ESG INDICATORS

Transform your ESG data into actionable insights

The surge in ESG data — across formats (scores, ratings), providers, and multi-level hierarchies — makes integration and quality control increasingly complex. Asset Owners and Asset Managers must merge ESG with financial data, manage multi-level structures, and adapt to evolving sustainability targets such as the SDGs. Without the right tools, turning raw ESG inputs into clear, actionable insights is slow and costly.

At the same time, regulatory pressure, investor expectations, and internal sustainability ambitions demand fast, transparent, and reliable ESG reporting. To move from raw ESG data to real impact, you need a solution that ensures flexibility, precision, and control — without disrupting your investment workflows.

With AMINDIS, turn ESG data into a strategic advantage — from seamless integration to advanced analytics.

ESG DATA, FULLY UNDER CONTROL

Our ESG module empowers you to centralize, standardize, and enrich ESG data from multiple providers while maintaining full control over data quality, structure, and integration.

Easy integration

Easy integration

Connect all your ESG data sources effortlessly through the AMINIDS Connector, designed to harmonize multiple formats and providers without technical barriers.

You can easily add new datasets through simple configuration, ensuring your ESG framework evolves as your needs grow. Whether your sources are internal or external, our configurable ETL workflows streamline onboarding and make your new ESG data immediately ready for analysis.

Our partnership with Rimes provides a standard gateway acting as a powerful data aggregator—one gateway, all data—enabling the import of multiple ESG providers in a single, streamlined process.

ESG data at a glance

ESG data at a glance

NATIVE METRICS LIBRARY

FROM DATA TO INSIGHTS

Automated checks

Automated checks

Maintain full confidence in your ESG reporting with over 120 configurable validation checks applied at every stage of the process. Our system ensures accuracy, consistency, and compliance before your data is used in any calculation or report. Learn more about our robust validation capabilities on our Data Validation page.

UNLOCK STRATEGIC VALUE

EASY SCALABILITY:

Integrate ESG data from any format or provider while managing growing volumes of indicators and sources without adding workflow complexity.

RELIABLE DATA:

Built-in validation ensures your ESG data is accurate and consistent, empowering decision-making.

UNIFIED STRUCTURE:

All your data is centralized in a single source. Once validated, it’s ready to use across all your business processes, reducing operational workload.

