ENSURE ACCURATE HOLDINGS AND TRUSTED VALUATION

Real-time holdings and accurate valuation are essential. They are the foundation for performance analysis, compliance reporting, middle-office processes, and more. Without them, the entire investment chain loses consistency. Valuation is not an isolated calculation—it supports all downstream uses, from regulatory filings to strategic decision-making.

But data is often fragmented. Holdings may differ between internal tools and custodians. Valuation logic varies across systems. Reconciliation becomes slow, manual, and difficult to trust. The risk grows with portfolio complexity and non-listed instruments.

A central and consistent valuation engine would limit those risks, reduce operational workload, and ensure all teams work with the same, up-to-date information.

A UNIQUE HOLDING AND VALUATON ACROSS YOUR STACK

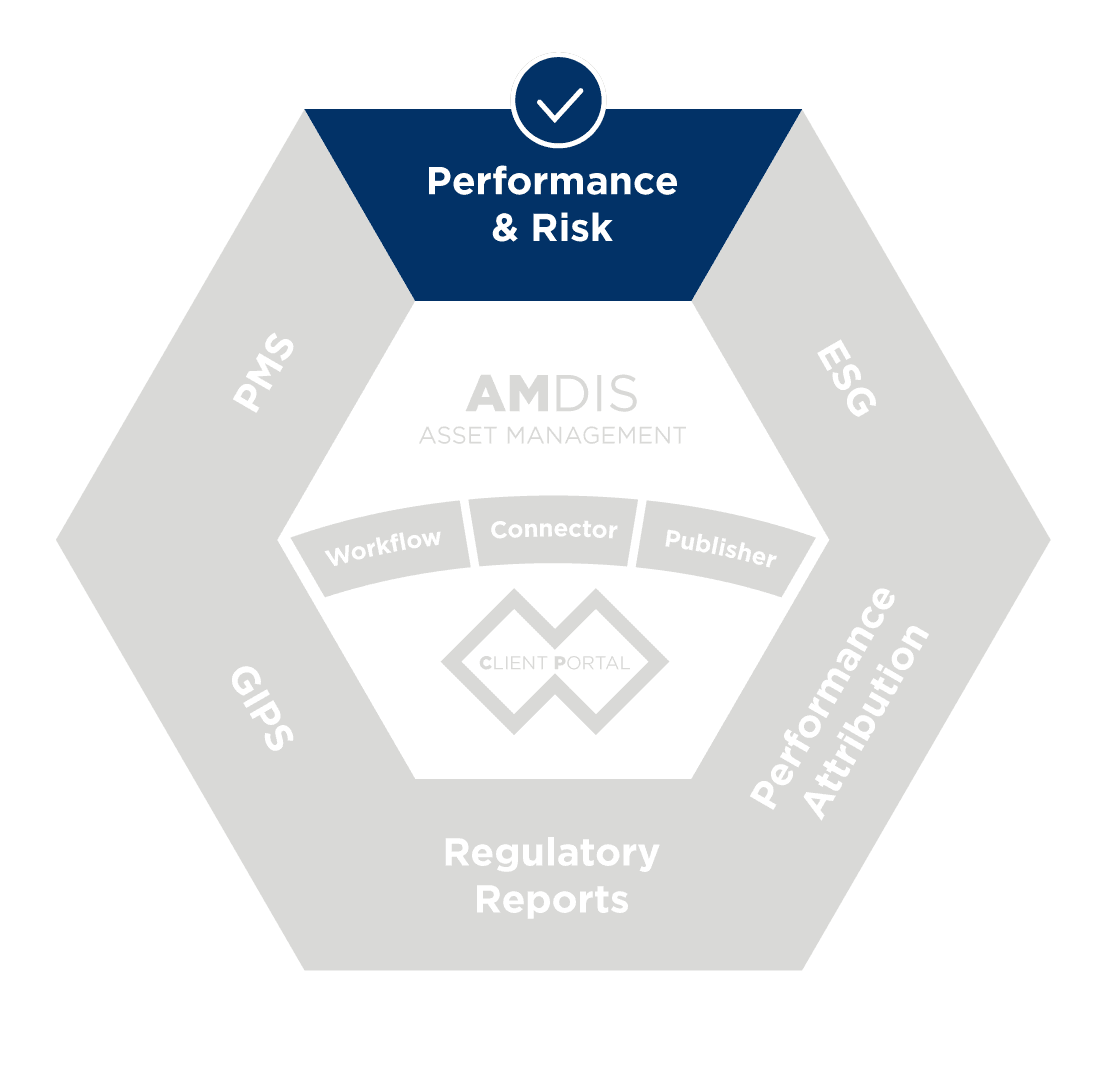

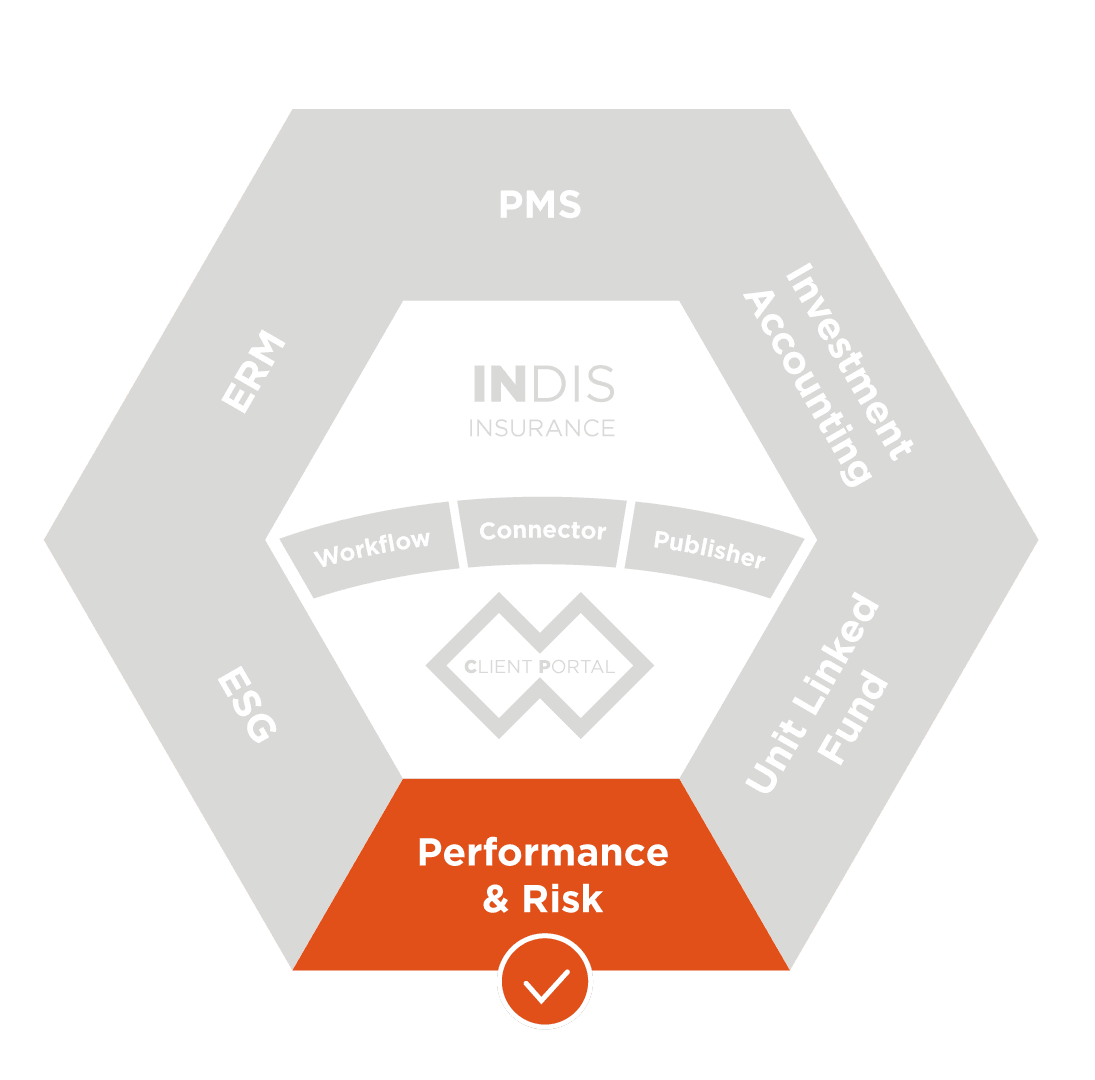

AMINDIS provide a single, reliable engine that centralize valuation across your entire organization. Positions, prices, FX rates, and accrued interests are consolidated in one model and made available to every team—performance, risk, accounting and reporting.

All modules work with the same logic, updated in real time. Valuation becomes a shared foundation across the front, middle and back office—as well as accounting and analytics. This improves consistency, reduces operational workload, and enables faster, more confident decisions.

WHAT YOU GAIN BY CHOOSING AMINDIS

RELIABLE DATA ACROSS ALL MODULES

With positions and valuations aligned at every date, performance metrics and exposure calculations are always accurate and ready.

ALWAYS ON HAND VALUATION

Fallback rules between price providers ensure uninterrupted valuations—even when one source fails. No more manual fixes or data gaps.

LESS MANUAL WORK AND FEWER ERRORS

Automated sourcing and reconciliation reduce operational effort. Teams spend less time checking data and more time using it.

SEAMLESS RECONCILIATION WITH ALL STAKEHOLDERS

Internal positions are automatically reconciled with external data—from PMS, custodians, or valuation agents—ensuring complete alignment at every level.

EXPLORE MORE: RELATED TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

Make your holdings and valuations a trusted foundation—not a source of doubt. With AMINDIS, you gain end-to-end consistency, automated control, and full transparency across your portfolio.

Ready to see it in action?

Contact us for a tailored demo and discover how we can help asset owners and asset managers turn data into confidence.