MASTER YOUR BUDGET FORECASTING

Budget forecasting is a mission-critical for asset owners—especially when investments represents the majority of the balance sheet.

To be effective, your forecasts must be solid, strategic, flexible, and defensible. That means:

Anticipating the company’s key monitoring indicators, such as market value, P&L, accounting value, and return

Testing the impact of reinvestments or disinvestments on future outcomes

Delivering clarity to investment committees with consistent figures, meaningful comparisons, and actionable insights.

This can't be achieved with spreadsheets or siloed tools. You need a single, transparent, fully integrated modeling environment—bringing together all your data, models, and assumptions in one place.

FROM BUDGET FORECAST TO STRATEGIC DECISION-MAKING

Turn your budget forecast into a strategic decision-making tool.

AMINDIS empowers you with a transparent, flexible, and fully integrated modeling environment—so you can simulate scenarios, test strategies, and deliver clear, reliable projections with confidence.

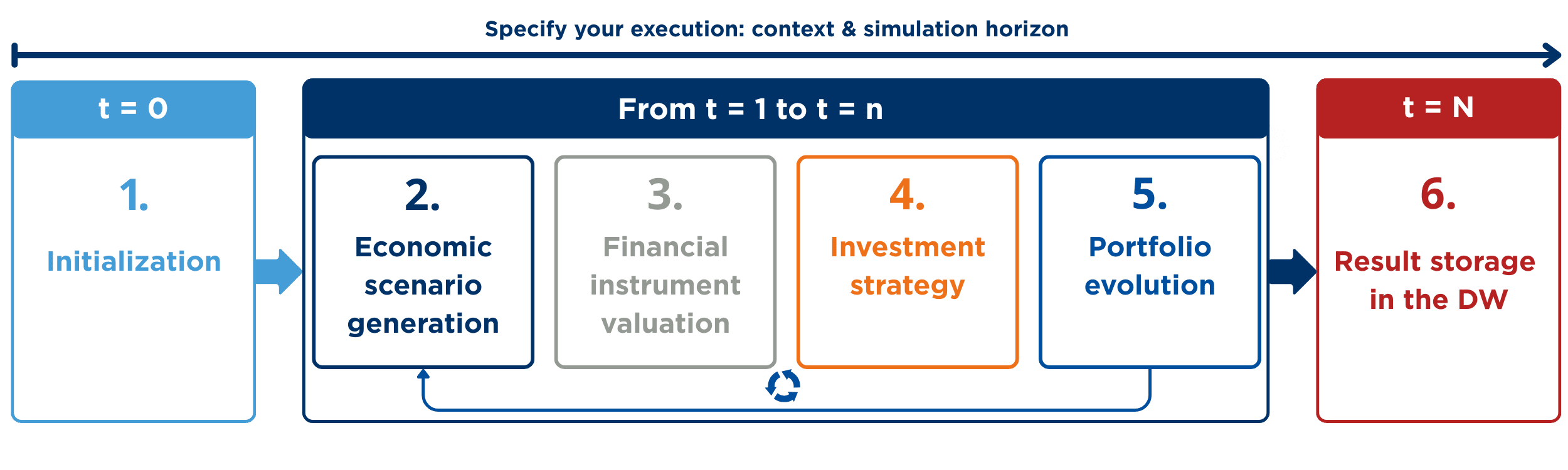

Initialization: Initialize all data needed for the simulation (holdings, security indicators, ...).

Economic scenario generation: Generate projections and values of risk factors, taking correlations into account.

Financial instrument valuation: Calculate selected indicators (theoretical market value, accounting value, ...) under simulated conditions using risk factor values.

Investment strategy: Use instrument indicators to apply scenarios, reallocate the portfolio, and factor in new cash flows and investment policy.

Portfolio evolution: Track reallocations, create and update new positions, and monitor changes in exposures over time.

Results: Store, compare, and share outputs instantly via dashboards or the Client Portal.

Each step in the simulation workflow is supported by robust features that make your budget forecasting faster, more accurate, and easier to manage.

KEY STRENGTHS THAT SET AMINDIS APART

STRATEGIC BENEFITS FOR BUDGET FORECASTING

INVESTMENT STRATEGY CONTROL

Strengthen decision-making with clear, simulation-based insights.

SAVE TIME

Reduce manual work and speed up forecasting cycles through integrated automation.

