ALIGN YOUR PERFORMANCE ATTRIBUTION WITH YOUR INVESTMENT STRATEGY

Performance attribution is more than an analytical tool. It's a strategic asset that helps build trust, explain decisions, and ensure transparency. As an asset manager, you're expected to explain your results clearly and with confidence. Clients want to know where active return comes from—was it allocation, selection, or any additional factors?

Attribution reflects the quality of your decisions and demonstrates the value you bring. It gives structure to the conversation with your clients. But today's investment strategies are more diverse than ever—multi asset, ESG, fund-of-funds, derivatives—each with its own logic and complexity. A single model can't fit all.

You need a solution that mirrors your process. One that adapts to your strategy and reveals the most relevant drivers. Only a flexible, well-aligned model allows you to explain performance with clarity and accuracy.

PERFORMANCE ATTRIBUTION TAILORED TO YOUR NEEDS

AMINDIS is a pioneer in performance attribution. Our expertise is backed by years of research and in-depth development. We offer a sophisticated and highly flexible solution tailored to the real needs of asset managers.

At the core of our solution is a modular Building Block approach. It allows full customization of attribution models to reflect the investment strategy using adequate criteria levels—asset classes, regions, sectors, or any relevant dimension. To explain active return clearly, you need attribution models that adapt to how you actually invest.

The right methodology for your portfolio

Attribution models should fit the strategy—not the other way around. Whether the focus is equities, fixed income, multi-layered funds, ESG, or carbon-driven mandates, the right methodology ensures performance is explained through the relevant lens.

Multi-level drill down

Run attribution by level and scope, following a top-down setup that mirrors how decisions are structured across portfolio layers. Break performance down using dimensions like asset class, sector, region, or custom views. This structure brings clarity to mandates, sleeves, and strategies, aligned with how portfolios are actually managed.

Advanced benchmark handling

Benchmarks evolve just like investment strategies. As allocations shift, rebalancing occurs, or new indices are introduced, attribution remains coherent. Full benchmark histories and underlying index composition are tracked, ensuring performance stays aligned with the manager's intent—even across multiple benchmarks.

OTCs and derivatives

Modern portfolios often include complex instruments. Derivatives and structured products are fully integrated intro attribution—not treated as outliers. Their effects on performance, whether from hedging, leverage, or overlays, are captured with the same clarity as traditional assets.

Chain attribution over time

Performance isn't static—it builds over time. By chaining effects across the full analysis period, attribution reveals how short-term decisions accumulate into long-term results. This continuity helps assess the strategy's true trajectory, no matter the timeframe chosen.

WHY IT MATTERS TO YOUR DAY-TO-DAY

STRONGER CLIENT COMMUNICATION

Turn complex results into clear explanations. Provide structured, confident answers to show how value is created.

GROUNDED IN PROVEN METHODOLOGIES

Rely on attribution models that are industry-recognized and academically validated—ensuring credibility in every figure.

ADAPTABLE TO ANY STRATEGY

Easily align attribution logic with your specific investment style, regardless of asset class, structure, or ESG integration.

EXPLORE MORE: RELATED TOPICS

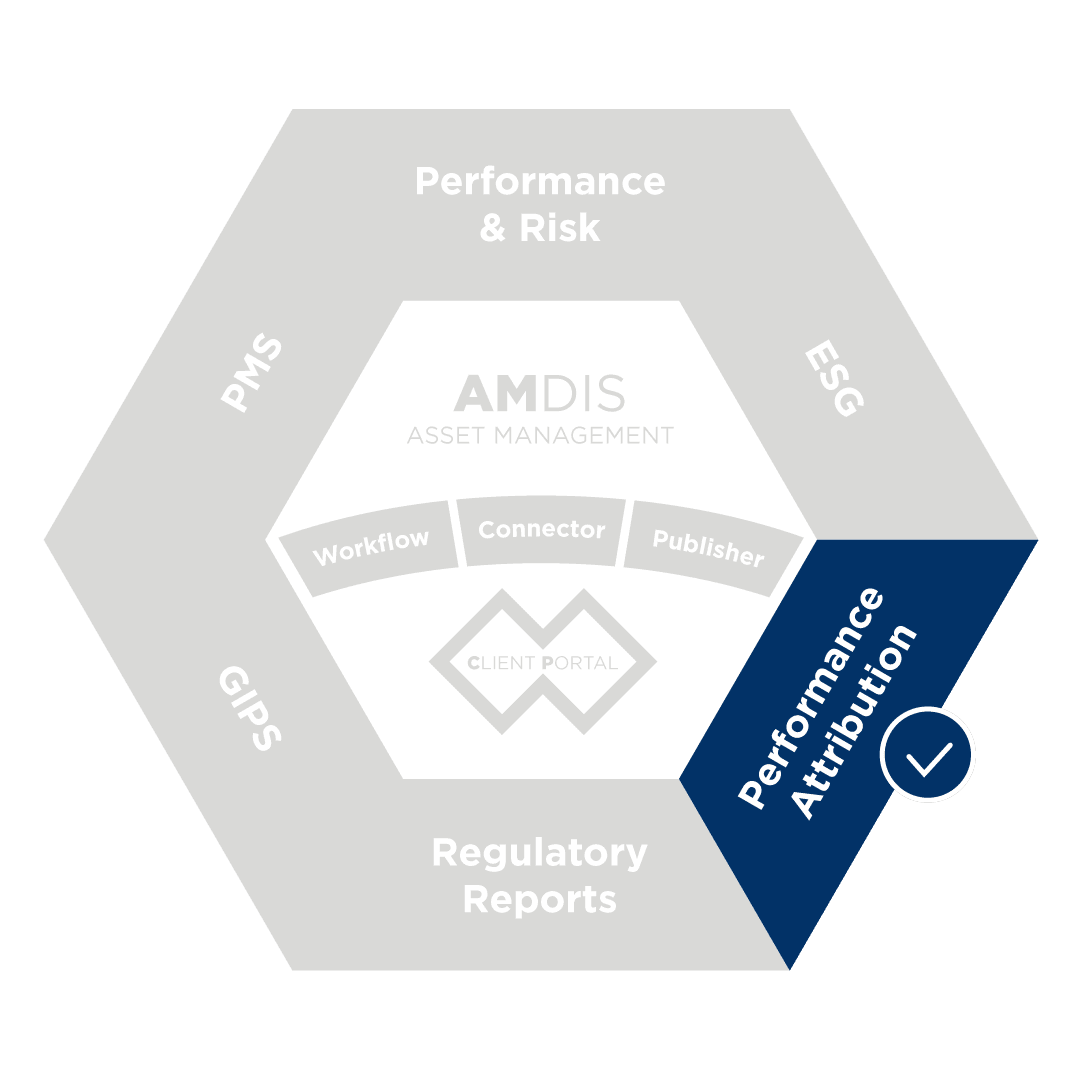

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision