INVESTMENT ACCOUNTING

From trade to ledger: native accounting built into your PMS

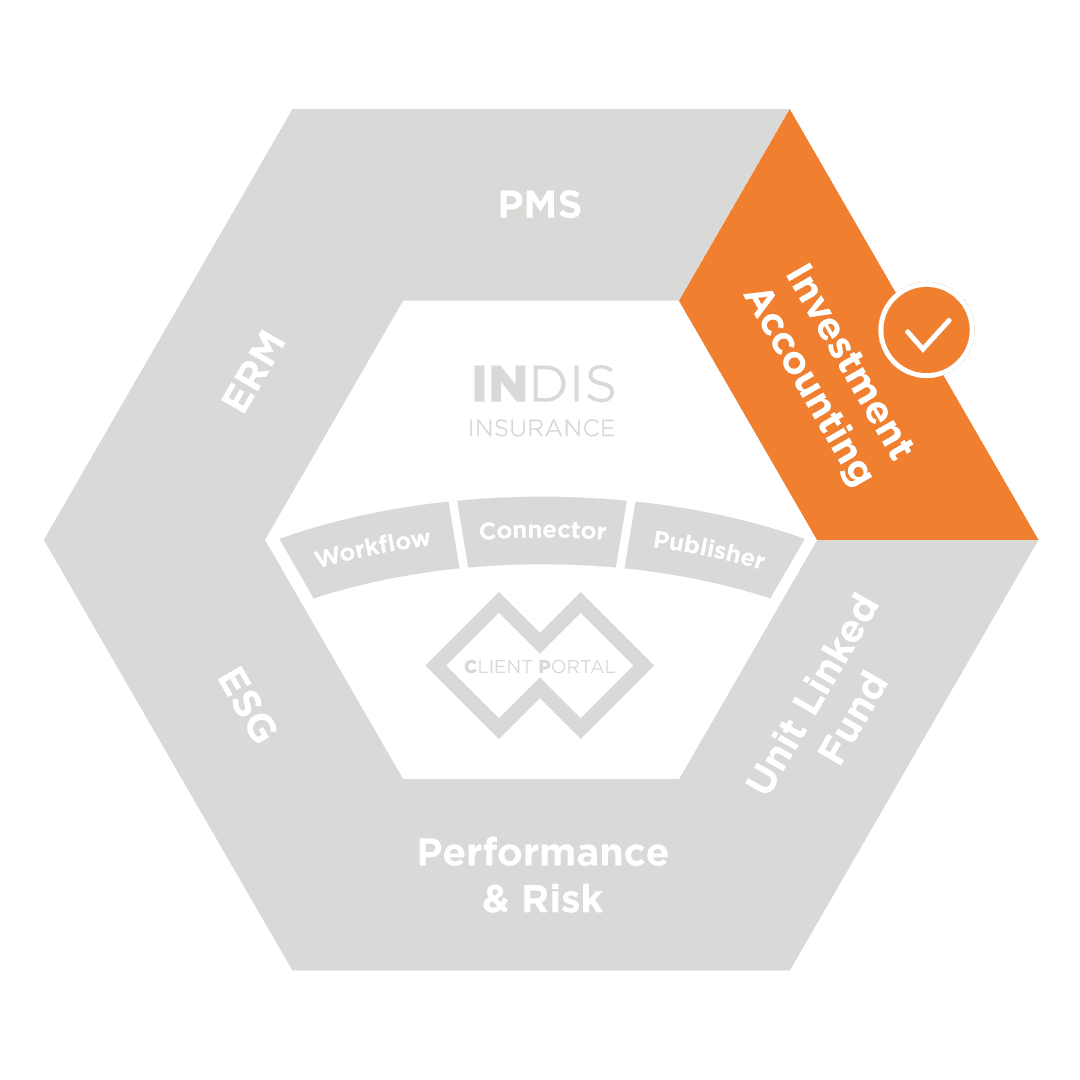

For asset owners, portfolio accounting has evolved from a back-office task into a strategic function. Over the past decade, the emergence of new standards such as IFRS and Solvency II—combined with increasingly complex instruments—has significantly raised the bar in terms of compliance, precision, and operational workload.

Accounting is no longer isolated: it's a core link in the investment value chain, closely integrated with front, middle office and reporting. Today's expectations include monthly valuations, real-time visibility, multi-GAAP parallel accounting, high-volume reporting, and historical traceability. Regulations demands and growing oversight on impairment rules and value adjustments require greater flexibility and precision—making accounting a fully embedded part of portfolio management.

With AMINDIS, front-to-back integration becomes a reality: from order execution to ledger booking, accounting is not the end of the chain—it’s part of your strategy.

END-TO-END ACCOUNTING, FULLY INTEGRATED WITH MIDDLE/BACK OFFICE ACTIVITIES

AMINDIS enhances your front-to-back investment platform with a configurable accounting module—covering everything from trades (corporate actions, OTC operations, cash management, settlement) to month-end close. The entire process is automated, traceable, and aligned with both operational workflows and regulatory standards.

