MASTER YOUR ASSET & LIABILITIES MANAGEMENT

Aligning assets with liabilities isn't just a routine task—it's a constant strategic challenge. It demands a complete view of the balance sheet, bringing together the characteristics of invested assets and precise liability data.

With a built-in liability-drive investment (LDI) approach, asset and liability are matched by comparing expected and actual cash flows over different horizons—tailored to each business model and product offering.

But flexibility is hard to achieve. Too often, ALM becomes a complex custom IT project—difficult to update, slow to adapt, and reliant on actuaries to act as developers. On top of that, collecting data across the organization is rarely straightforward, delaying the insights needed for timely, well-informed decisions.

TURNING ALM INTO A STRATEGIC DECISION-MAKING TOOL

AMINDIS delivers a transparent, flexible, and fully integrated modeling environment—enabling precise asset-liability matching, realistic scenario testing, and clear insights to guide investment strategies with confidence.

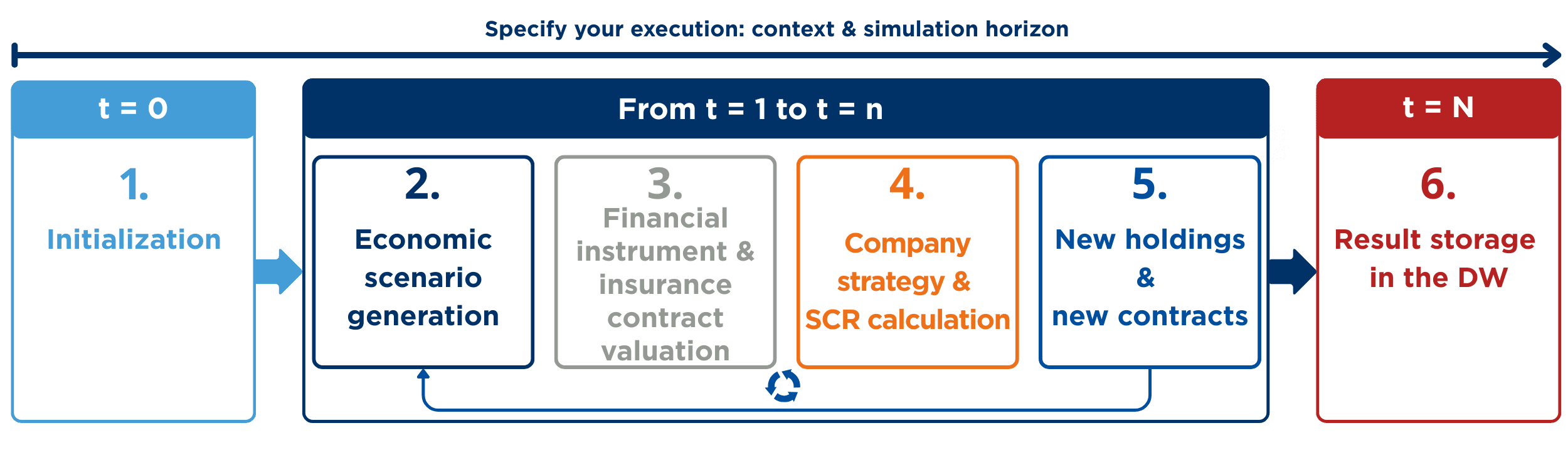

Initialization: Load all data for the simulation—holdings (contract by contract or by pool), liabilities, and key indicators.

Economic scenario generation: Generate projections and values of risk factors, taking correlations into account.

Financial instrument & insurance contract valuation: Calculate key indicators for assets and liabilities under simulated conditions.

Company strategy & GAP calculation: Apply scenarios, adjust allocations, and measure asset-liabilities gaps.

Portfolio evolution (optional) : Track reallocations, create and update new positions, and monitor changes in exposures over time.

Results: Store, compare, and share outputs instantly via dashboards or the Client Portal.

KEY STRENGTHS THAT SET AMINDIS APART

STRATEGIC BENEFITS FOR ALM

INVESTMENT STRATEGY CONTROL

Strengthen decision-making by aligning asset allocations with liability profiles, using clear, simulation-based insights.

SAVE TIME

Reduce manual work and accelerate ALM cycles through integrated automation and streamlined data handling.

