ESG MODULE

Master ESG diversity with a scalable, no-code solution

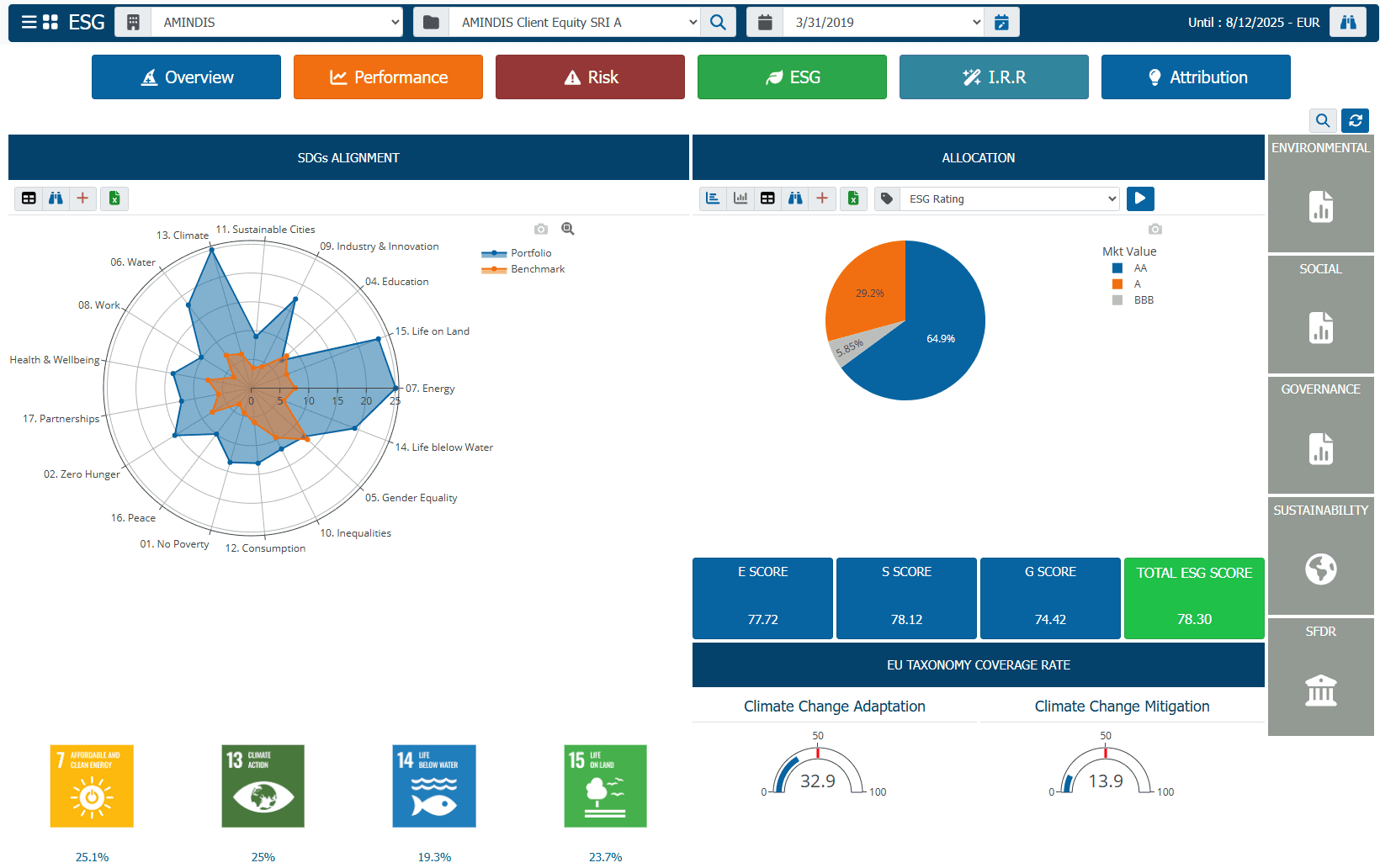

The AMINDIS ESG module empowers asset owners to embed sustainability at the heart of their investment process. More than a reporting tool, it consolidates fragmented ESG data, automates complex calculations, and ensures compliance with ever-evolving regulations.