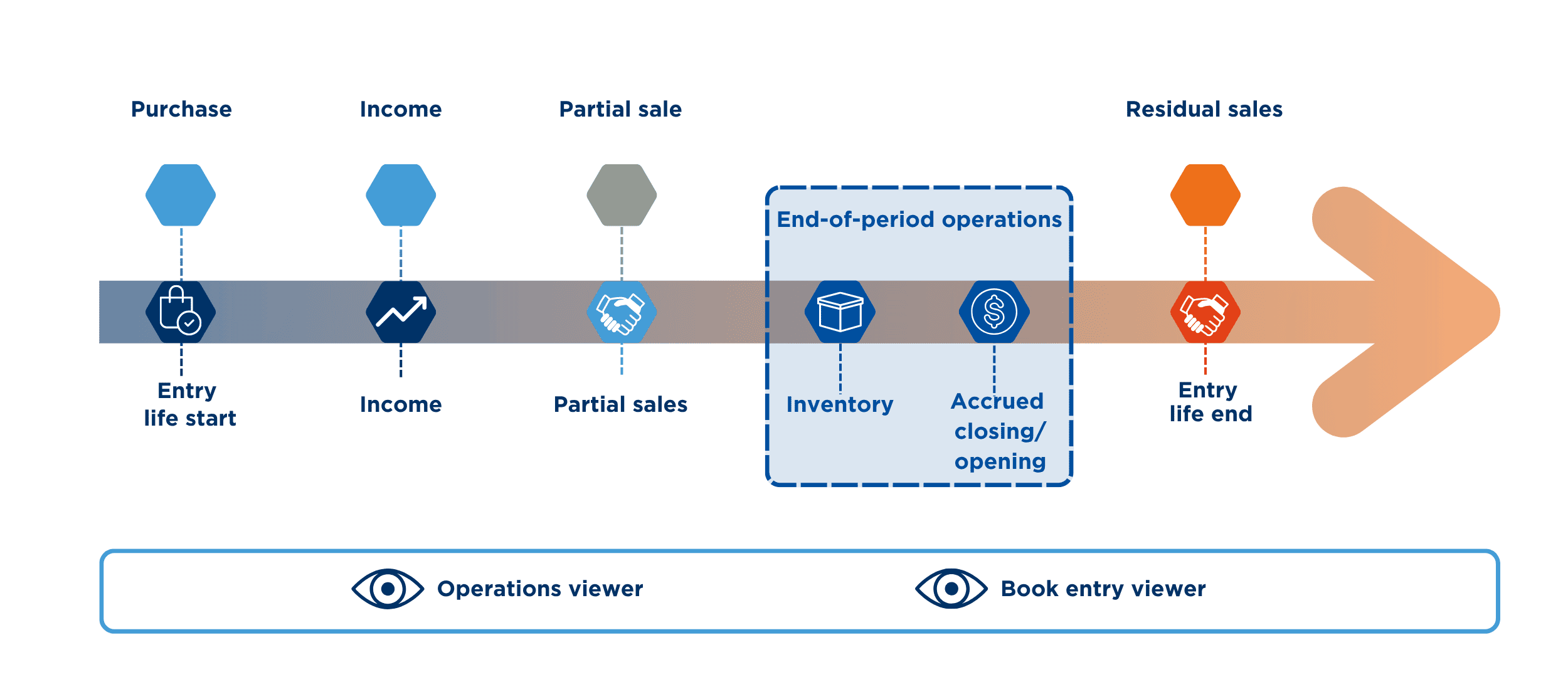

ACCOUNTING REINVENTED AROUND THE ENTRY LIFECYCLE

The concept of Entry Life is at the heart of AMINDIS' accounting module. It provides a continuous, end-to-end view of each position, from initial purchase to final sale, including all intermediate events such as income, partial sale, and end-of-period operations.

This timeline approach enables:

- Full traceability of every accounting movement

- Accurate tracking of valuation, depreciation, and accrued income

Operations Viewer and Book Entries Viewer are two different types of views providing clear, consistent access to all operations and accounting entries, allowing for intuitive navigation across the full set of records.

By structuring data around the lifecycle of each Entry Life, AMINDIS offers full auditability and operational control.

FULL CONFIGURABILITY FOR ALL ACCOUNTING SCENARIOS

As part of a complete front-to-back ecosystem, accounting is no longer a silo — it’s an integrated, traceable, and compliant component of your investment operations.

VALUE DELIVERED TO ASSET OWNERS

CONFIGURABLE FOR ANY BUSINESS CASE:

Adapt schemas, charts of accounts, and valuation methods to match your operations.

MULTI-GAAP SUPPORT:

Simultaneously manage local GAAP, IFRS 9, and Solvency II with automatic journal generation and rule-based configuration.

ADVANCED VALUATION:

Automate end-of-month valuations and amortizations, while seamlessly calculating Expected Credit Loss (ECL) in full compliance with IFRS 9.

FROM FRONT TO ACCOUNTING: COMPLETE INVESTMENT CHAIN INTEGRATION

Looking to understand the full picture? Explore how our Front Office Optimizer and Middle Office modules work together to deliver seamless continuity, full control, and accurate traceability across your entire investment lifecycle.

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE CONTROL OF YOUR ACCOUNTING

With AMINDIS, automate and secure every step of your investment accounting process — from trade capture, monthly revaluations to journal entry generation — within a fully integrated, front-to-back platform.

Join the asset owners already enhancing accuracy, compliance, and auditability through seamless accounting integration.

Book your personalized demo and discover the power of embedded accounting