TAILORED MODELING

Select and adapt ALM models to match your specific business needs with ease.

EXPLORE MORE: RELATED TOPICS

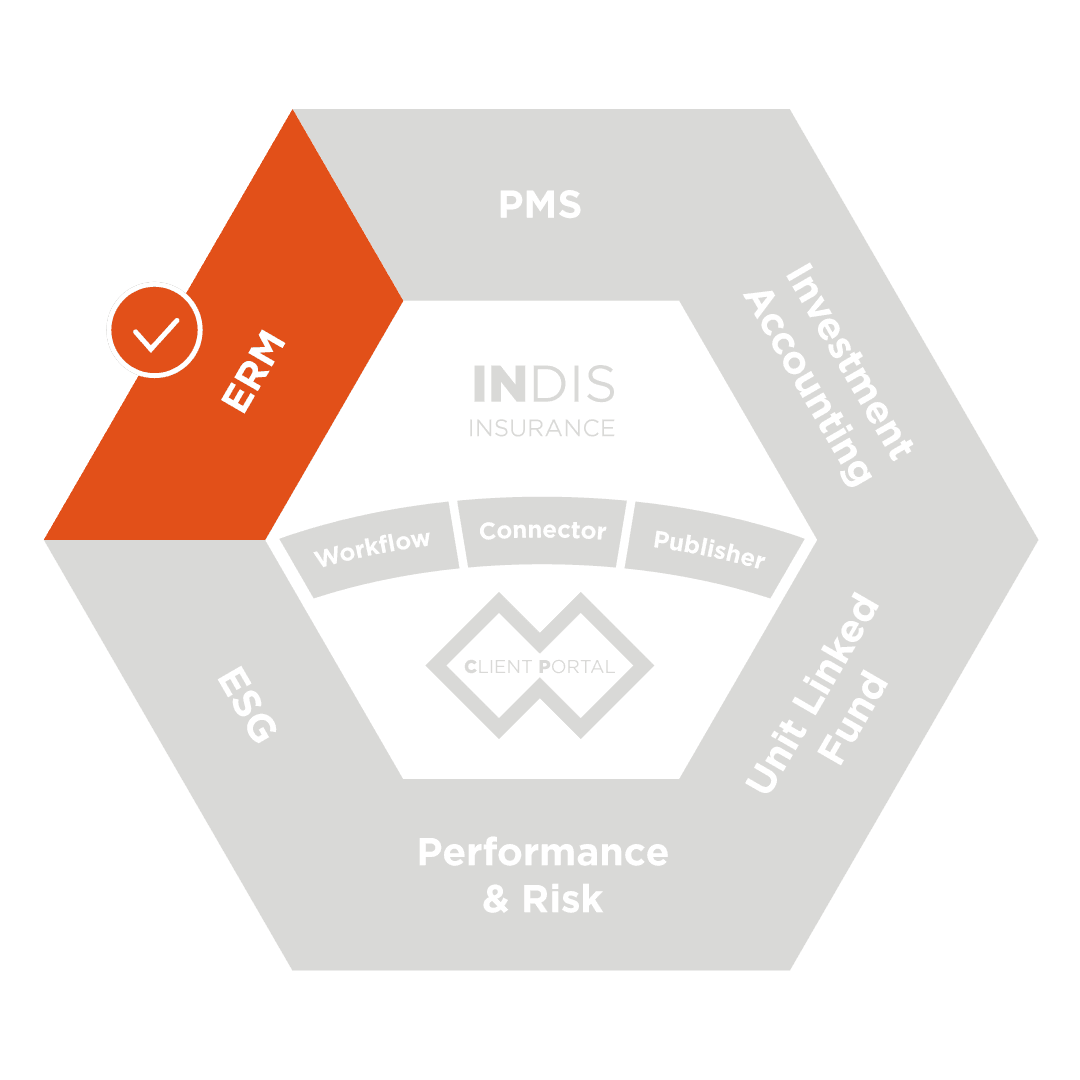

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

READY TO ELEVATE YOUR FORECASTING PROCESS?

Still relying on static model or fragmented data for your ERM projections? It's time to shift to a more transparent, accurate, and operationally efficient approach.

Get in touch with us to discover how AMINDIS' ERM solution can transform your budgeting and simulation workflows.