FRONT OFFICE: FROM STRATEGY TO EXECUTION

Support better investment decisions within a comprehensive solution

The Front Office is the strategic hub where investment decisions are taken, simulations are tested, and orders are placed. For asset managers aiming to outperform benchmarks and asset owners seeking to align investments with long-term goals, the Front Office is essential. It enables real-time portfolio steering, compliance checks, and accurate trade execution—all while adapting to fast-changing market conditions.

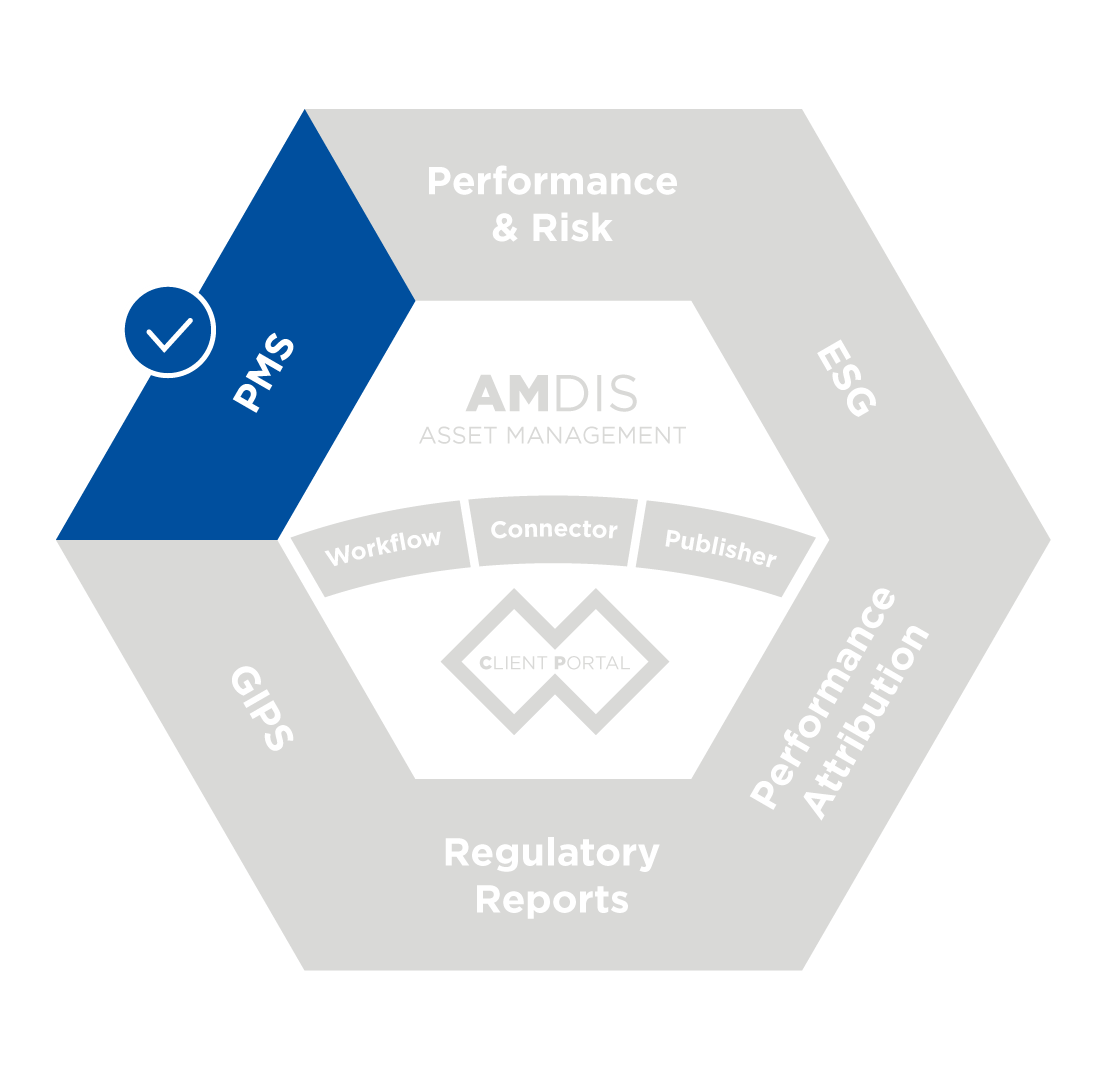

Alongside sophisticated Front Office tools, AMINDIS stands out with a straightforward solution that aligns closely with your portfolio structure and decision-making flow.

EMPOWERING THE FRONT OFFICE WITH AN END-TO-END PLATFORM

AMINDIS delivers a comprehensive and integrated Front Office Optimizer module designed specifically for portfolio managers, and institutional investors. It enables agile and responsive portfolio management aligned with market dynamics, while ensuring the operational discipline required through built-in compliance controls.

