FLEXIBLE AND ACCURATE INVESTMENT PERFORMANCE CALCULATIONS

Performance is at the heart of investment management. Yet calculating it—correctly, consistently, and comprehensively— remains a real operational challenge.

Asset managers must demonstrate the value of their strategies. Asset owners must ensure their portfolios generate returns aligned with long-term liabilities constraints.

Meeting these expectations takes more than numbers—it requires a reliable, accurate, and adaptable system that handles everything from daily returns to full attribution, including complex instruments, with fully configurable logic. Performance isn’t just a metric—it’s the foundation for trust and strategy.

At AMINDIS, this is what we deliver.

BUILT FOR ACCURACY, DESIGNED FOR COMPLEXITY

Performance calculation is not a plug-in. It's a foundation.

For over two decades, we've helped asset managers and asset owners turn performance into a decision-making tool. Through advanced technology, expert publications, and tailored training by AMINDIS Academy, we've shaped how investment professionals measure, analyze, and explains analysis results.

This expertise lives at the core of our platform—powered by our building block approach and our entity-based model, which let you build exactly the performance logic you need, and apply it to the portfolios, funds, and views that matter most.

Core capabilities

Profit & Loss - From global to granular views

Track P&L at every level—portfolio, security, trade, or any other financial or analytical breakdown—for a complete and transparent view of results.

Calculations can be done over any time period: monthly, quarterly, annually, or custom. All frequencies are fully configurable to match your reporting needs.

Supported indicators include:

- Gross/Net financial total P&L (configurable by tax or fees types)

- Price/income/FX P&L split

- Accounting P&L

- Realized/unrealized P&L

- Split P&L for bonds (for carry, rate, duration, credit, rolldown, shift, ...)

Global return - contribution/withdrawal based

Compute performance at the portfolio level using market value, contribution and withdrawal logic, along with other IN and OUT cashflows.

Available methodologies:

- Modified Dietz methodology

- Holding period return

- Internal rate return (IRR)

- Accounting return

For flexibility, these returns can be calculated on any period.

Calculations support both gross and net money-weighted returns (MWR), with full integration of portfolio fee breakdown into the calculation.

Fund return - NAV-based

Measure performance using fund NAV and corporate actions, across all share classes, aligned with official reporting and factsheet production.

- Calculation periods are auto-synchronized with NAV dates for consistency and no manual adjustments

- Enables seamless benchmark comparisons at fund level or across custom scopes

- NAV-based returns feed directly into risk/ratios calculations, including volatility and tracking error

Line-by-line transaction-based returns and contributions

Analyze returns at the most detailed level—by asset, asset class, issuer, strategy, entity, or any custom criteria—aligned with your investment process.

Split returns for deeper understanding, apply custom frequencies (daily, weekly, monthly), and calculate in any output currency—base, local or specific.

The weighted-sum method allows you to aggregate security or asset-level returns by any criteria. It also enables you to compute the contribution to return for each element at the most granular level.

Return indicators:

- Return contribution

- Gross/Net total return

- Price/income/FX return (hedged or non-hedged)

- Securities/Future return

- Accounting return

Derivatives and OTCs performance

Performance calculations natively integrate derivatives and OTCs using built-in algorithms. These complex exposures are consistently handled across all views.

Derivatives and OTCs are calculated in two branches when needed. Long and short positions are reaggregated seamlessly into global performance for a clear, complete view.

No separate treatment—just one coherent view of performance.

Time-based chaining, built for flexibility

Chain performance over any period you define—daily, weekly, monthly, year-to-date, or custom period.

Chain return:

Apply time-weighted return (TWR) and cumulative TWR—either absolute or rebased to 100—to monitor how performance evolves across time.

Chain contribution:

Use GRAP or Carino methods to link contributions across periods.

Benchmark comparison

Compare any entity (portfolio, business account, carve-out, ...) with its benchmark—side by side, over time, across scopes, and at criteria level. Benchmark integration is native and automatic, thanks to embedded criteria matching.

Work with composite benchmarks made of multiple indices, using provider-supplied index prices or returns.

Benchmarks can also be automatically rebalanced based on the portfolio’s selected rebalancing period. Benchmark views remain aligned with your portfolios at all times.

