YOUR BENCHMARK AND INDEX MANAGEMENT

Accuracy, flexibility, and total control for asset managers and asset owners

In an increasingly complex investment landscape, ensuring the quality, control, and automation of indexes and benchmarks is a growing challenge for asset managers and asset owners. The rapid expansion and diversification of market indexes - particularly with the continuous emergence of ESG indexes - add layers of complexity to benchmark management. At the same time, evolving strategic and operational asset allocation approaches demand more sophisticated benchmarks to remain aligned with investment strategies. To navigate this complexity, a seamless, automated, and precise benchmark management solution is essential.

At AMINDIS, we provide the technology to manage every step of the benchmark and index process—from customization to rebalancing—so you can enhance operational efficiency, ensure compliance, and use data with confidence to make decisions.

WHY FLEXIBILITY AND ACCURACY MATTER

A well-aligned benchmark is more than a reference point—it’s a strategic asset:

Reliable and adaptable date: correct and verified benchmarks ensure consistency and reliability, alowing seamless integration into complex portfolio strategies.

Scalability and connectivity: the ability to integrate multiple data sources and automated validation processes ensures accurate and complete benchmarks.

Tailored allocation models: customizable indexes and benchmarks adapt to client-specific needs, supporting increasingly sophisticated asset allocations.

Consistency in allocation and performance analysis: a complete and coherent integration of index characteristics ensures reliable portfolio comparisons.

With increasingly dynamic portfolio management, benchmarks need to evolve. AMINDIS ensures full historical tracking of benchmark changes and precise weight rebalancing to keep pace with your strategy.

Are outdated or misaligned benchmarks limiting your portfolio insights?

HOW AMINDIS REDEFINES BENCHMARK MANAGEMENT

At AMINDIS, we combine flexibility and precision to ensure your benchmarks align with evolving market conditions and investment mandates.

Customizable index construction

- Build scoped indexes by asset class, region, or ESG factors.

- Multi asset benchmark to align with your risk and performance goals.

- Combine traditional indices with emerging asset classes such as infrastructure, real estate, and private equity.

Automated rebalancing & drift control

Keep benchmarks aligned with your strategic asset allocation through automated rebalancing and real-time drift monitoring.

Track benchmark changes over time with full historization and manage weight rebalancing dynamically.

Multi-benchmark analysis

Compare performance across multiple indexes to pinpoint outperformance or inefficiencies and refine allocations.

Integrate indices even when full composition details are unavailable.

Data integrity & centralized governance

Ensure accuracy with built-in validation checks and a secure central hub for benchmark data, financial data and extra financial data.

Automate index data integration with seamless connections to multiple providers.

Advanced workflows prioritize error detection and correction, minimizing operational workload.

