DELIVER SOLVENCY II REPORTING WITH CONFIDENCE

In force since January 2016, the Solvency II directive sets strict requirements for risk management and capital adequacy in the EU insurance market. It demands precise risk measurement, accurate Solvency Capital Requirement (SCR) calculations, and full regulatory reporting—while ensuring long-term financial stability.

This means producing QRTs, performing these capital requirement calculations across multiple asset classes and insurance contracts, and running numerous stress scenarios—on both assets and liabilities, over long horizons. Every calculation must be accurate, validated, traceable, and flexible enough to evolve with the new products the firm adds.

The challenge?

Many tools slow the process down—rigid systems, opaque models, and IT-dependent changes drain time and reduce transparency. Meanwhile, regulators expect clarity, and risk boards expect precise, timely, and well-documented answers.

Meeting these demands requires a solution that automates complexity, adapts to insurance contracts (liabilities and assets) or securities type, and gives you full control over every assumption, input, and result.

TURN SOLVENCY II INTO A STREAMLINE, INSIGHT-DRIVEN PROCESS

AMINDIS delivers a transparent, flexible, and fully integrated simulation environment—making it easy to run scenarios, calculate SCRs, and produce QRTs with speed, accuracy, and full traceability.

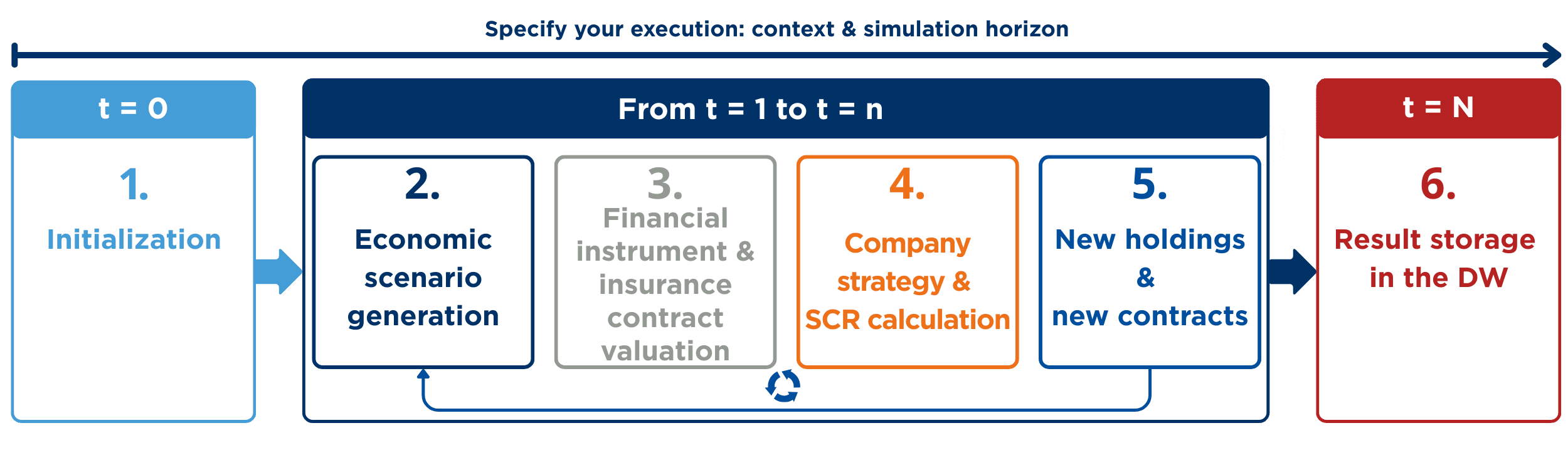

Initialization: Load all data for the simulation, including financial instruments and insurance contracts.

Economic scenario generation: Generate projections and valuations of risk factors, taking correlations into account.

Financial instrument & insurance contract valuation: Calculate key indicators under simulated conditions for both assets and liabilities.

Company strategy & SCR calculation: Apply scenarios, reallocate portfolios, and compute SCR values.

New holdings & new contracts: Track reallocations, create and update new positions, add new contracts, and monitor changes in exposures over time.

Results: Store, compare, and share outputs instantly, with QRT production automated from Excel to XLM for regulatory submission.

Each step in the Solvency II process is powered by robust features that make regulatory compliance faster, more accurate, and easier to manage.

KEY STRENGTHS THAT SET AMINDIS APART

WHY IT MATTERS FOR YOUR SOLVENCY II PROCESS

BE ON TIME

Automate QRT production and workflow to meet strict SLAs.

