ESG IN ALL ITS FACETS

Master ESG diversity with a scalable, no-code solution

ESG—and the ability to communicate it effectively—is no longer optional. Over the past decade, ESG investing has become central to how Asset Owners and Asset Managers define long-term value, manage reputational risk, and meet evolving regulatory expectations.

Today, producing an ESG report means more than ticking boxes—it requires combining fragmented data sources, managing proxy data, navigating inconsistent issuer coverage, and adapting to rapidly changing frameworks like SFDR, CSRD, and the GHG Protocol.

At the same time, the rise in ESG fund volumes and thematic diversity has drastically increased the need for robust, tailored reporting. From quantitative indicators to qualitative policies, you need a partner who can manage it all.

AMINDIS empowers you to unlock the full potential of ESG investing—through unified data, automated reporting, and a holistic approach to sustainability.

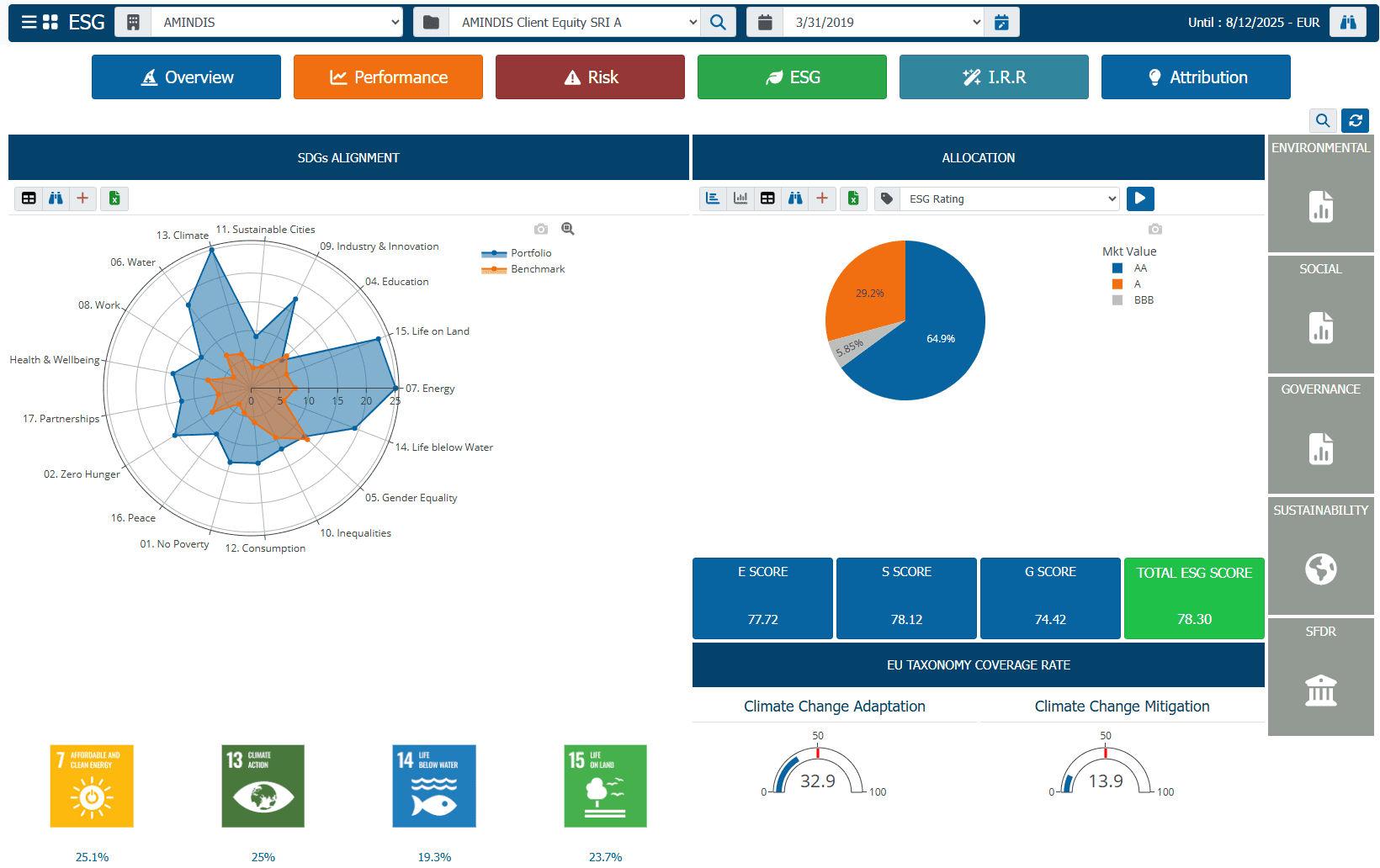

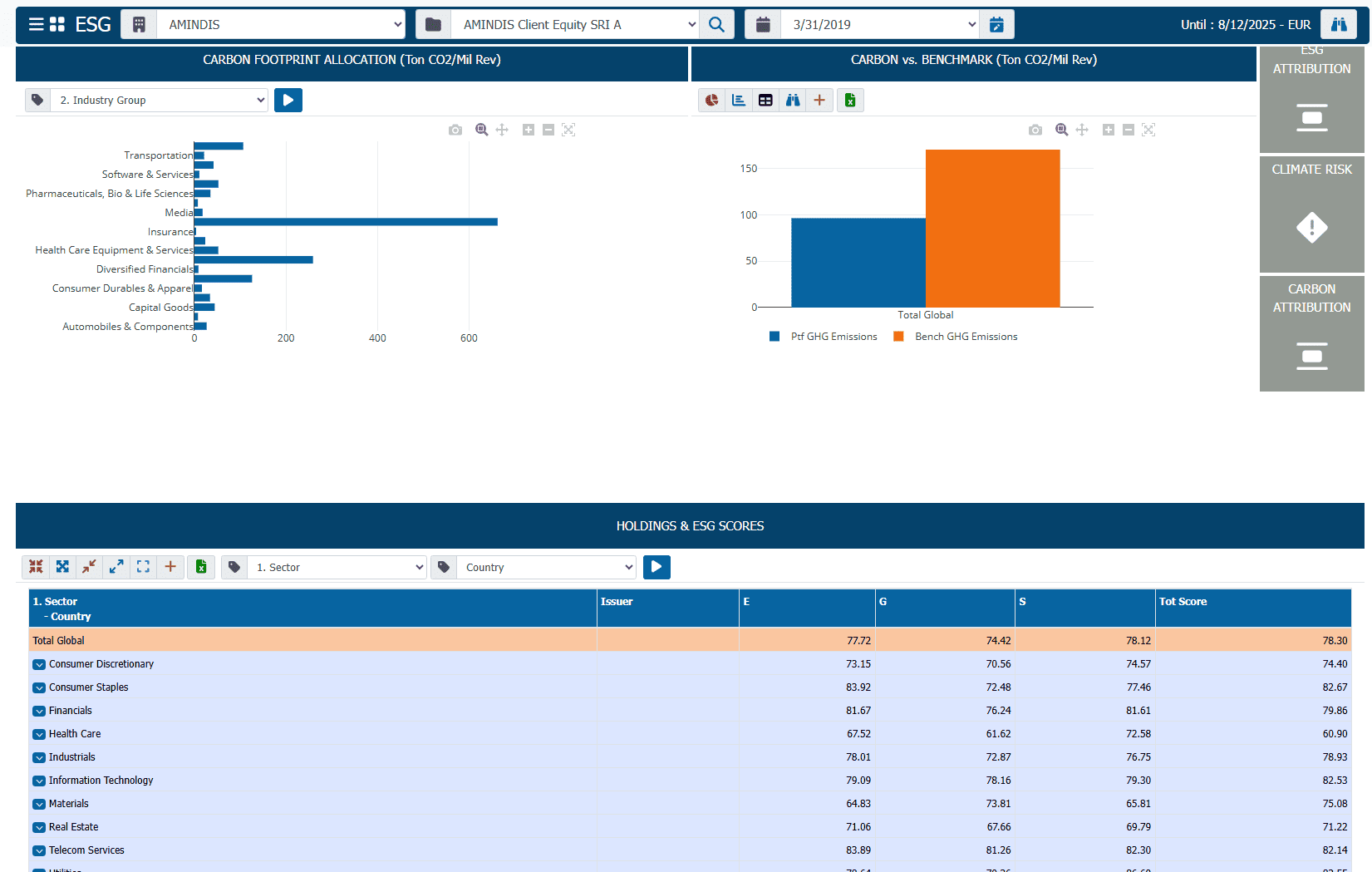

TURN YOUR ESG DATA INTO 360° VALUBALE INSIGHTS

Go beyond data collection—leverage our advanced ESG engine to transform integrated datasets into actionable insights. Built for asset owners and managers, our solution consolidates calculations across multiple ESG dimensions, delivering a clear and accurate picture of portfolio alignment with sustainability objectives.