TAILORED MODELING

Select and adapt models to match specific business needs with ease.

EXPLORE MORE: RELATED TOPICS

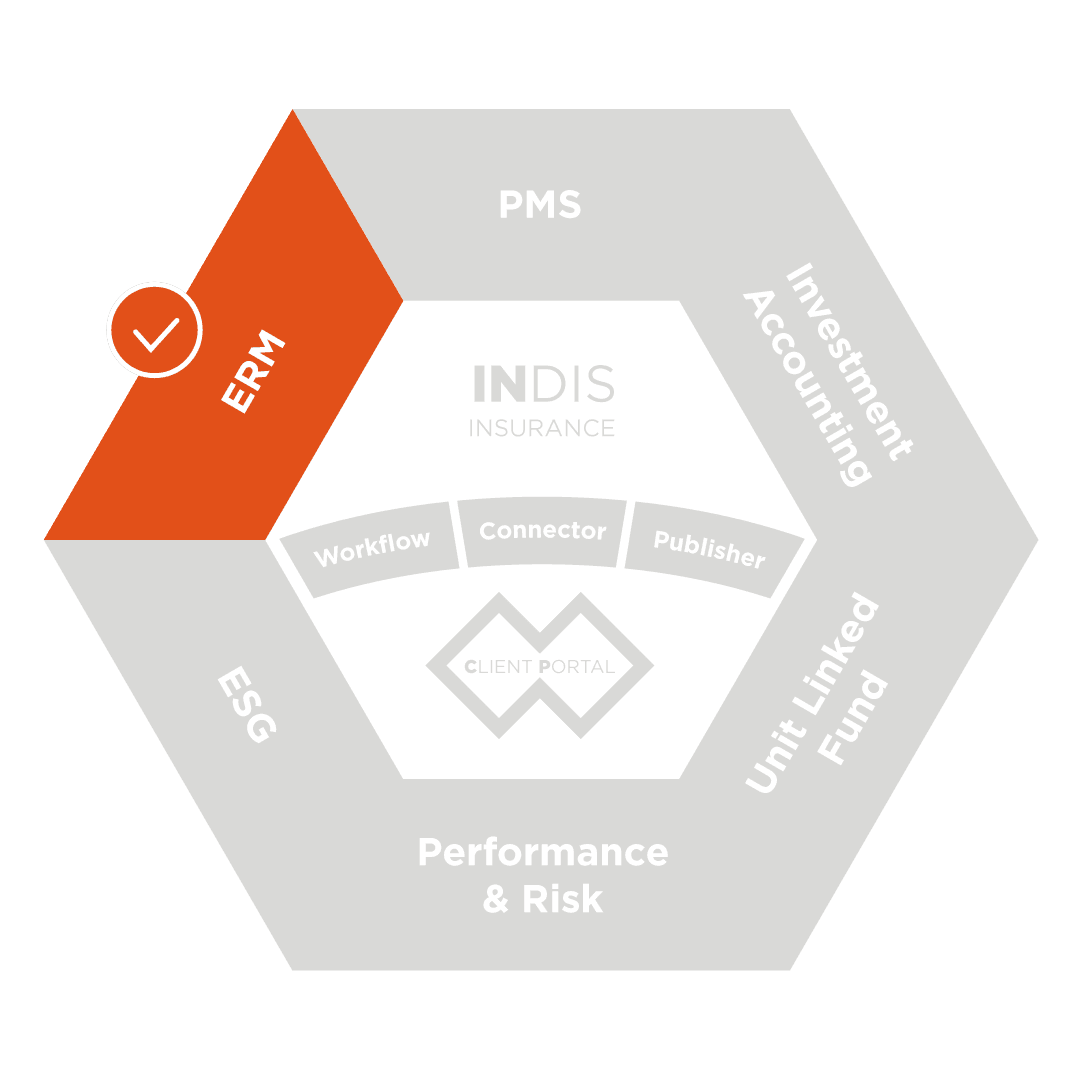

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

READY TO ELEVATE YOUR FORECASTING PROCESS?

Still relying on static model or fragmented data for your ERM projections? It's time to shift to a more transparent, accurate, and operationally efficient approach.

Get in touch with us to discover how AMINDIS' ERM solution can transform your budgeting and simulation workflows.