FIVE STEPS TO INFORMED EXECUTION

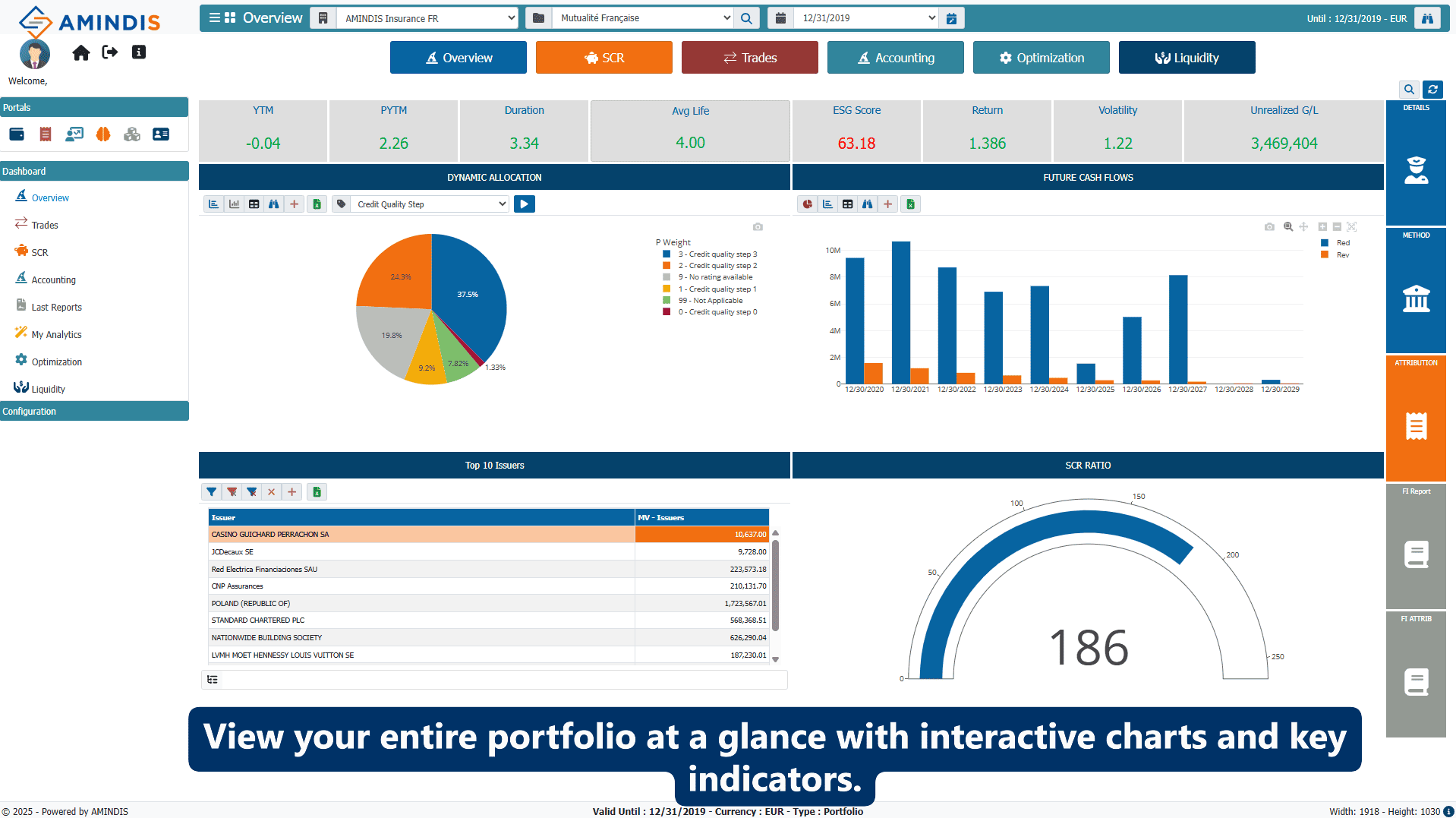

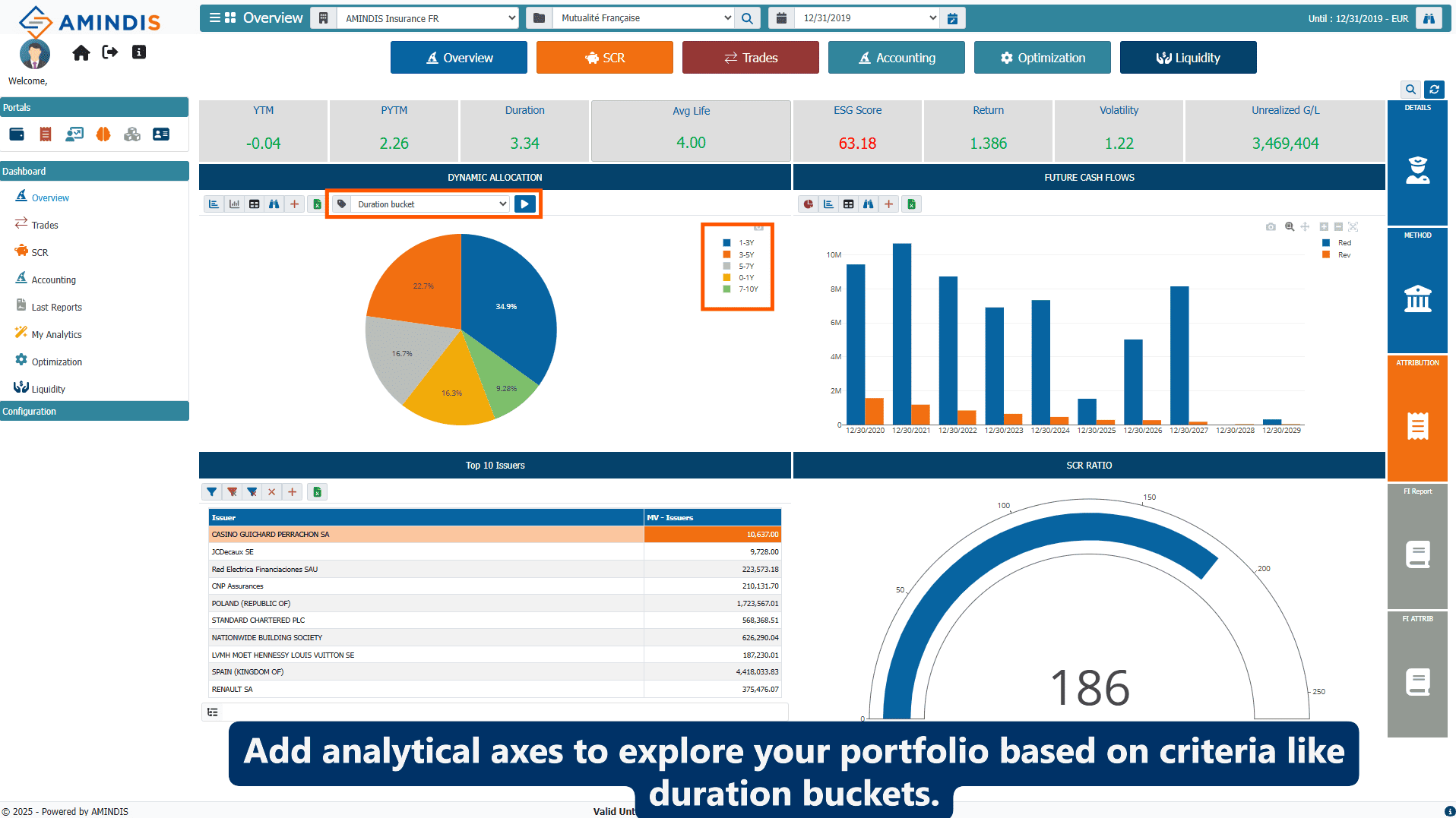

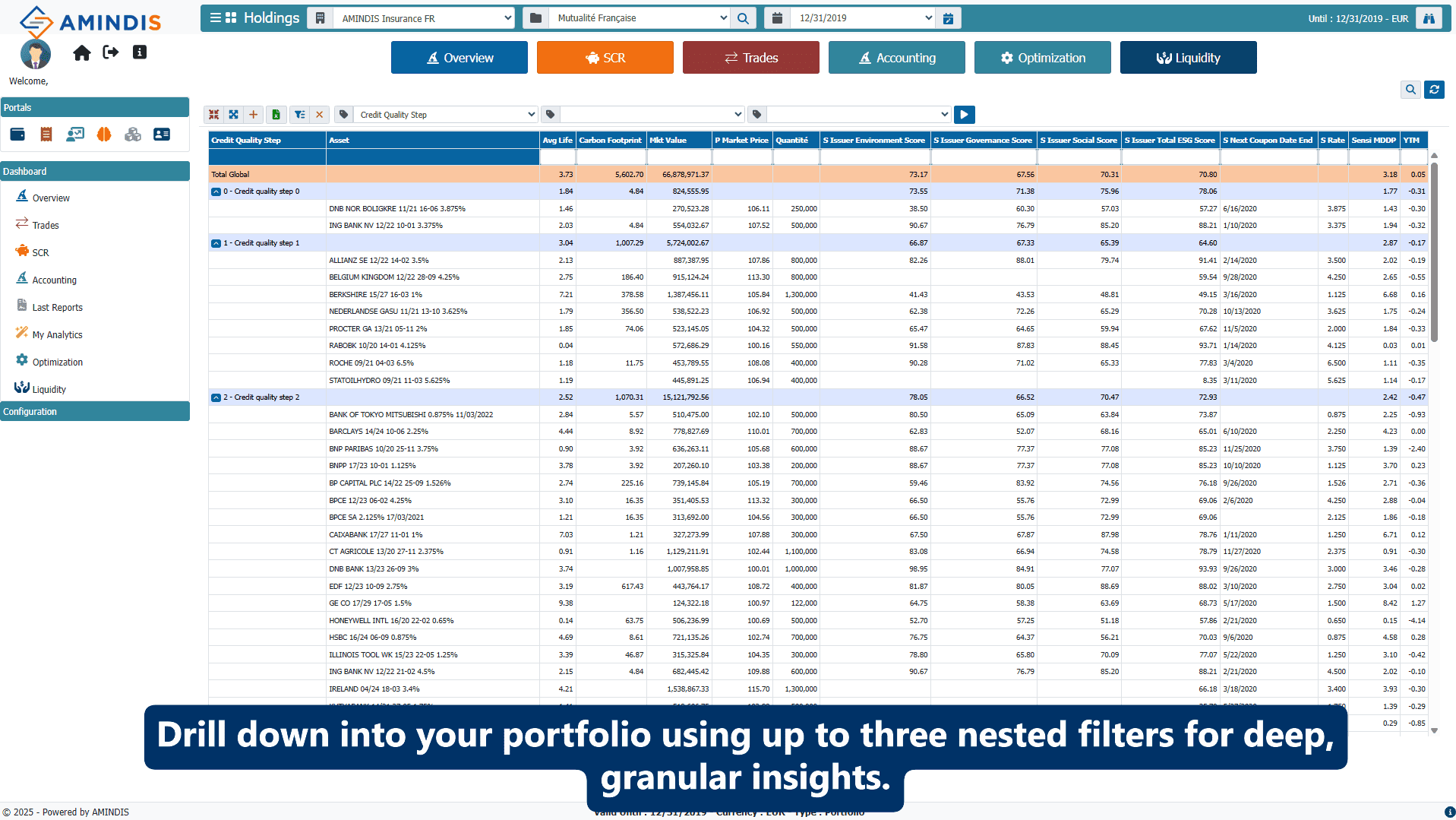

1. Explore your portfolio

Before acting, understand the full context.