VALUE DELIVERED TO ASSET OWNERS

ESG MODULE FEATURES

AMINDIS empowers asset owners to fully integrate sustainability into their investment process. Each feature is designed to give you control, clarity, and compliance—from raw data to impactful reporting.

Title

ESG data, fully under control

Centralize, standardize, and enrich ESG data from multiple providers while keeping full control over quality, structure, and integration.

![]() Easy integration

Easy integration

- Connect all ESG data sources effortlessly via the AMINIDS Connector, harmonizing multiple formats and providers without technical barriers.

- Add new datasets in just a few clicks thanks to configurable ETL workflows. Whether your sources are internal or external, make your ESG data immediately ready for analysis.

- Partnership with Rimes: a standard gateway to import and aggregate multiple ESG providers in a single, streamlined process.

![]() Native metrics library

Native metrics library

- Sustainable Development Goals alignment: assess portfolio alignment with the SDG using configurable scoring and mapping.

- Voting data: track shareholder engagement and voting outcomes with governance dashboards.

- Carbon footprint: measure portfolio emissions and track decarbonization progress.

- Taxonomy alignment: ensure that your portfolios comply with the EU Taxonomy framework.

- Biodiversity impact: analyse exposure to biodiversity-related risks and opportunities across holdings.

- … and more.

![]() From data to 360° insights

From data to 360° insights

Go beyond raw data collection—our ESG engine consolidates datasets across multiple dimensions to deliver a clear and accurate picture of portfolio alignment with sustainability objectives.

- Automatic cascading: ESG data is retrieved progressively—from instrument to issuer, parent, then ultimate issuer—to ensure the most complete coverage possible.

- Proxy handling: fill data gaps using market proxies from peers.

- Instant analytics: make data ready in the analytics engine for reporting, scoring, and continuous monitoring.

- Own ESG indicators: define and build your own ESG indicators from any internal or external dataset.

- Historical storage: store ESG data overtime.

- Data formats covered: store both quantitative and qualitative data.

Title

Advanced ESG analytics

Turn integrated data into actionable insights with powerful analytics.

- New IRR: integrates risk, return and ESG for a holistic portfolio overview.

- Carbon attribution: measure decarbonization and its return impact.

- ESG attribution: break down which ESG decisions impact your performance.

- Look-through: fund look-through available on ESG data.

- Multiple aggregation methods: select the best aggregation methods to consolidate ESG data across your strategies.

- Available for benchmark & indexes: calculate ESG metrics for major benchmarks and indexes.

Title

ESG reports at a glance

Produce regulatory-compliant and customized reports in one click.

- Environment reports: generate a detailed analysis of the environmental impact.

- Social reports: produce tailored reports on social criteria such as diversity, labor practices, and community impact.

- Governance reports: deliver governance insights, including voting behavior and board composition.

- Client reports: Create customized ESG reports for mandates.

- CSRD & SFDR: automated compliance reporting.

- Factsheets: Integrate ESG data smoothly into factsheet production with dedicated ESG pages.

- Global ESG report: Consolidate all ESG dimensions into a unified report.

- Biodiversity: measure and report on biodiversity impact within your investment portfolio.

- Sustainable Development Goals: track alignment and progress towards UN SDG in your reports.

- Carbon emissions reports: Produce in-depth carbon emissions analysis for transparent disclosure.

- EET templates: generate standardized ESG data files for distributors.

- Reports available for Front Office and compliance teams.

- Instantly accessible through the AMINDIS’ Client Portal.

Title

Automated checks

Maintain full confidence in your ESG reporting with over 120 configurable validation rules applied at every stage of the process. Our system ensures accuracy, consistency, and compliance before your data is used in any calculation or report.

