FINANCIAL INDICATORS MADE SIMPLE

Centralize. Calculate. Control.

The diversity of financial instruments keeps growing, along with the complexity and volume of associated data. Accessing additional information, ensuring consistency, and integrating it seamlessly into your reporting and analysis processes has become a daily challenge.

Regulatory requirements and client expectations now demand precise management of financial indicators, combined with rigorous data validation. But with multiple data sources and price feeds, errors and inconsistencies increase costs.

Boost the potential of your financial indicators.

INTEGRATE, COMPUTE, AND VALIDATE YOUR DATA WITH AMINDIS

AMINDIS empowers asset owners and asset managers to centralize, calculate, and validate all their financial indicators in one place. From smooth data integration to instant calculations and robust checks, our platform ensures accuracy, consistency, and efficiency across your portfolio.

Seamless integration effortlessly

Seamless integration effortlessly

Data — Calculation, storage, and instant availability

Data — Calculation, storage, and instant availability

CALCULATED INDICATORS

Included by default in the solution.

Title

Bonds

Title

Derivatives

- Delta

- Gamma

- Rho

- Theta

- Vega

Title

Equity

- Dividend yield

- Price to book

- Total market value

Title

Solvency II

SUPPORTED INDICATORS

Illustration of possibilities. Easily add any other indicators you require.

Title

Bonds

- Duration adjustment

- Option adjusted duration (OAD)

- Option adjusted spread (OAS)

- Option adjusted spread duration (OASD)

- Yield adjustment

- Yield to put

Title

Derivatives

- Kappa

- Sigma

Title

Equity

Title

IFRS 9

- IFRS 9 loss given default

- IFRS 9 probability default

Title

PRIIPs

- PRIIPs average return

- PRIIPs credit risk measurement

- PRIIPs market risk measurement

- PRIIPs recommended holding period

- PRIIPs std return

Title

Solvency II

Data checks — Consistency and control

Data checks — Consistency and control

WHAT YOU GAIN WITH AMINDIS

FLEXIBLE INDICATORS:

Create and define indicators according to your needs.

CONSISTENT & CONTROLLED:

Ensure reliability and consistency of your financial data through built-in quality checks.

IN-SOLUTION CALCULATION:

Perform calculations directly within the platform, with no extra costs.