ENSURE TRANSPARENCY

Transparent, equation-based calculations—free from black boxes—guarantee audit readiness.

STAY FLEXIBLE

Easily test multiple scenarios and add additional contract types when needed through immediate equation editing.

EXPLORE MORE: RELATED TOPICS

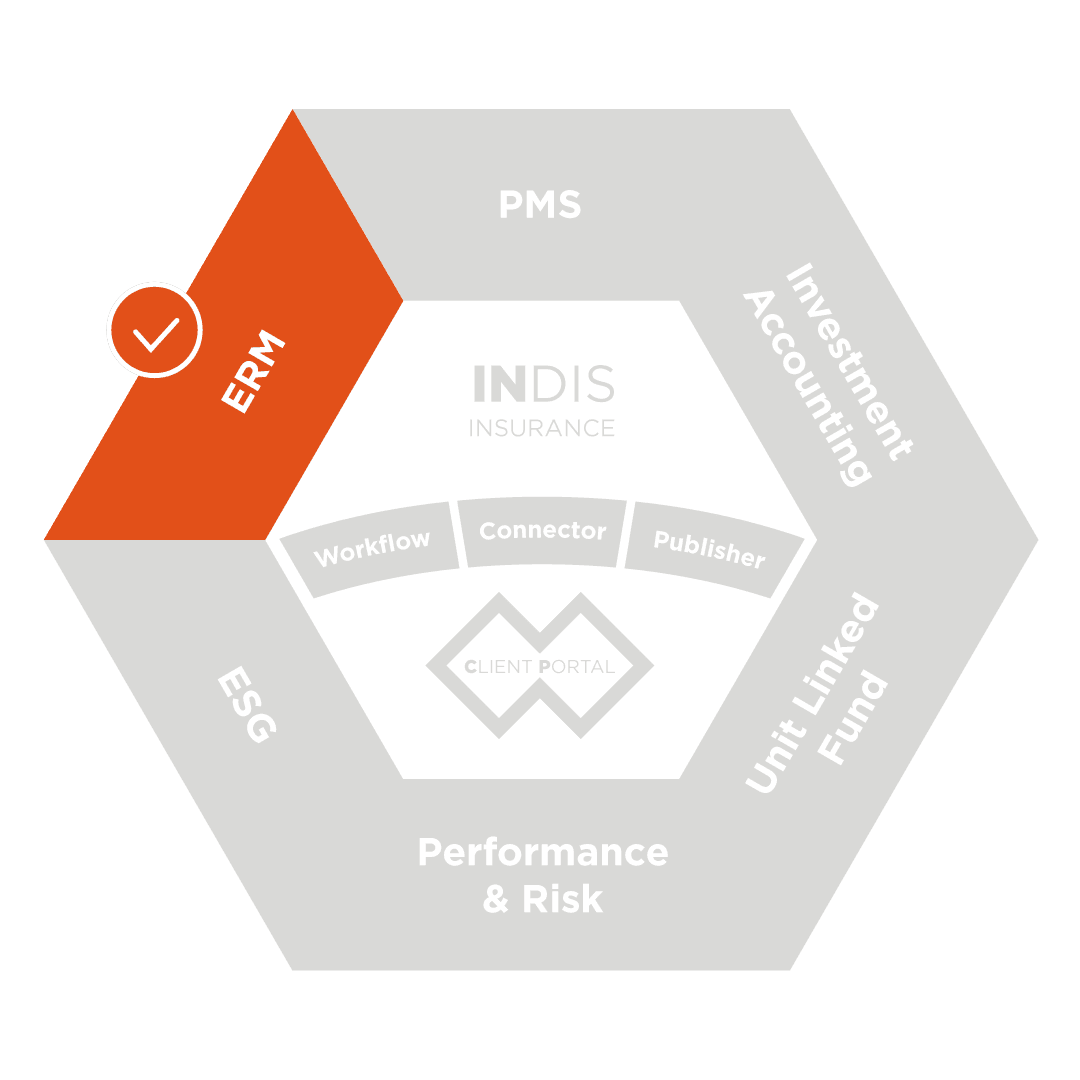

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

READY TO TAKE CONTROL OF YOUR SOLVENCY II PROCESS?

Tired of endless calculations, inflexible tools, and fragmented data slowing down your regulatory reporting?

It’s time to switch to a faster, smarter, and fully transparent approach—one that keeps you in control of every step.

See how AMINDIS’ Solvency II solution transforms compliance into a competitive edge.