With AMINDIS you can:

- Visualize and explore your portfolio from every angle: segment and aggregate your holdings by asset class, region, ESG score, duration bucket, credit quality step, and more.

- The Client Portal adapts dynamically to display your portfolio using any financial or non-financial criteria, offering fully customizable and insightful views.

- Detect exposure concentrations and rebalancing needs

This clear overview ensures that every decision is built on a strong, data-driven understanding of your investments.

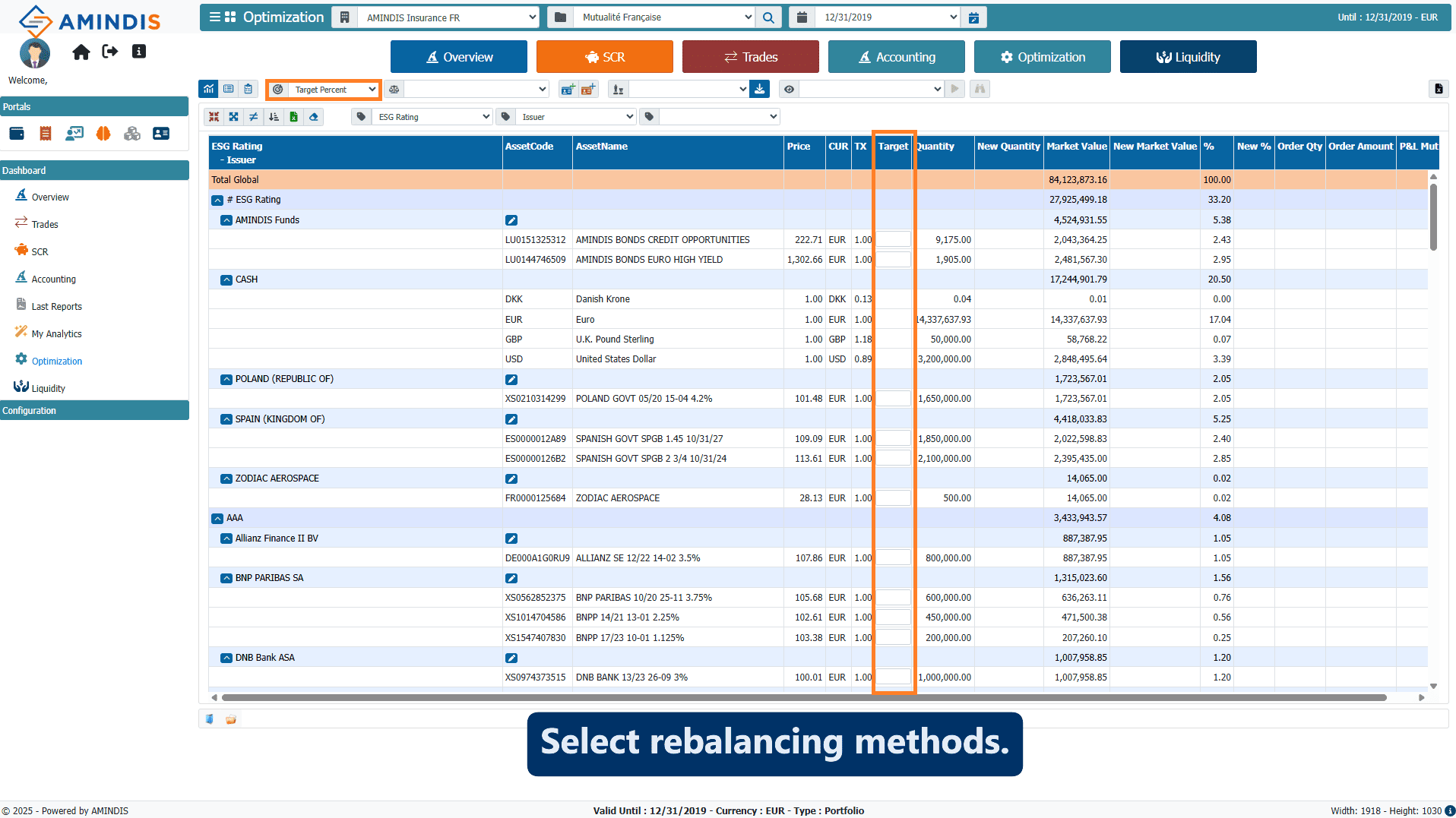

2. Test strategies

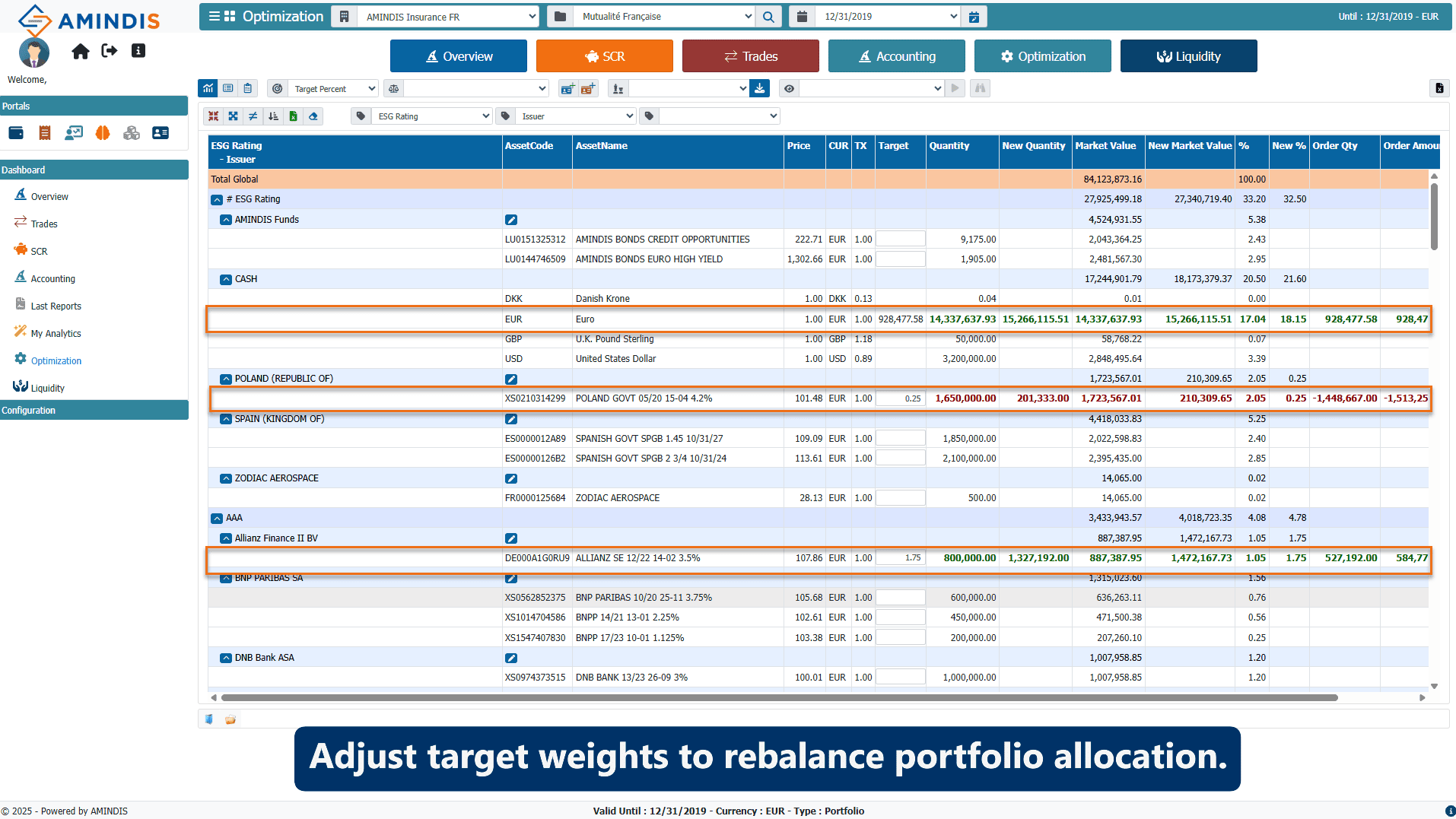

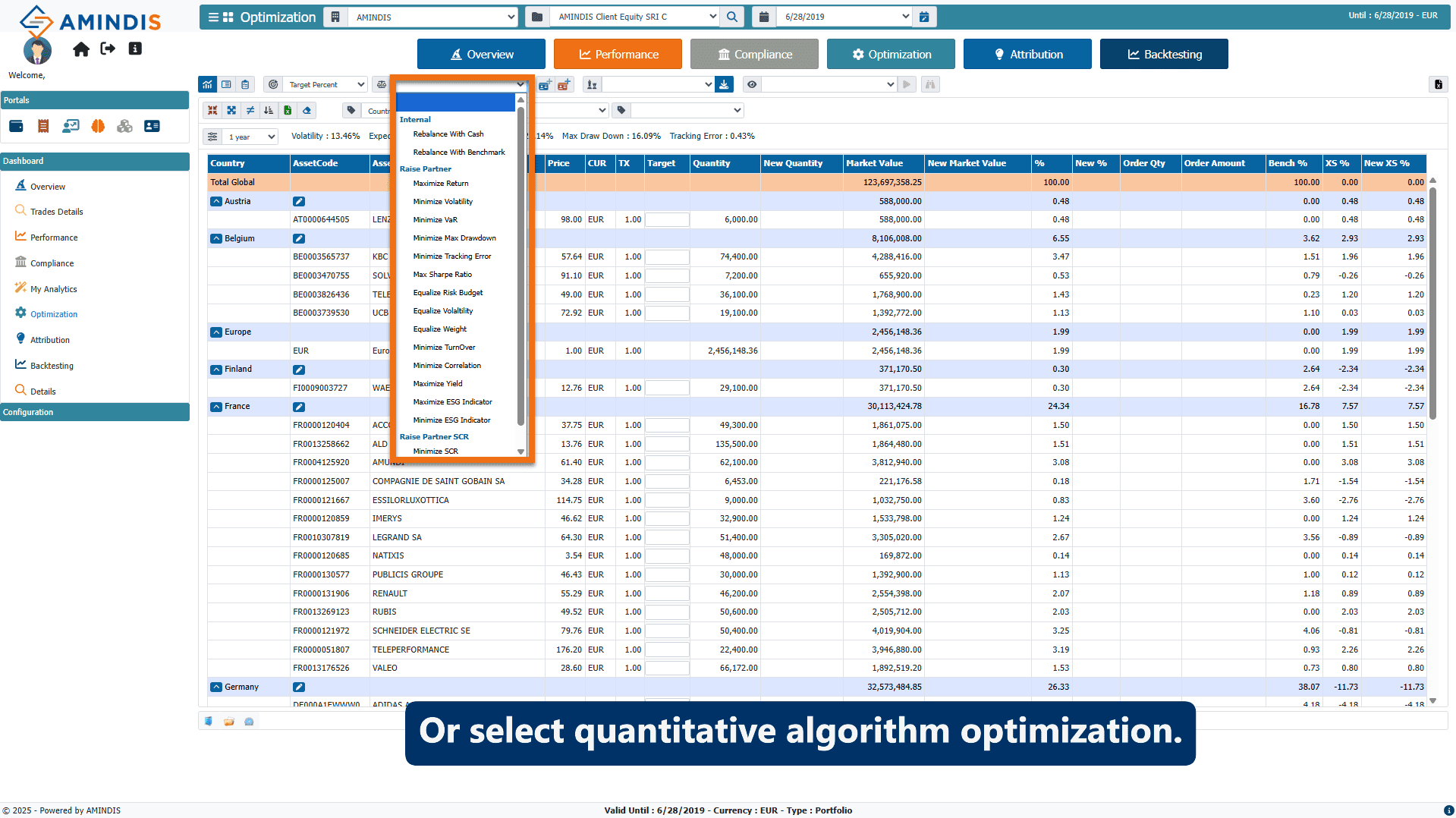

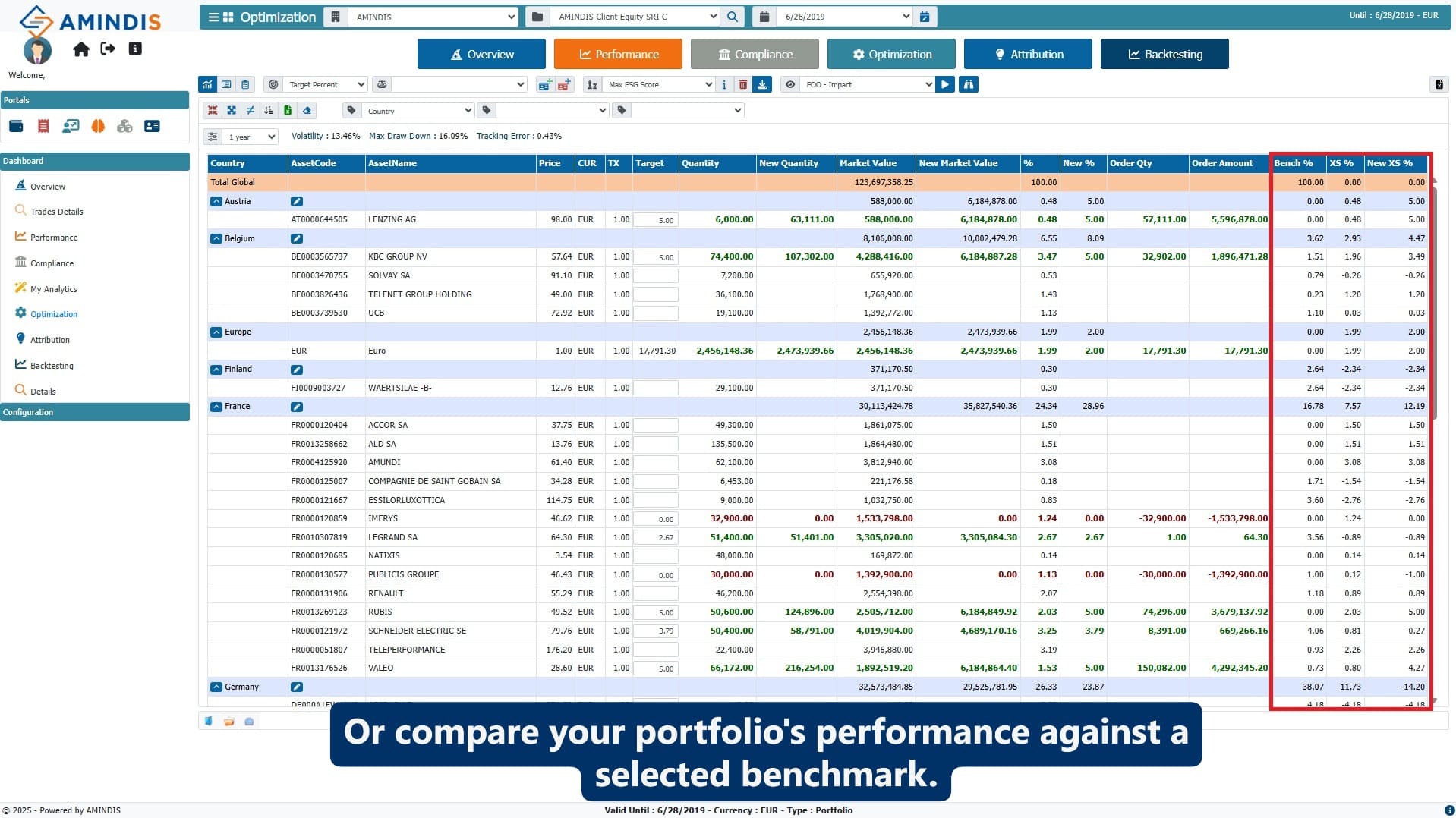

Design and simulate allocation strategies using multiple methods: line-by-line adjustments, pocket level rebalancing, global cash allocation or benchmark-driven scenarios. Our Front Office Optimizer module integrates optimization algorithms and scenario simulation thanks to our integration with Raise Partner API.

