UNDERSTANDING R³: HORAN’S PROPOSAL FOR ESG-ADJUSTED PERFORMANCE MEASUREMENT (CFA INSTITUTE, 2022)

EXTERNAL ARTICLE

Estimated reading time: 3 min.

The integration of ESG (Environmental, Social, and Governance) factors into portfolio evaluation is no longer optional — it’s a necessity. But how can we objectively assess both financial performance and responsible investing practices in a single, meaningful metric?

In 2022, James Horan, from the CFA Institute Research Foundation, proposed a novel framework named R³ — standing for Risk, Return, Responsibility. This framework seeks to capture a more complete picture of portfolio management by combining classic risk-adjusted returns with an ESG performance component.

WHAT IS R³?

Horan’s R³ metric combines two key elements:

A traditional Sharpe ratio, measuring excess return per unit of total portfolio risk.

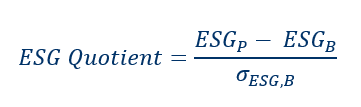

An ESG quotient, designed to assess how far the portfolio’s ESG score deviates from its benchmark.

By normalizing the ESG spread using benchmark dispersion, the quotient becomes dimensionless, comparable across universes, and less sensitive to absolute score levels. In theory, it allows investors and analysts to identify managers who not only deliver performance but do so while meaningfully distancing themselves from the market’s ESG profile.

WHY DOES IT MATTER?

This approach has several advantages:

It offers a combined signal for assessing financial and ESG performance.

It provides a benchmark-aware view of responsibility.

It supports multi-dimensional ranking of managers or portfolios.

Yet, it also raises a number of technical and conceptual challenges — especially around:

the interpretability of combining heterogeneous quantities,

the sensitivity to benchmark composition, and

the lack of direct link between ESG spread and manager skill.

Read the source article: Horan, J. S. (2022). Risk, Return, and Responsibility: ESG and Performance Measurement. CFA Institute Research Foundation Briefs

EXPLORE MORE ARTICLES

COMMON QUESTIONS ABOUT THIS TOPIC

Title

What is ESG-adjusted performance?

ESG-adjusted performance combines traditional risk-adjusted return metrics (e.g., Sharpe-ratio) with an ESG component that reflects how a portfolio's ESG profile deviates from its benchmark—enabling a holistic view of performance and sustainability.

Title

Why does ESG-adjusted performance matter for asset managers and asset owners?

Because it allows firms to assess not only financial performance but also how their ESG strategy contributes to value creation or risk reduction—thereby supporting both investor expectations and regulatory demands.

Title

How is an ESG quotient built in the ESG-adjusted performance framework?

An ESG quotient typically measures the spread between the portfolio's ESG score and the benchmark's, normalized by the benchmark dispersion of ESG ratings; this creates a dimensionless metric comparable across universes.

Title

What are the main challenges when using ESG-adjusted performance metrics?

Key challenges include: combining heterogeneous metrics (financial returns vs ESG scores), sensitivity to benchmark composition, and the fact that ESG-score deviations may not directly reflect manager skill.

Title

How should firms use ESG-adjusted performance in portfolio analysis?

Firms should integrate it as a complementary performance view, compare portfolios not only by returns but by ESG-adjusted results, monitor ESG deviations versus benchmarks over time, and use the findings to refine allocation, reporting and stewardship strategies.