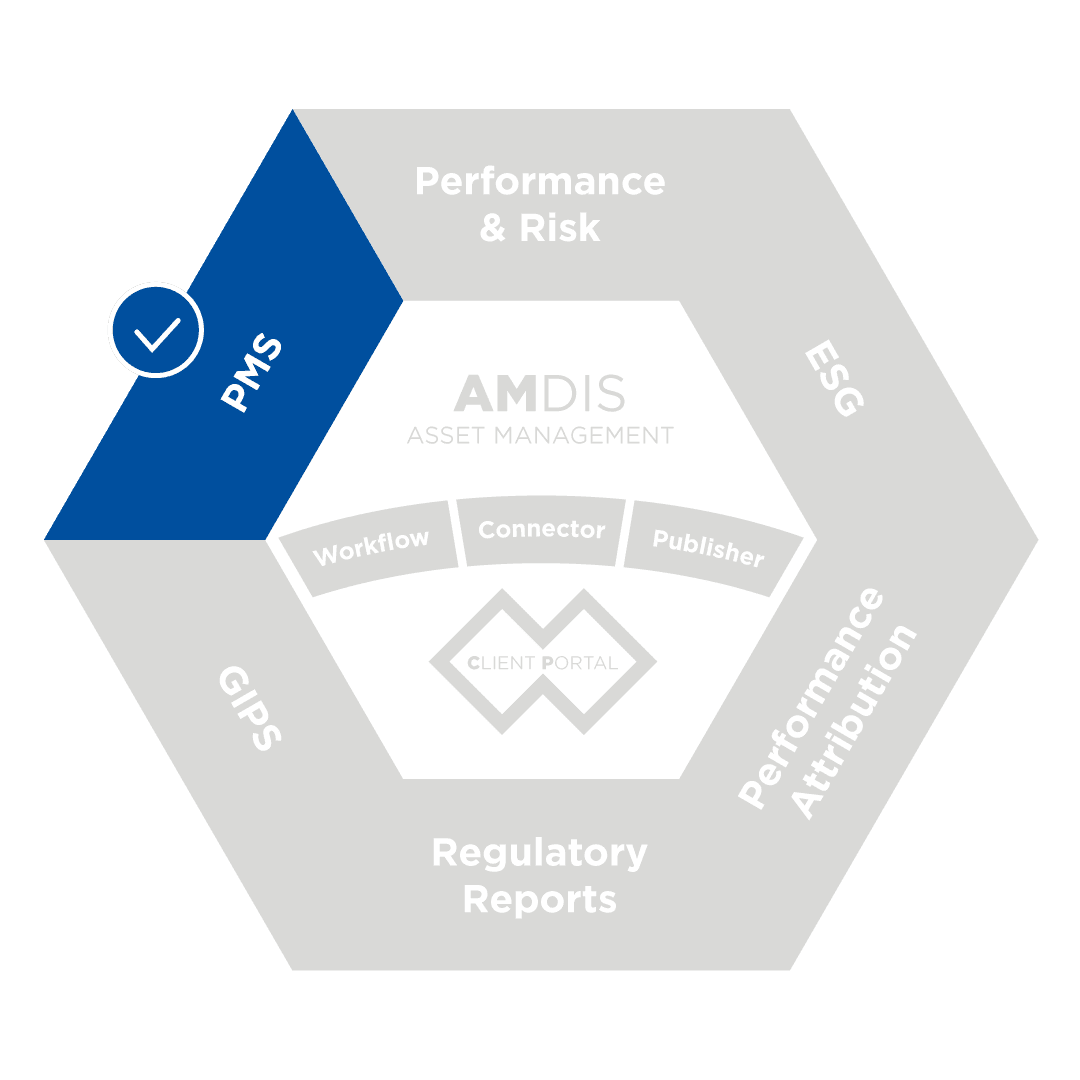

PMS MODULE

Seamless front-to-back portfolio management.

AMINDIS’ PMS Module ensures seamless front-to-back portfolio management by connecting data, processes, and compliance in one secure and consistent ecosystem.