KEY BENEFITS AT A GLANCE

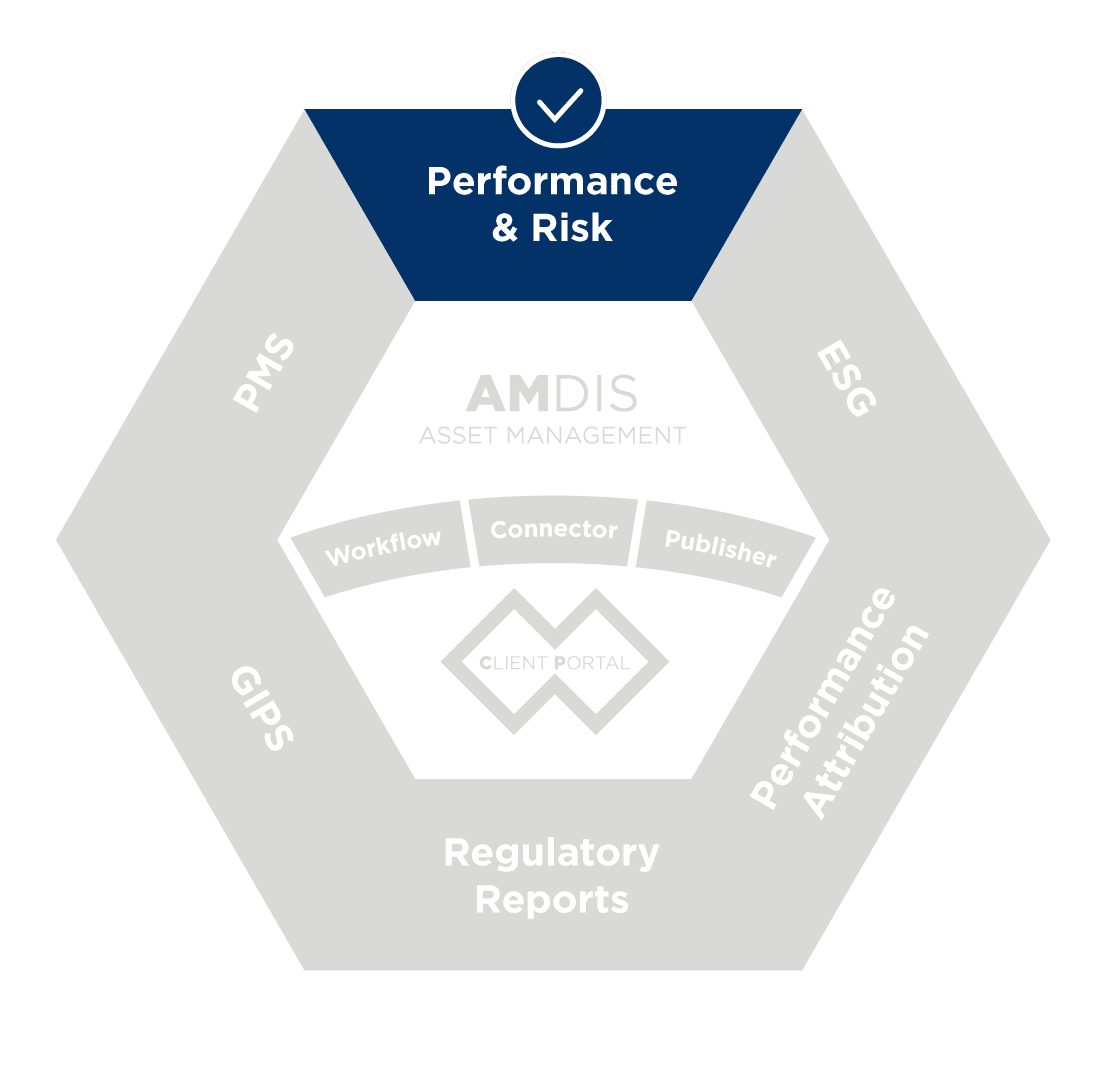

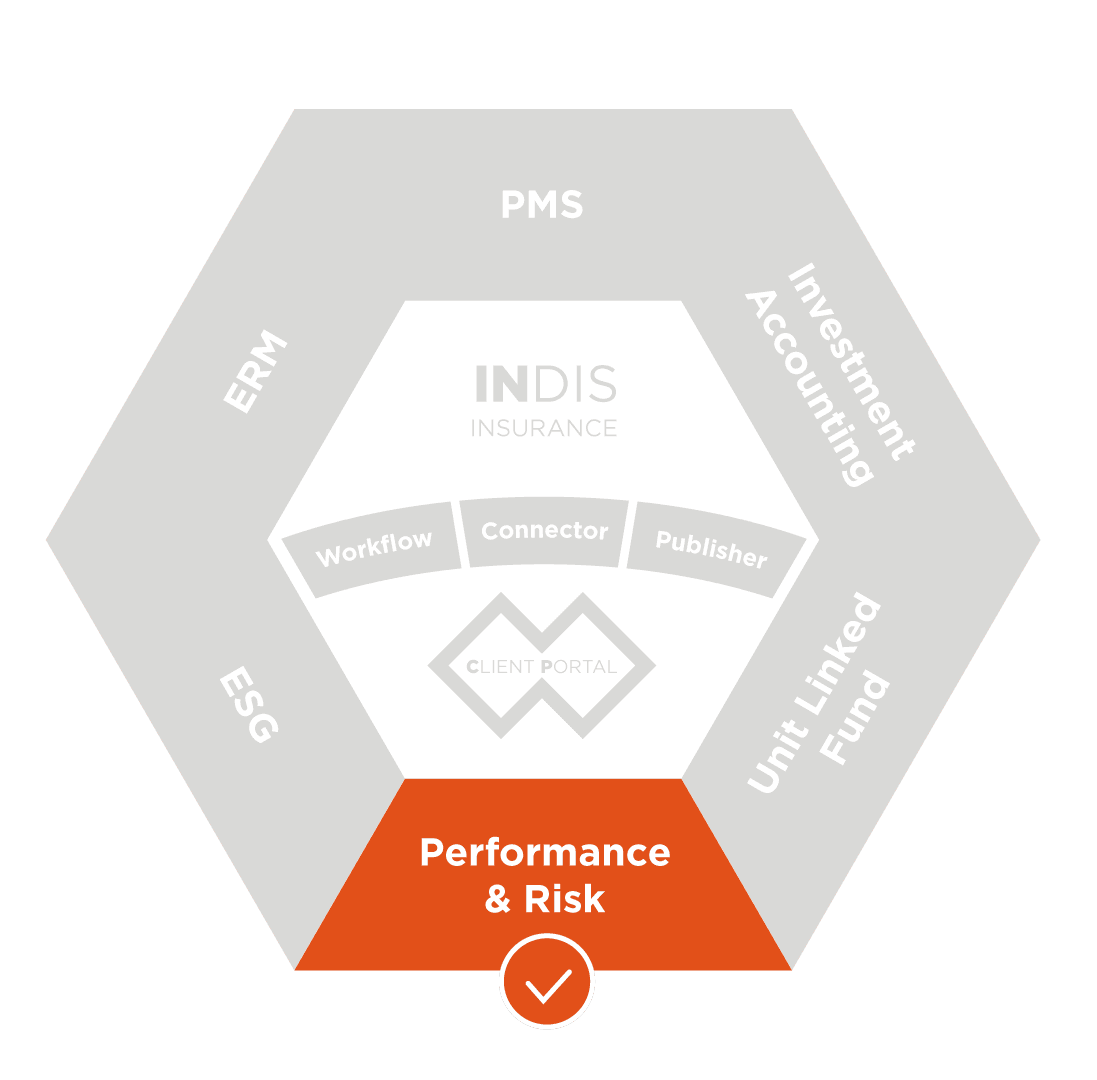

Integrating AMDIS and INDIS solutions into your benchmarks and indexes ensures:

EFFICIENCY

Reduce manual workload by 40% with automated processes.

QUALITY CHECK

Minimize errors with built-in data validation and historical tracking.

COMMUNICATION

Justify investment performance with clear, auditable benchmarks.

SCALABILITY

Adapt seamlessly as the number of indexes continues to grow.

Why choose AMINDIS?

AMINDIS offers unmatched control and flexibility for managing your benchmarks and indexes. Whether you’re optimizing asset portfolios with AMDIS or enhancing asset ownership analytics with INDIS, our solutions keep your benchmarks aligned with your strategy and evolving market conditions.

Full automation: integration with market data providers like Rimes ensures real-time updates with minimal manual intervention.

Cost effective scalability: automated workflows reduce operational complexity while ensuring high data integrity.

Dynamic adaptability: benchmarks evolve with market shifts, ensuring accurate investment analysis and compliance.

Choose AMINDIS for seamless adaptability and accurate insights in both portfolio management and asset ownership.

EXPLORE MORE: RELATED TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

Don’t let misaligned benchmarks or inconsistent data undermine your performance analysis.

Discover how AMDIS and INDIS can enhance your approach—ensuring precision, efficiency, and compliance at every stage.

Request a demo today and see why leading asset managers and asset owners trust AMINDIS.

Trusted by leading asset managers and asset owners across Europe.