From in-depth analysis to tailored reporting, AMINDIS empowers you to monitor progress, identify gaps, and communicate results with clarity.

ADVANCED ESG ANALYSIS TOOLS

ESG REPORTS AT A GLANCE

Every ESG report, one click away — instantly available AMINDIS’ Client Portal.

DRIVING ESG SUCCESS

EXTENSIVE ESG COMMUNICATION:

Showcase your ESG commitment with comprehensive, high-impact reports across environmental, social, and governance dimensions—tailored to your audience and objectives.

EFFORTLESS COMPLIANCE:

Stay compliant with evolving sustainability regulations across Europe, including SFDR, CSRD, GHG, and more.

STRATEGY-DRIVEN:

Adapt to any ESG investment strategy and generate tailored reports.

ESG IN ACTION:

Integrating ESG data and insights directly into portfolio management, enables truly holistic and operational ESG investing.

EXPLORE MORE TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

MASTER THE FULL ESG DATA & REPORTING WORKFLOW

With AMINDIS, every aspect of your ESG investing process is unified within a single intelligent platform. Seamlessly navigate SFDR, CSRD, fund classification, and ESG factsheets—all without writing a single line of code.

Trusted by asset owners and managers to deliver ESG insights with speed, accuracy, and compliance.

Book your personalized demo!