3. Analyze the impact

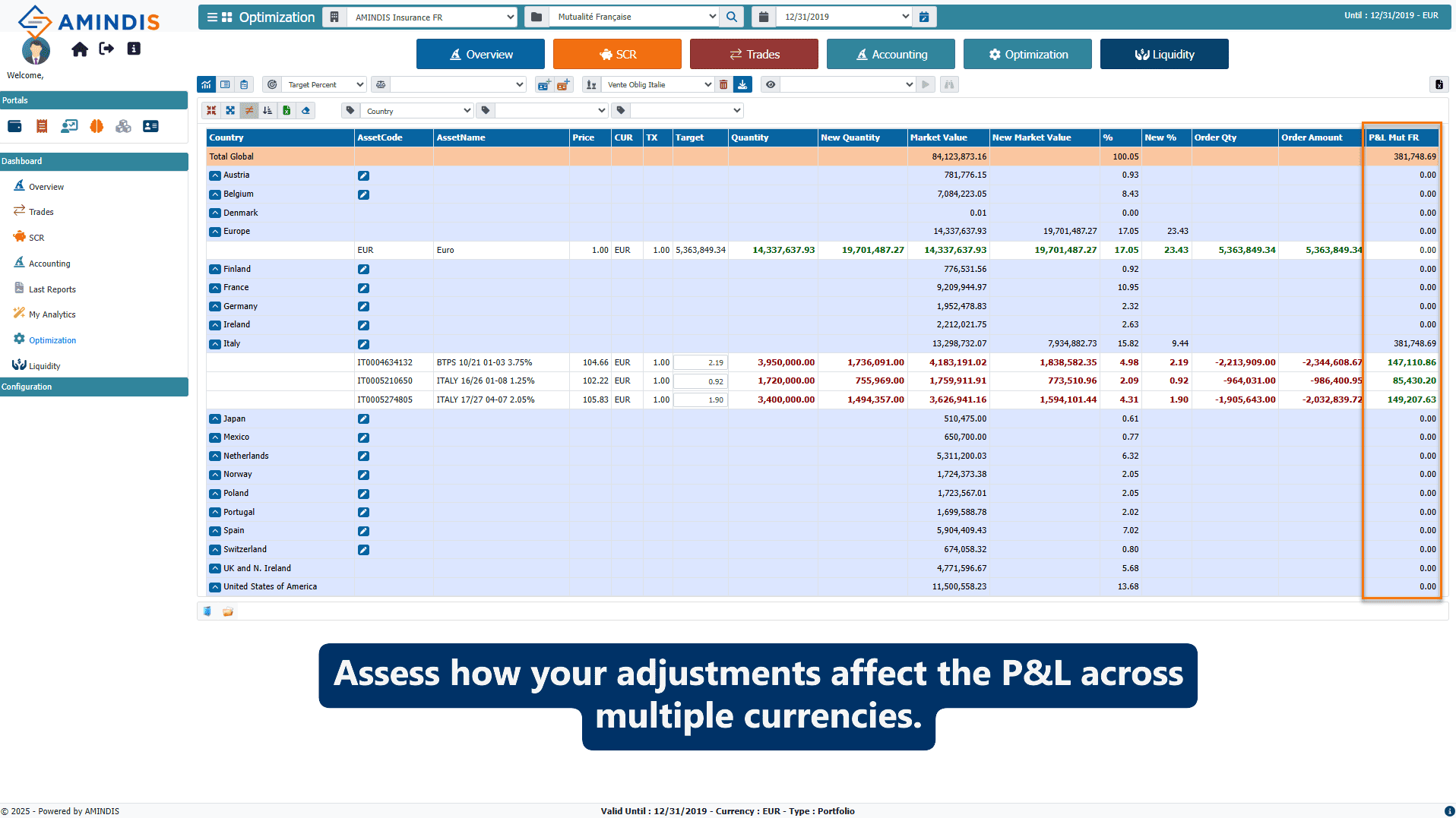

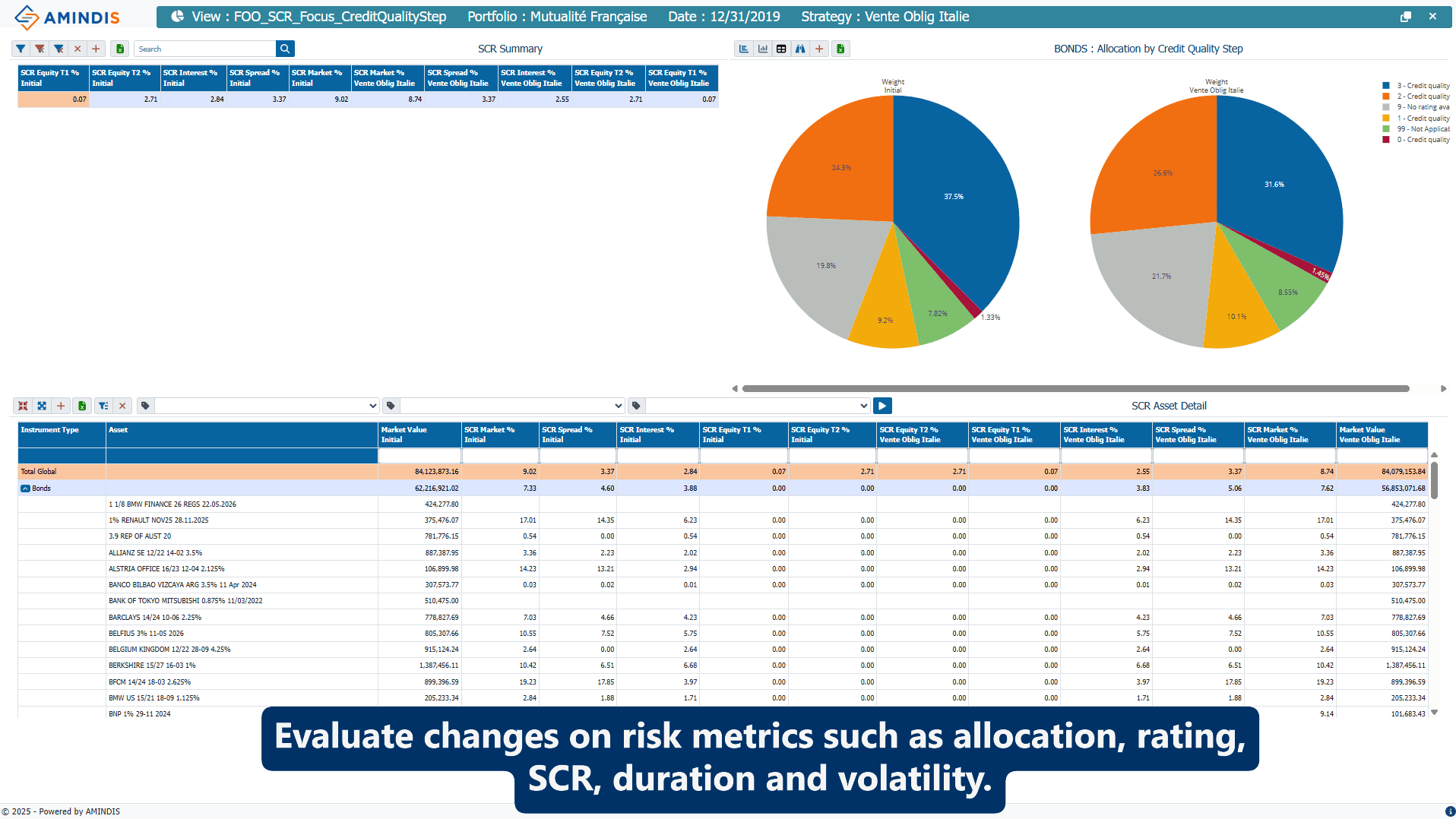

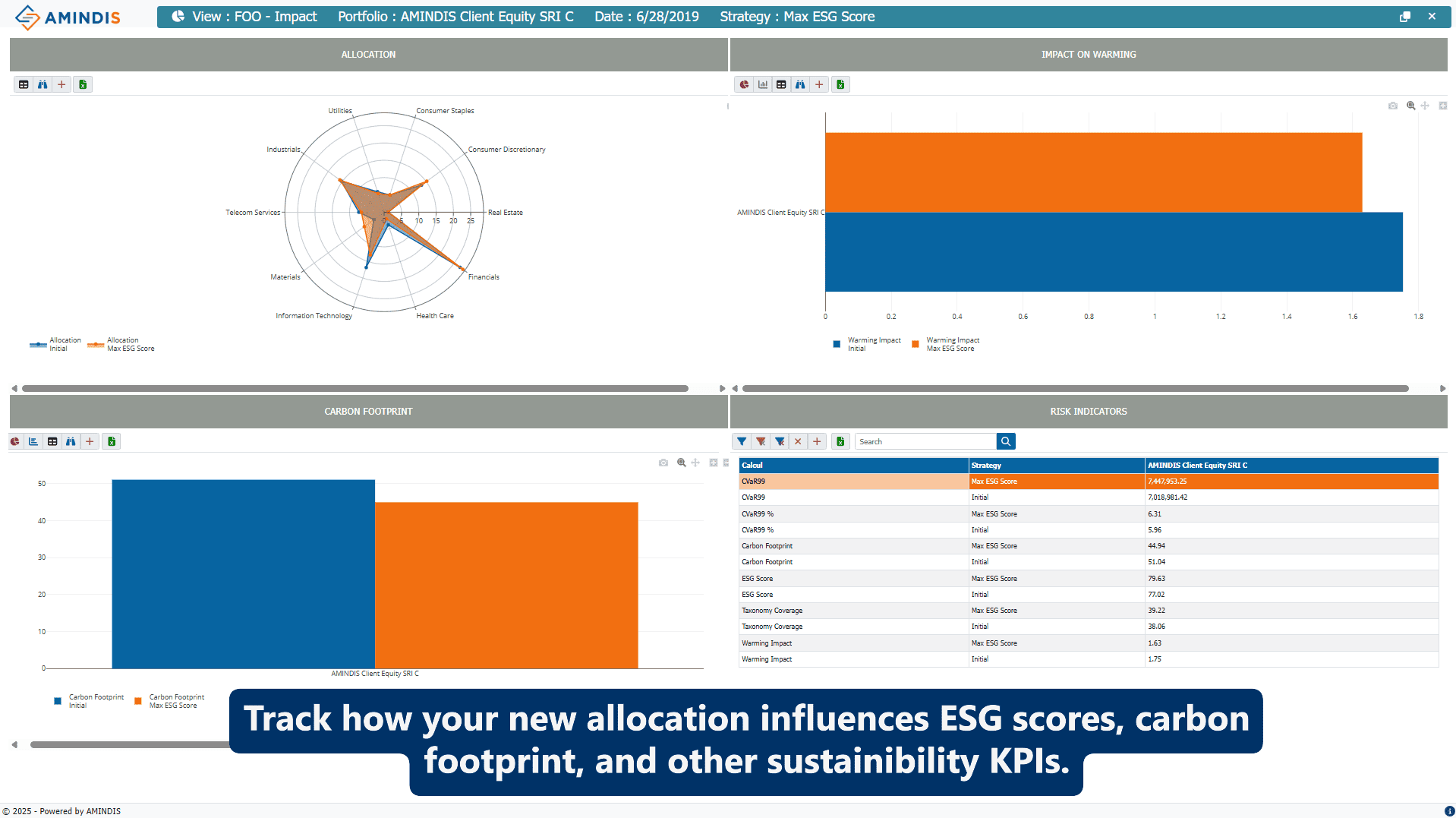

Assess how each investment decision affects:

- P&L: evaluate accounting results at transaction level.

- Cash & currencies: measure the effect of each order on available liquidity and currency balance.

- Risk impact: monitor how changes in allocation or credit ratings affect duration, SCR, volatility, and other key risk metrics.

- ESG indicators: assess the influence of each scenario on your portfolio's ESG profile, including footprint, exposure, and scores.

