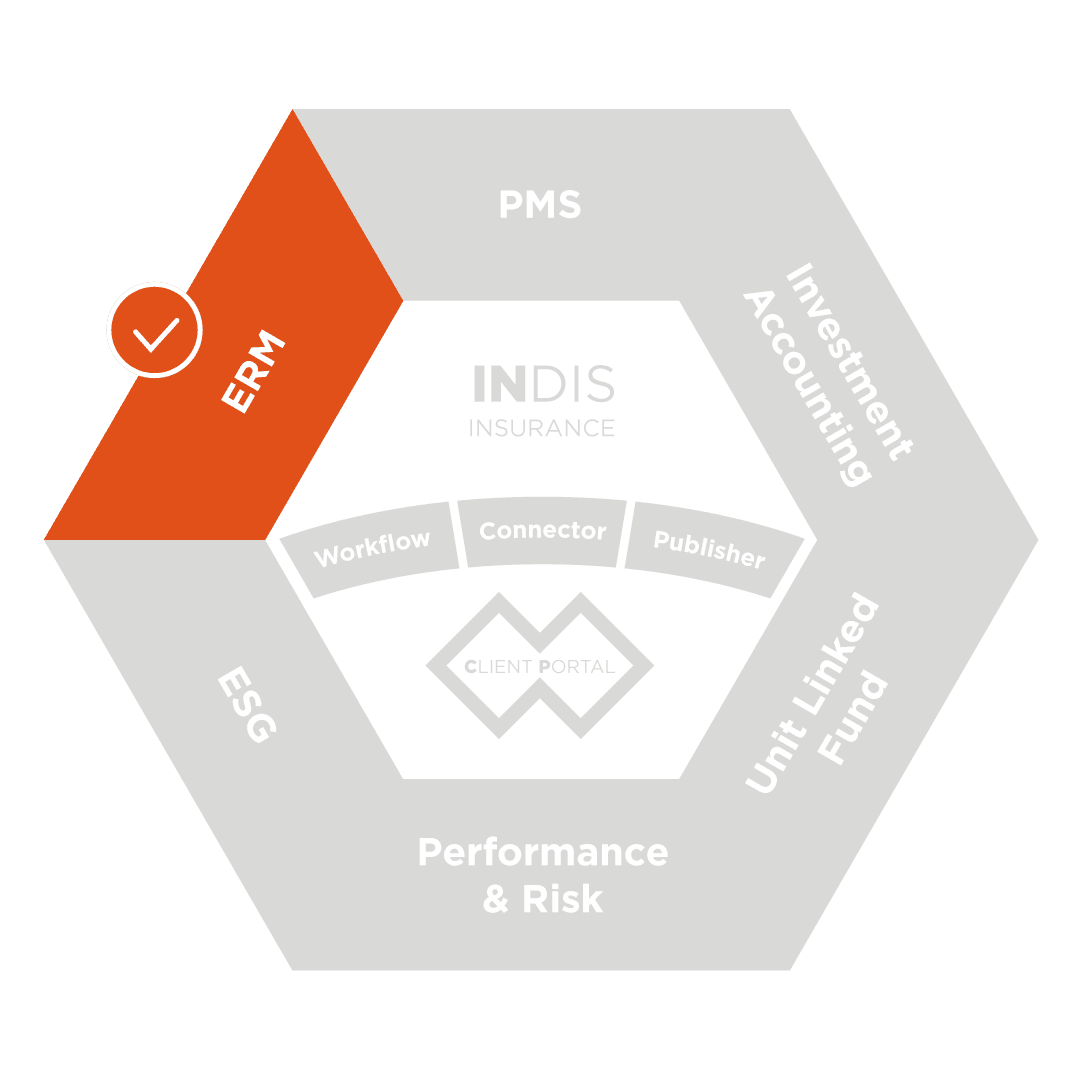

ERM MODULE

Flexible simulations for risk and strategy.

AMINDIS’ ERM Module unifies simulations for Solvency II, ALM, and budget forecasting. With its low-code equation editor, flexible architecture, and centralized data, it delivers transparent, auditable, and adaptable models for smarter decision-making.

BENEFITS OF AMINDIS' ERM MODULE

ERM FEATURES

The ERM Module combines flexibility, transparency, and automation to handle every stage of enterprise risk modeling. From scenario design to results monitoring, each feature ensures consistency, auditability, and decision-ready outputs—turning complex simulations into a reliable management tool.

Title

Ultra-flexible architecture

The ERM Module is built on unique four-layer design that connects market factors, products, strategies, and new instruments into one coherent simulation framework.

Title

Equation editor, no black boxes

The ERM Module features an intuitive low-code equation editor where users can design and adapt models without IT support. Equipped with standard function libraries and inter-model links through criteria matching, it ensures transparency and flexibility. Built-in audit tools track changes over time, guaranteeing full control and eliminating black-box approaches.

Title

Scenario-based simulations

Simulations can be run deterministically, stochastically, or with multi-parameter variations to explore sensitivities and stress resilience. Users define horizons and time steps—for instance, monthly over 3 years for budget forecasts or annual over 50 years for Solvency II—while selecting the exact variables to calculate and monitor. This flexibility makes scenario analysis both precise and scalable.

Title

Integrated results management

All outputs are stored in a centralized database, historized for backup, comparisons, and sharing across teams. This ensures consistency between different runs and dates, providing a reliable foundation for reporting and strategic decisions. Results are accessible to all stakeholders, avoiding data silos and ensuring traceability.

Title

Workflow & monitoring integration

Simulations integrate into organizational workflows and can be scheduled for automated production. Dedicated dashboards monitor execution progress and SLA compliance, offering real-time visibility and control. This turns simulations into and operational process that is both efficient and reliable.

CHECK OUT COMPLEMENTARY SOLUTIONS FOR ASSET OWNERS

EXPLORE THE BUSINESS RELATED TO OUR ERM MODULE