OPERATIONAL EXCELLENCE IN MIDDLE & BACK OFFICE

Efficient portfolio administration—from trade to accounting

Mastering Middle & Back Office complexity is a strategic imperative for asset managers and asset owners.

Your Middle & Back Office teams form the operational backbone of your organization, ensuring each portfolio is administratively sound, every transaction is accurately processed, every cash movement is validated, and every corporate action is properly handled.

Traditional Portfolio Management Systems (PMS) often perform well with standard workflows but struggle with complexity and exceptions.

Manual workarounds for non-standard corporate actions (e.g., tender offers, stock splits, bonus issues) or margin calls can lead to operational inefficiencies and errors.

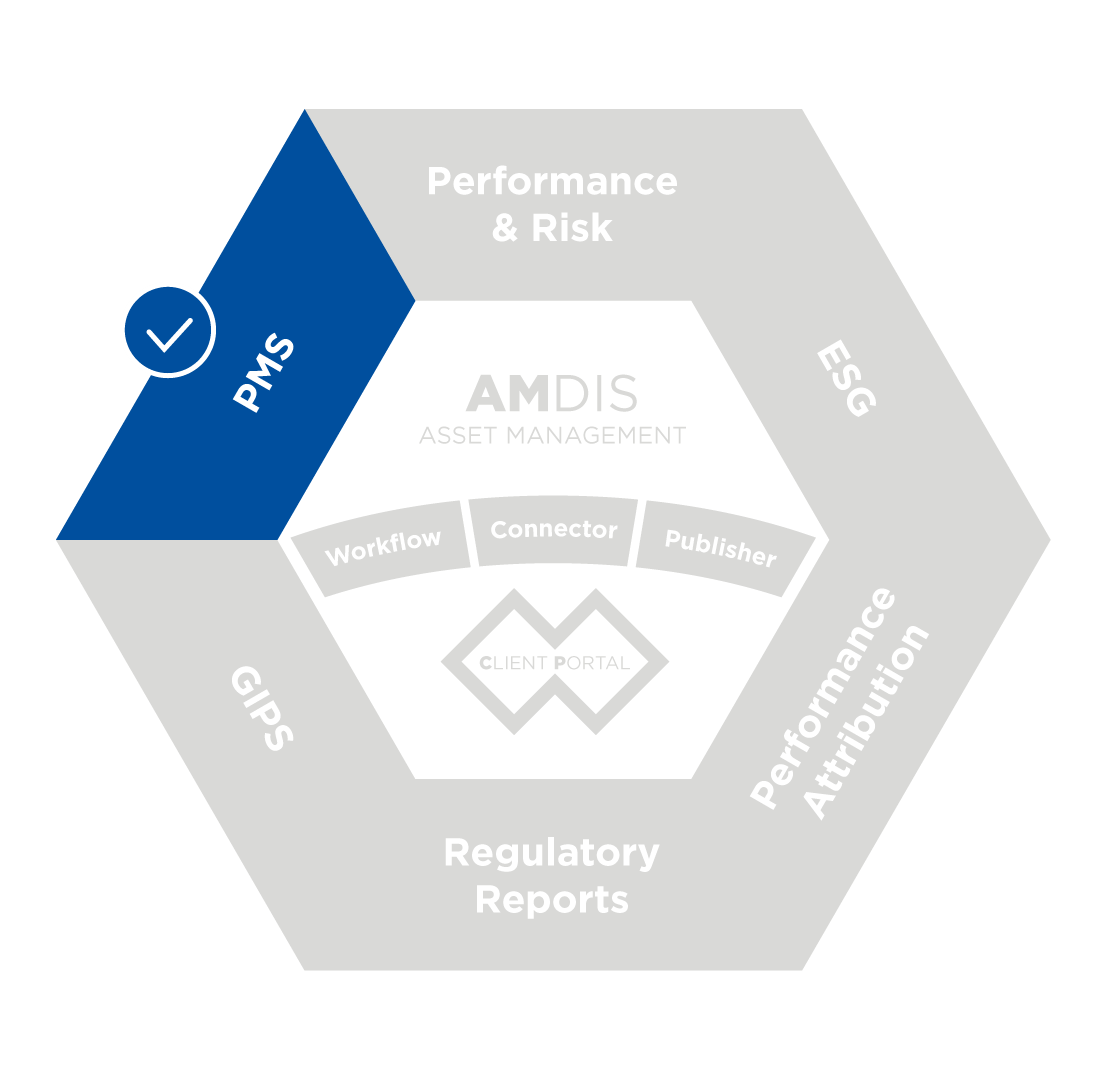

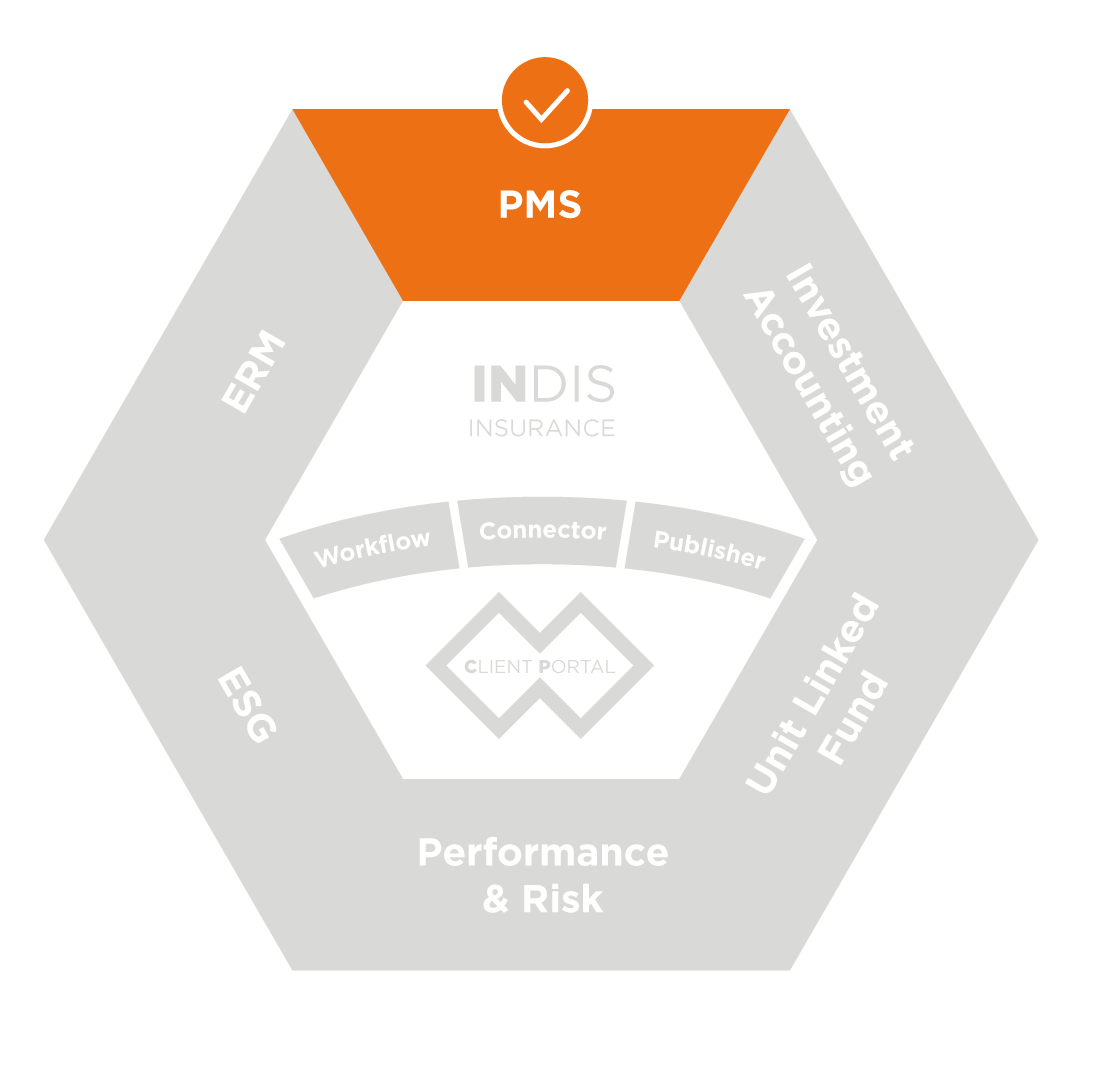

That's where AMINDIS comes in.

AN INTEGRATED SOLUTION TO STREAMLINE MIDDLE & BACK OFFICE OPERATIONS

AMINDIS provides a robust and integrated solution designed to streamline all critical Middle & Back Office functions (trade settlement, cash management, corporate actions, OTC).

The results: fewer manual interventions, strong automation capabilities, maximum configurability, and seamless accounting integration—ensuring better compliance and operations that scales with your activiy.

CORE FUNCTIONALITIES

SETTLEMENT & TRADE MANAGEMENT

Ensure flawless trade processing with full control over settlement workflows. AMINDIS enables you to capture and validate every detail associated with a transaction, ensuring timely and accurate settlement.

CORPORATE ACTIONS MANAGEMENT

Automate all standard and complex corporate actions for every instrument type. AMINDIS centralizes the process and gives you full control over choices.

OTC OPERATIONS & SPECIAL PRODUCTS

Simplify the management of instruments and special products with tools designed for flexibility and control.