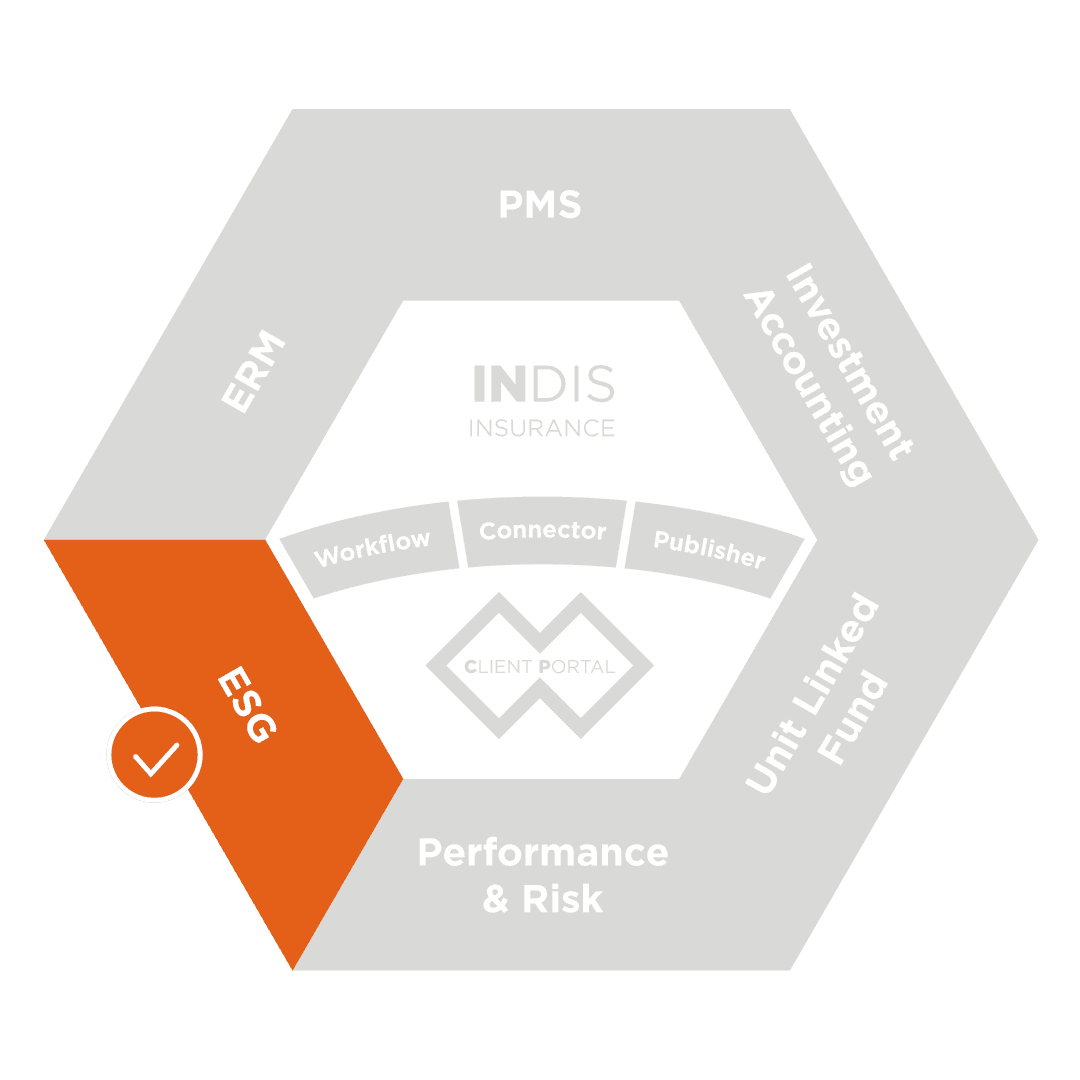

COMPLEMENT THE ESG WITH OUR OTHER MODULES FOR ASSET OWNERS

EXPLORE THE ESG MODULE IN ACTION ACROSS EVERY BUSINESS ACTIVITY