EXPLORE MORE TOPICS

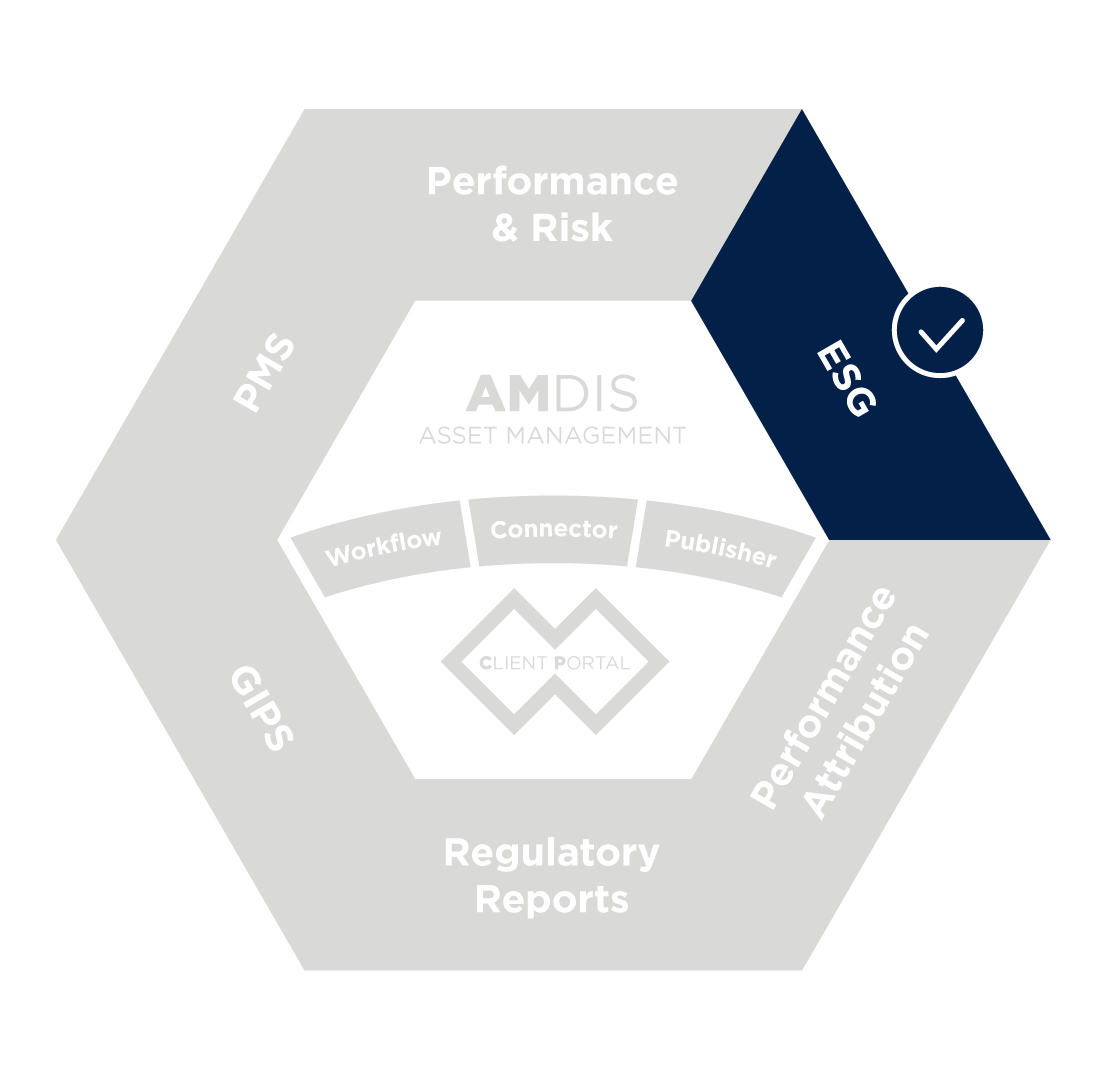

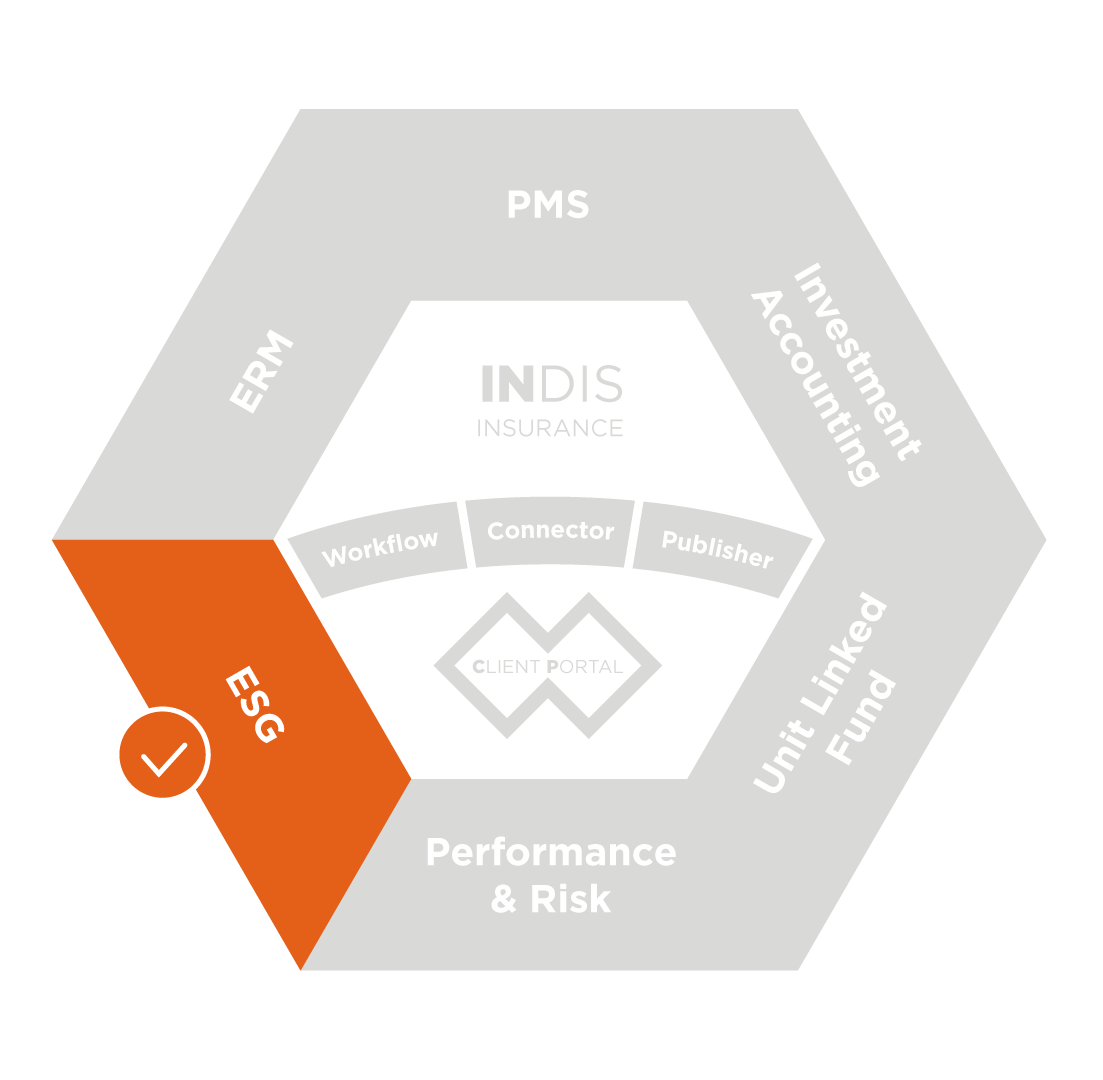

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE FULL CONTROL OF YOUR ESG DATA ECOSYSTEM

AMINDIS ESG indicators centralize all your ESG data processes into one powerful, user-friendly platform. Streamline the integration of diverse data sources, automate multi-level data handling and unlock actionable ESG metrics without technical hurdles or delays.

Preferred by asset owners and managers seeking accuracy, speed, and full regulatory compliance in their ESG workflows.

Schedule a personalized demo and discover how AMINDIS simplify ESG data into clear investment advantages.