EXPLORE MORE

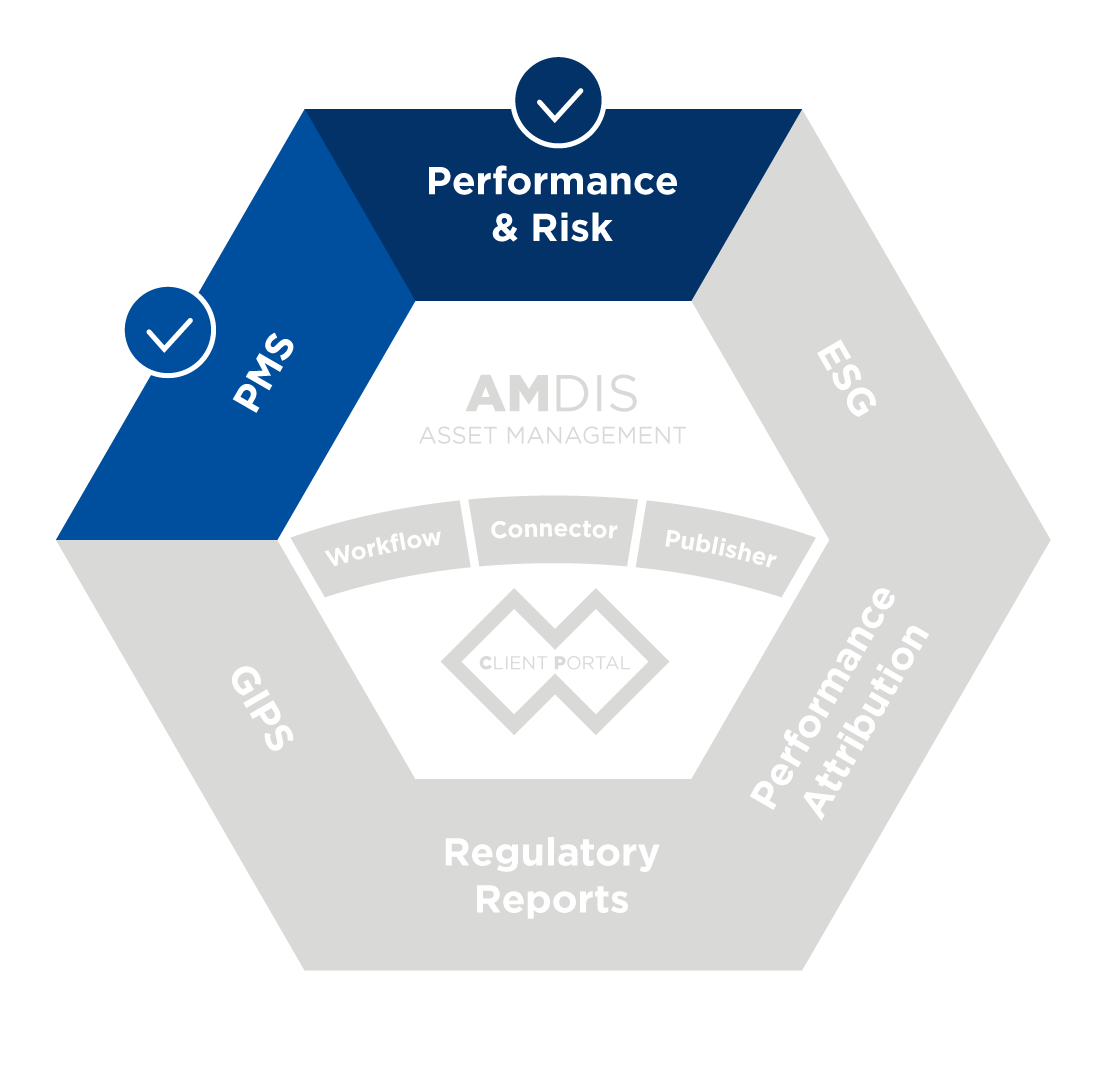

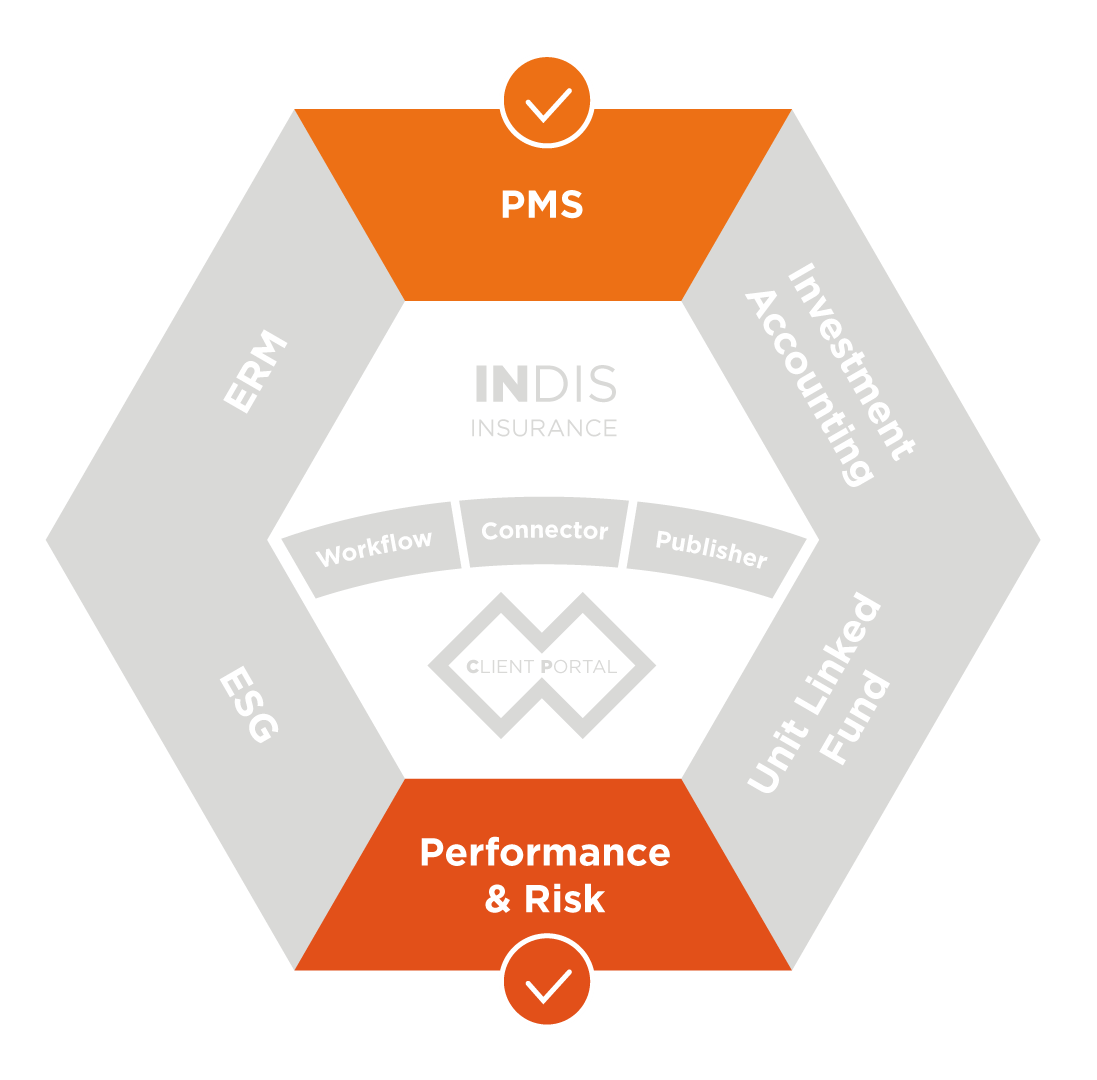

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.