INVESTMENT ACCOUNTING MODULE

A core component of your end-to-end investment platform

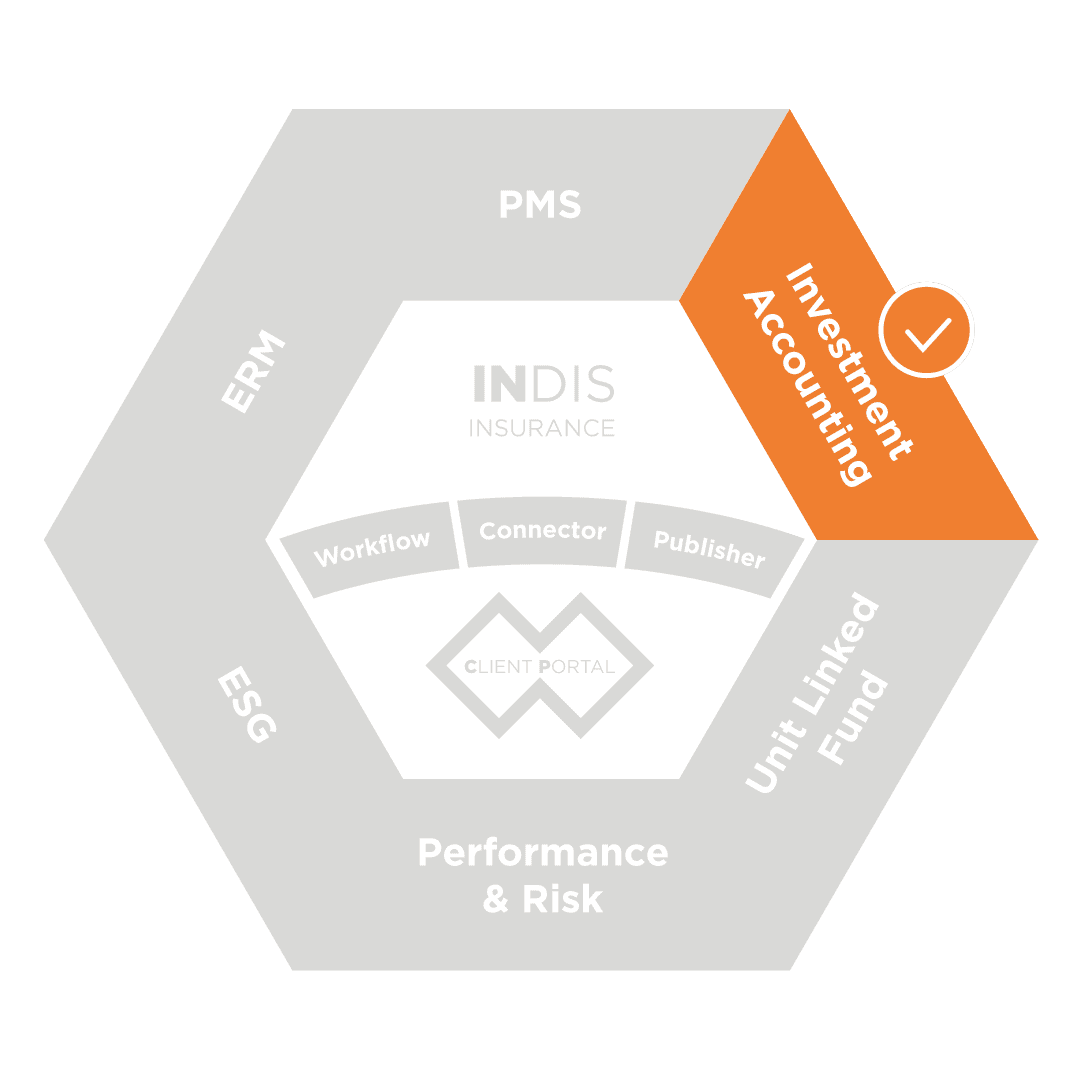

AMINDIS’ Investment Accounting module automates your entire accounting process—from transaction capture to multi-GAAP valuation and reporting. Fully integrated across front, middle/back, and reporting systems, it delivers real-time visibility, full traceability, and flexible configuration aligned with your operational and regulatory needs.

VALUE DELIVERED TO ASSET OWNERS

INVESTMENT ACCOUNTING MODULE FEATURES

As part of AMINDIS’ front-to-back platform, the Investment Accounting module is no longer a silo—it’s a fully integrated component of your investment operations. From trade processing (corporate actions, OTC operations, cash management, settlement) to automated month-end close, every step is traceable, configurable, and aligned with both operational workflows and regulatory standards.

Title

From trade to ledger

Watch how our Investment Accounting module transforms each financial event—purchase, sales, inventory, and accrued interests—into traceable journal entries. Each process begins with transaction capture, continues with automatic schema matching, and ends with precise accounting entries—fully aligns with your configured rules and multi-GAAP books.

Title

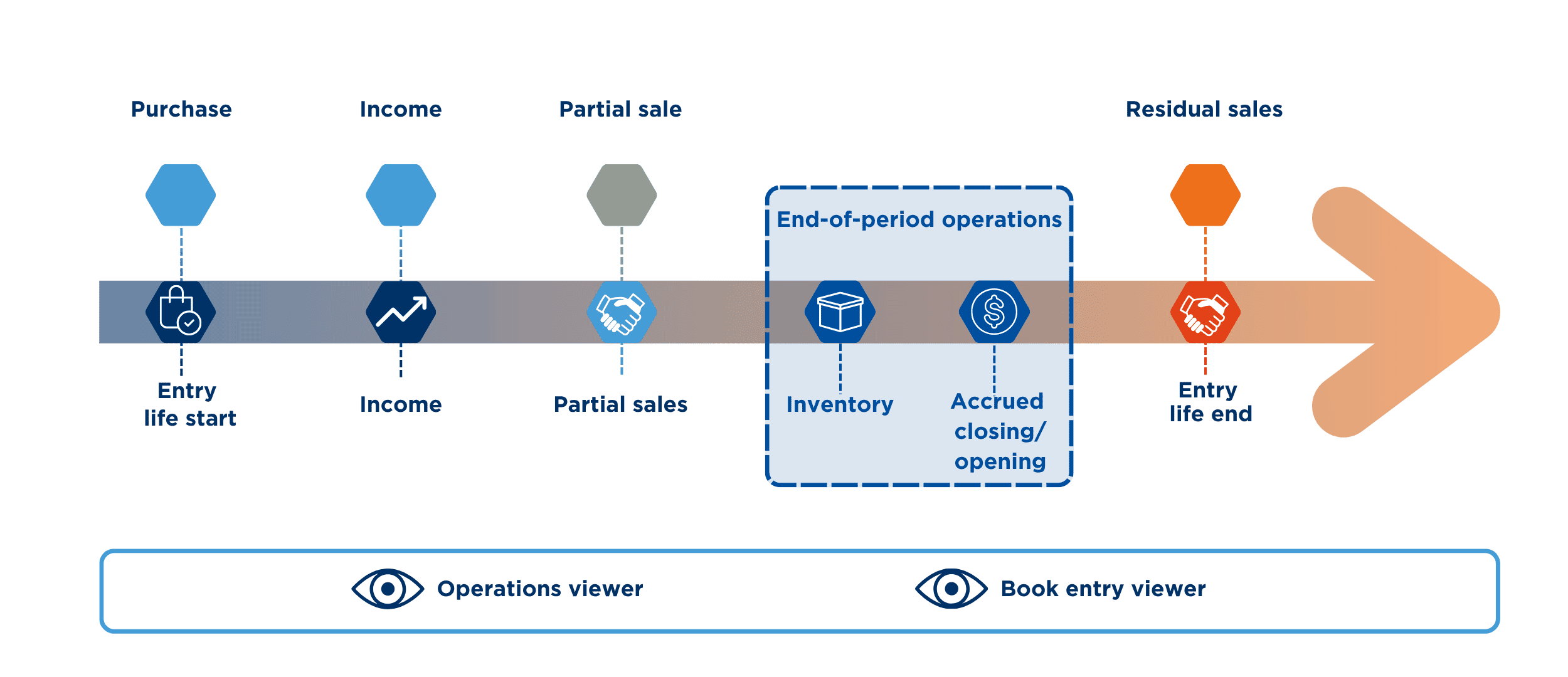

Accounting reinvented around the Entry Lifecycle

The concept of Entry Life is at the heart of AMINDIS' Investment Accounting module. It provides a continuous, end-to-end view of each position, from initial purchase to final sale, including all intermediate events such as income, partial sale, and end-of-period operations.

This timeline approach enables:

- Full traceability of every accounting movement

- Accurate tracking of valuation, depreciation, and accrued income

![]() Operations Viewer and Book Entries Viewer are two different types of views providing clear, consistent access to all operations and accounting entries, allowing for intuitive navigation across the full set of records.

Operations Viewer and Book Entries Viewer are two different types of views providing clear, consistent access to all operations and accounting entries, allowing for intuitive navigation across the full set of records.

By structuring data around the lifecycle of each Entry Life, AMINDIS offers full auditability and operational control.

Title

Multi-standard accounts plan

Simultaneously maintain multiple accounting books under various standards to meet all regulatory and internal reporting needs.

- Local GAAPs, French GAAP with including "Réserve de capitalisation" ; Belgian GAAP ; and other

- IFRS 9, with automated calculation of Expected Credit Losses (ECL)

- Multi-company support: manage multiple charts of accounts across different legal companies

- Customizable charts of accounts: create and tailor your own accounting standards to match specific business needs.

Title

Multiple matching modes

Select the adequate matching modes by company:

- FIFO

- LIFO

- Average cost

- Free

- Max profit

Title

All valuation methods

- Support multiple valuation methods: market value, amortized cost (linear or actuarial), or acquisition value

- Automatically calculate depreciation, price/FX P&L, Fair Value Adjustments (FVA)

- Handle intermediary periods with optional automatic reversals

- Configure custom rules for value impairment and write-downs

Title

Configurable accounting schema

Define accounting treatments for both daily operations and closing processes (end-of-month, quarterly, annual)—with a structured approach:

1. Scope of applicability: set conditions under each schema applies using flexible criteria such as asset classifications, transaction type, or lot-status characteristics (e.g., impaired/not impaired).

2. Account mapping: link each operation to the correct accounts, aligned with your chart of accounts and reporting standards.

3. Amount calculation: configure how amounts are computed using tailored formulas reflecting your internal logic.

Title

Advanced features

- Flexible date-based accounting: entries can be recorded based on value date, trade date, or operation date

- Full management of accrued interest for bonds

- Simplified transfer of entry life at book value between portfolios

- Management of write-backs, corrections, and audit status

- Mathematical reserves: freely associate reserves with managed portfolios for accurate accounting

Title

Accounting reports

Access detailed reports at every level:

- General ledger: view entries by accounting account

- Journal: fully traceable entries across all accounting operations

- Inventory reports: position and valuation tracking by asset, lot, entry life, and any other criteria

- Comparative views (N-1 vs N), year-over-year insights with full traceability of valuation changes and their origins

- Drill-down capabilities, from consolidated views to operation-level detail

- Analytics integration: link accounting data with our Performance & Risk module to create your customized analyses

CHECK OUT COMPLEMENTARY SOLUTIONS FOR ASSET OWNERS

DISCOVER THE BUSINESS WHERE OUR INVESTMENT ACCOUNTING MODULE PLAYS A CENTRAL ROLE