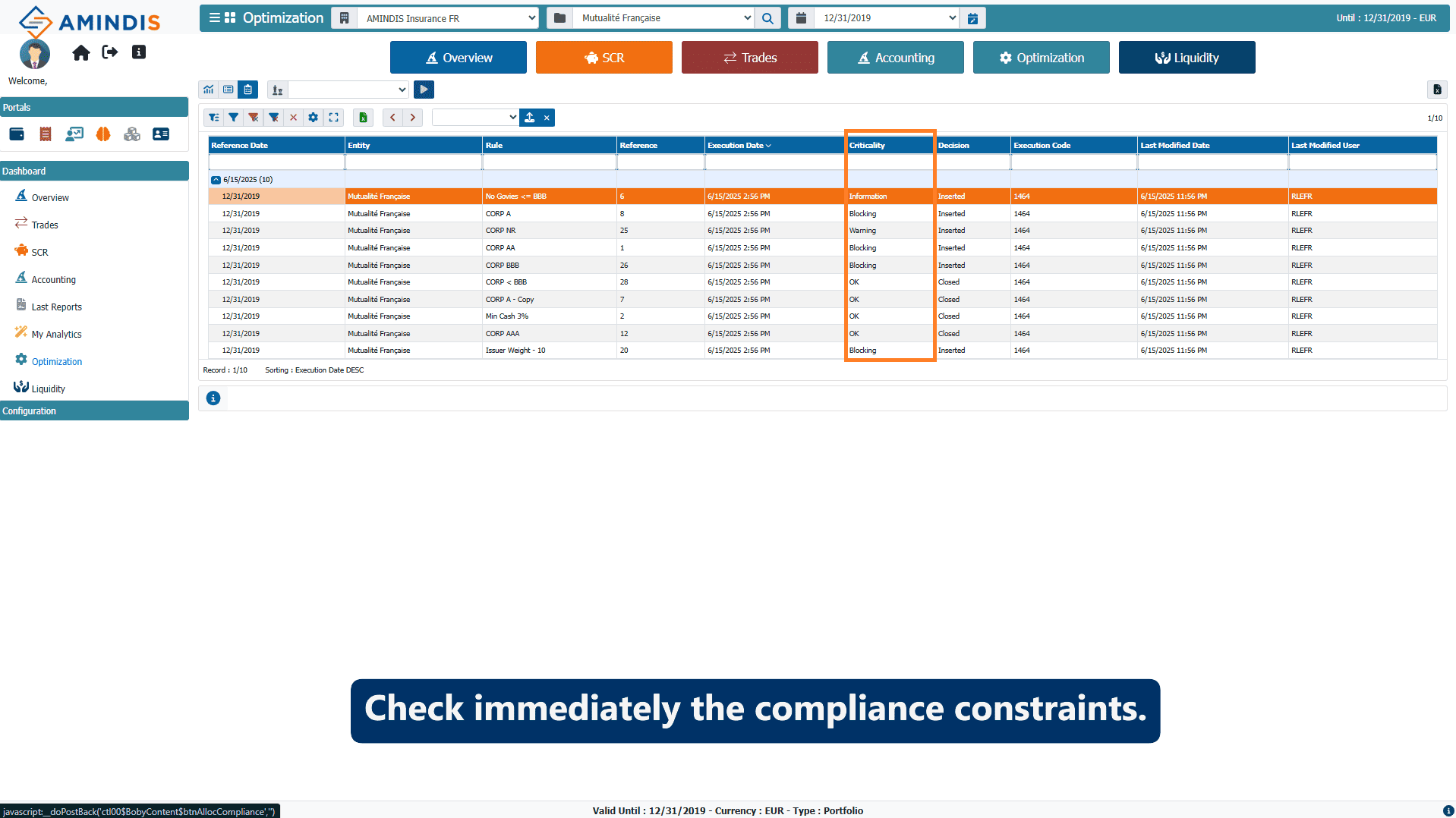

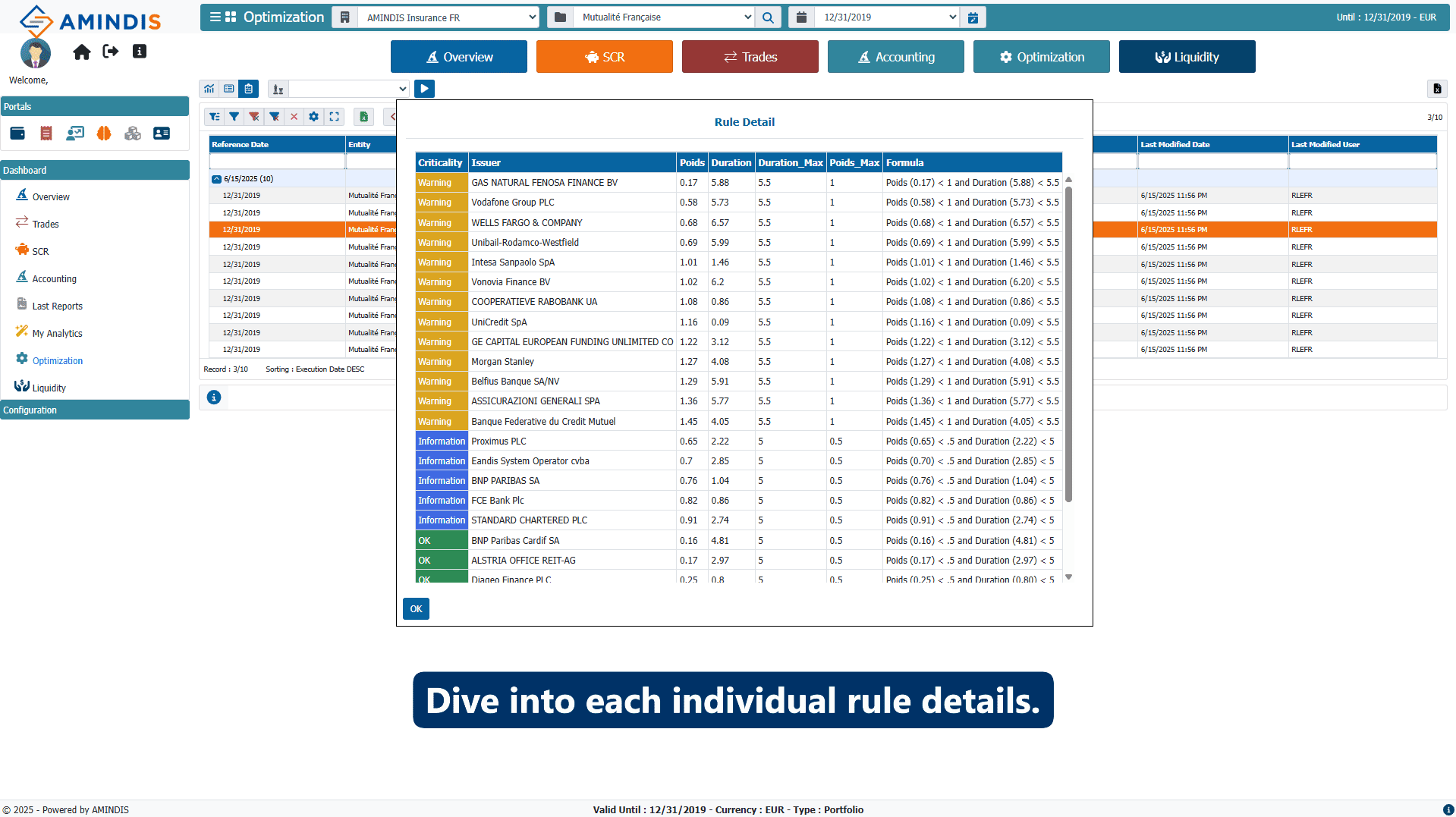

4. Check constraints

Orders are valitated against internal and regulatory constraints—issuer concentration, thresholds, ESG exclusions, and more. Non-compliant orders are flagged before execution, allowing timely adjustments.