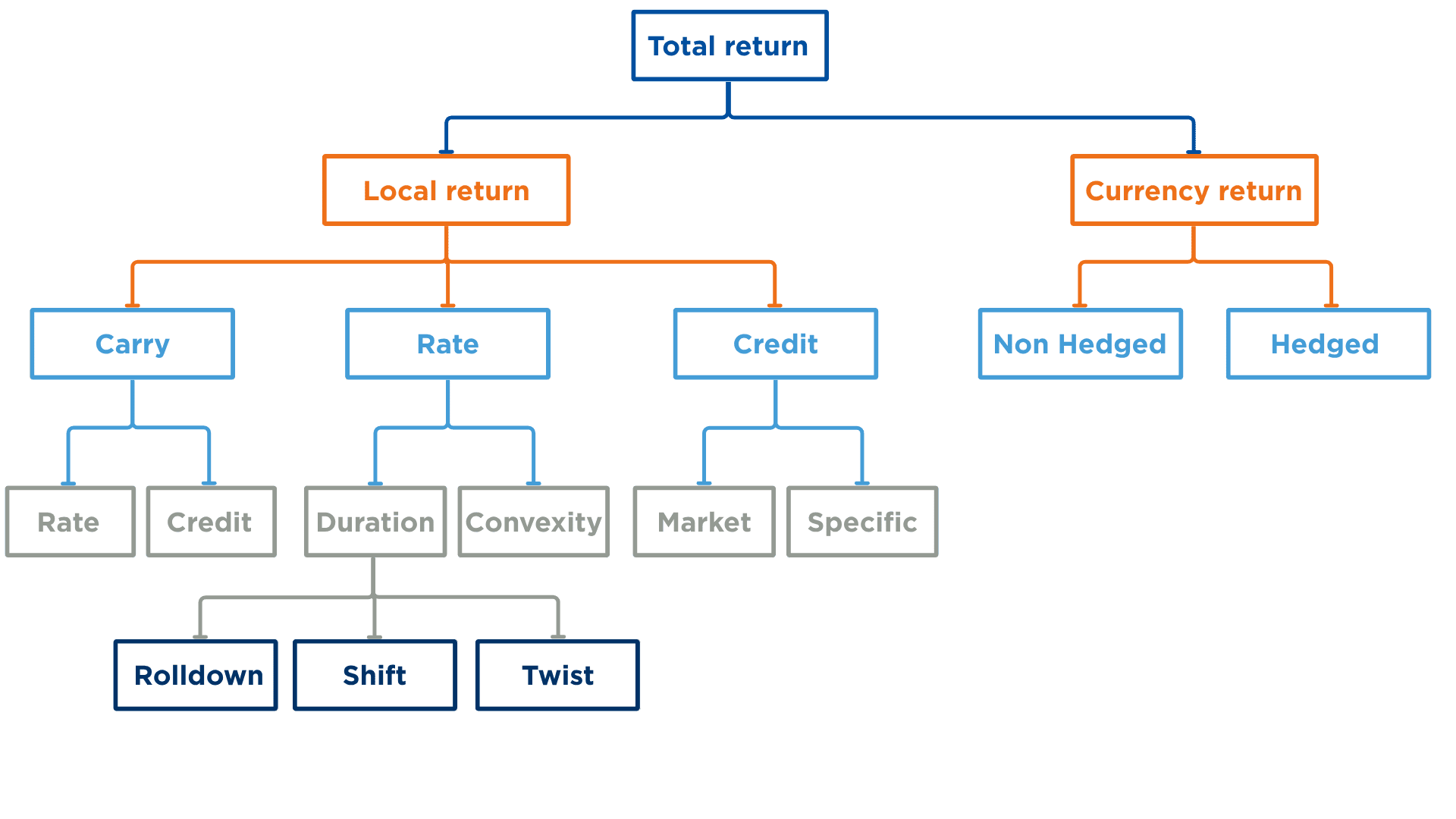

Bond-specific return methodologies

Our solution uses fixed income-specific logic and bond return methods.

Split global return into key components—carry, rate effect, duration, credit spread, rolldown—to reveal what truly drives each bond’s return.

WANT TO DEEPEN YOUR EXPERTISE IN PERFORMANCE AND RISK?

Explore our AMINDIS Academy training on Mastering performance and risk measurement. Learn how to interpret key indicators, apply advanced methodologies, and turn analytics into actionable insights.

Whether you're a portfolio manager, performance analyst, or risk officer, our training gives you the tools to better understand and explain the numbers.

KEY BENEFITS FOR ASSET MANAGERS AND ASSET OWNERS

GLOBAL AND DETAILED P&L VIEWS

Explore P&L at any level—globally or in detail—with full flexibility to break down results by effect.

FLEXIBLE RETURN ALGORITHMS

Measure return globally or line-by-line with adaptable algorithms that fit every analysis and reporting need.

IN LINE WITH STRATEGY

Track and calculate returns using any investment-driven criteria, and align results with strategic allocation decisions.

BENCHMARK READY

Compare portfolios to benchmarks by any scope or criteria, with index-level or native composite.

CUSTOM TIMEFRAMES

Chain and recalculate performance over any period or frequency, with full audit consistency.

INTEGRATED DERIVATIVES AND OTCS

Seamlessly integrate derivatives and OTCs into performance for a complete, consistent view.

EXPLORE MORE: RELATED TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

WANT TO TAKE PERFORMANCE CALCULATION FURTHER?

At AMINDIS, performance is not just calculated. It's explained, aligned, and understood.

Let's talk. Request a demo!