BENEFITS OF USING AMINDIS' PMS MODULE

PMS FEATURES

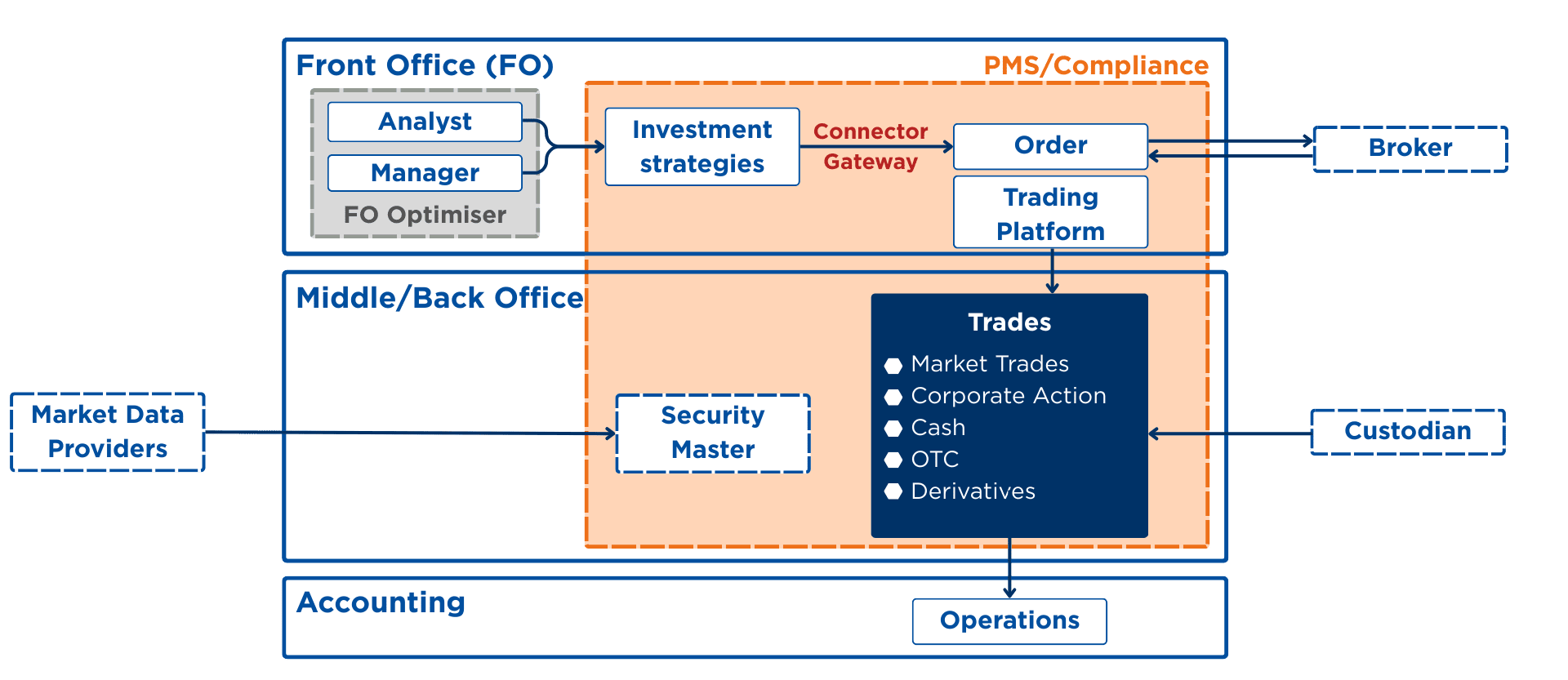

AMINDIS is a pioneer in integrated portfolio management. The PMS Module combines a robust data structure with advanced process management to cover the full investment chain—front office, middle office, and compliance. Every feature is designed to ensure operational consistency, data reliability, and secure workflows tailored to your business needs.

Title

Robust data structure

The PMS Module centralizes every portfolio dimension within a consistent and extensible model. It covers all data needed for investment management and ensures that information is always reliable and easy to use.

It manages:

- Business accounts, portfolios, and related bank or custodian accounts

- Security characteristics, including financial and non-financial data (ESG, ratings, market data)

With advanced classification systems—static, dynamic, historical, or automatically derived—data can be organized and reused across operational and analytical processes. The module also offers:

- Configurable extension to add new types of data without IT dependency

- Document integration with full historization

- Calculations engines for both standard and atypical financial instruments

This combination ensures completeness, flexibility, and a strong foundation for every investment process.

Title

Advanced order & transaction management

All transactions are handled in a secure, automated way, covering market trades, corporate actions, cash movements, and OTC operations including collateral. The module ensures every stakeholder—brokers, custodians, agents, and settlement partners—is fully integrated within a controlled and auditable workflow, reducing errors and increasing efficiency.

Title

Process integration across front-to-back

The PMS Module connects all actors in a single ecosystem where validated, consistent data is shared seamlessly.

Title

Customizable workflows

Each client can define its own operating model thanks to the workflow configuration engine. From data management to order handling or compliance tasks, processes are tailored to fit specific needs. This flexibility ensures efficiency while maintaining transparency and secure execution across the organization.

Title

Comprehensive compliance oversight

Compliance is fully integrated into portfolio management. Rules can be updated centrally and applied automatically in ex-ante mode, while ex-post controls and periodic monitoring reinforce regulatory assurance. Breaches are detected, tracked, and resolved within the same environment, ensuring transparency and full traceability.

Title

Auditability & transparency

Every action and document is historized and fully auditable. Detailed trails ensure traceability at every step of the workflow, while calculation engines handle both standard and complex instruments. This creates a secure and transparent environment where investment processes can be monitored, validated, and trusted.

CHECK OUT COMPLEMENTARY SOLUTIONS FOR ASSET MANAGERS

EXPLORE THE BUSINESS RELATED TO OUR PMS MODULE