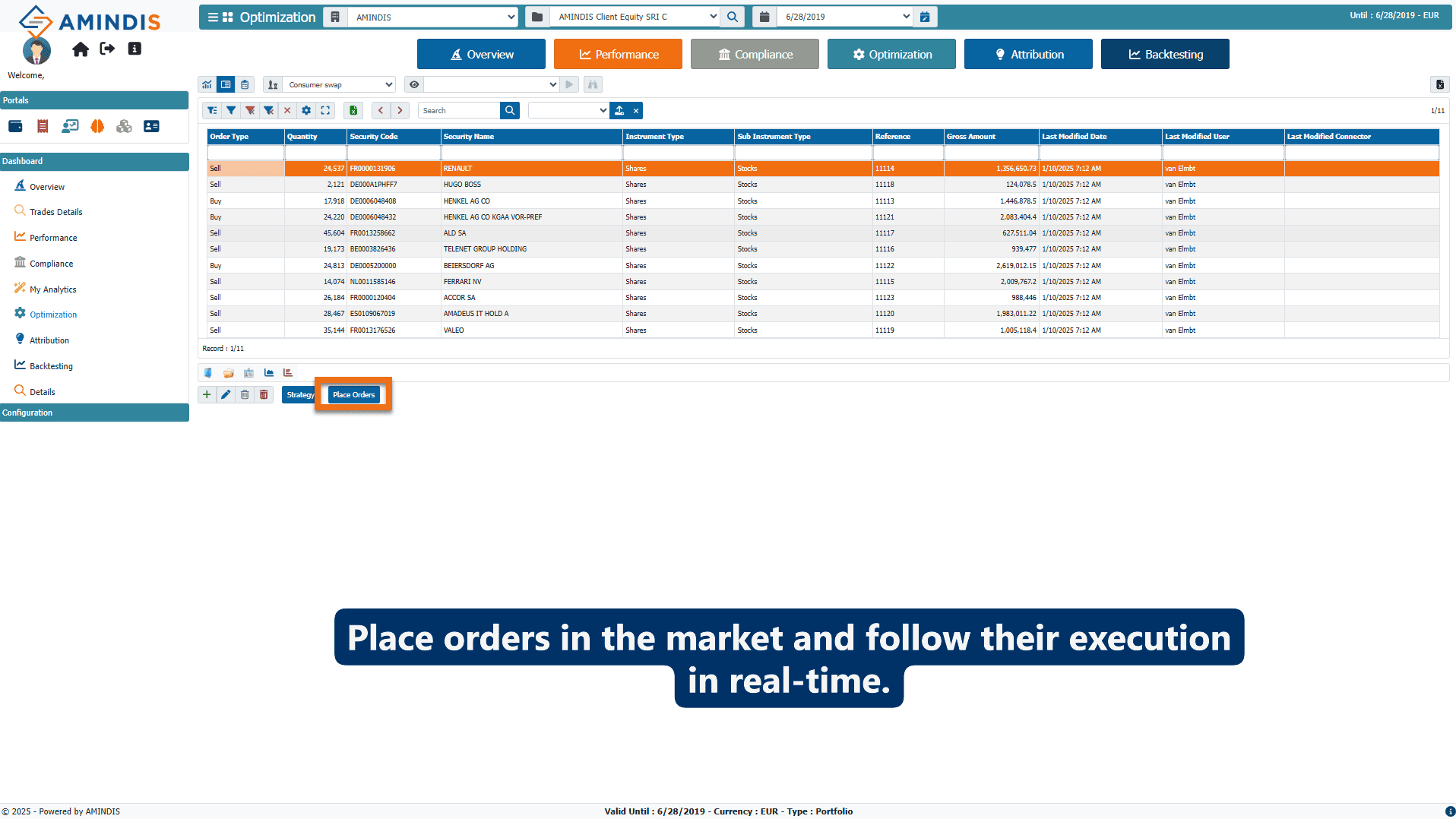

5. Execute and track

Orders can be routed via manual or automated workflows, depending on your internal processes. Choose from standard gateways—including a FIX connection via our partner ETOPS—with full traceability from strategy to execution.

FOR ASSET OWNERS: LONG-TERM OBJECTIVES

For asset owners, strategic investments are not just about market positioning—it’s about meeting long-term obligations while maintaining financial stability. AMINDIS supports asset owners in evaluating the P&L of any operation, offering a clear view on how investment choices impact financial statements—where traditional front office tools often fall short.

KEY BENEFITS FOR YOUR FRONT OFFICE TEAMS

INFORMED DECISION-MAKING:

Test, simulate, and compare strategies before execution.

TRADE WITH CONFIDENCE:

Avoid breaches thanks to built-in compliance checks. Pre-trade validation includes thresholds, regulatory, and custom constraints.

EXECUTION MADE SIMPLE:

Place and monitor orders directly via our solution. Manage brokers, order types, execution modes (manual or automatic), and get full traceability of actions.

INTEGRATED FRONT OFFICE OPTIMIZER WITHIN THE CLIENT PORTAL

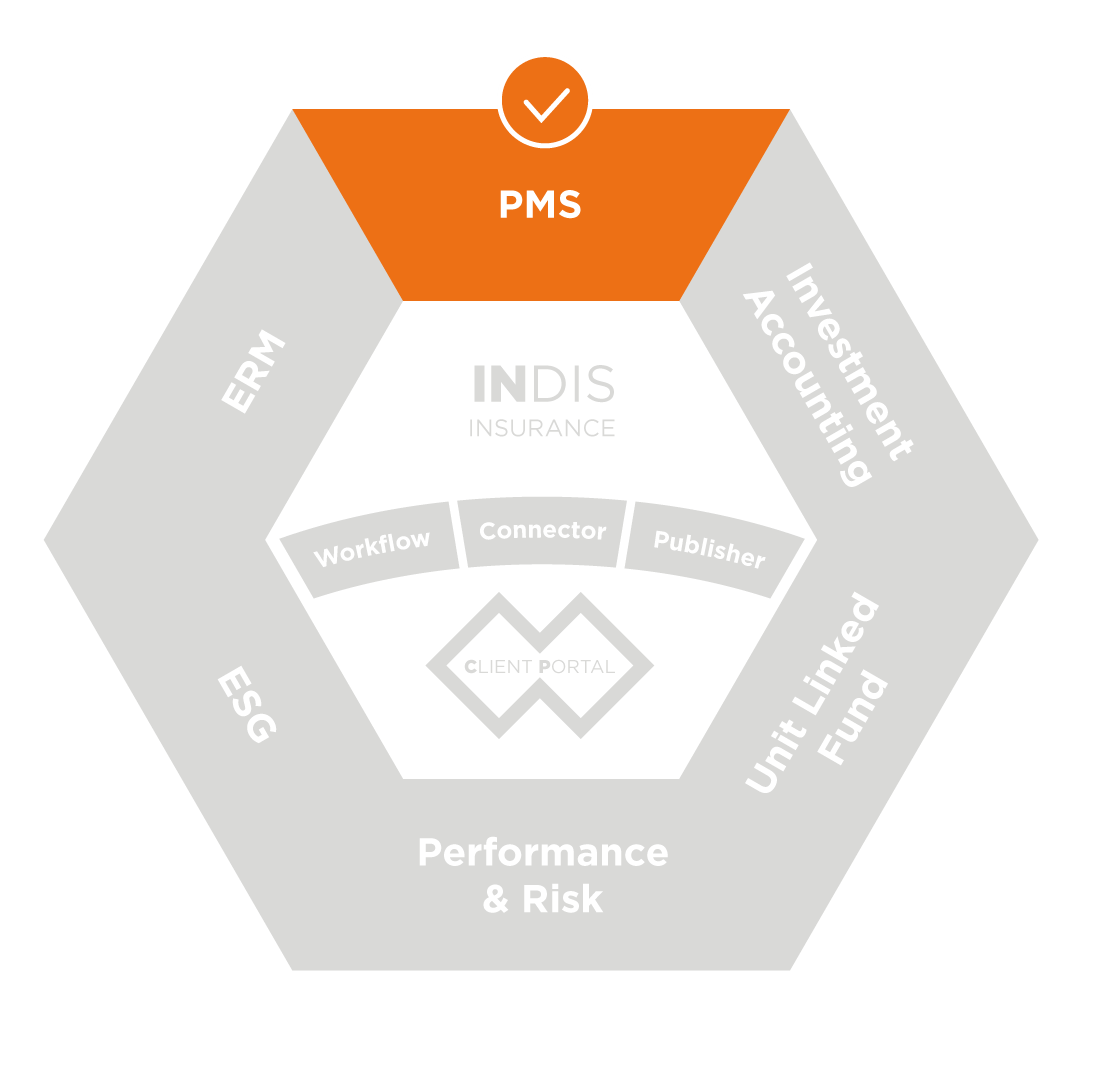

FROM FRONT TO BACK: A COMPLETE SOLUTION

WANT TO GO FURTHER? DISCOVER HOW OUR MIDDLE/BACK OFFICE AND ACCOUNTING MODULES ENSURE CONTINUITY, CONTROL, AND PRECISION TRHOUGHOUT YOUR INVESTMENT OPERATIONS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE CONTROL OF YOUR FRONT OFFICE, FROM STRATEGY TO EXECUTION

With AMINDIS, streamline every step, from simulation and compliance checks to seamless order placement, in a single, intuitve platform.

Join the asset managers and asset owners already transforming their decision-making process.

Book your personalized demo today.