CASH MANAGEMENT & FORECASTING

Gain real-time visibility on your cash positions and anticipate future needs with powerful forecasting tool.

FOR ASSET OWNERS: ACCOUNTING AT YOUR FINGERTIPS

AMINDIS seamlessly embeds portfolio accounting into every stage of the trade lifecycle. From automated lot matching (FIFO, LIFO, Average Cost, Free) at settlement to real-time entries for corporate actions, OTC operations, and cash flows, every booking is accurate, compliant, and audit-ready.

This deep integration gives asset owners instant access to accounting figures, and reinforces consistency between executed trades and their financial impact—ensuring clarity, transparency, and control over portfolio results.

MIDDLE & BACK OFFICE: CORE BENEFITS AT A GLANCE

OPERATIONAL RELIABILITY:

Automated workflows accross trade, cash, OTC operations, and corporate actions ensure consistent execution, and immediate accounting accuracy.

FUNCTIONAL FLEXIBILITY:

Easily configure transaction types, fees, value dates rules, collateral logic, and document flows to fit your specific operational needs.

FULL TRACEABILITY:

Track every action with a comprehensive audit trail, from trade entry to reconciliation and stakeholder updates.

FROM FRONT TO BACK: A COMPLETE SOLUTION

EXTEND YOUR TRADE CAPABILITIES BY DISCOVERING HOW OUR FRONT OFFICE AND ACCOUNTING MODULES WORK SEMALESSLY WITH MIDDLE & BACK OFFICE OPERATIONS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

CONFIDENTLY MANAGE MIDDLE & BACK OFFICE OPERATION

From settlement and coporate actions to cash management and reconciliation, AMINDIS, delivers seamless execution within a single, intuitive platform.

Join the asset managers and asset owners who rely AMINDIS for operational clarity, control at every stage of the investment lifecycle.

Book your personalized demo today.