FUND LOOK THROUGH SOLUTIONS FOR COMPLETE

PORTFOLIO TRANSPARENCY

Achieve end-to-end fund transparency with AMINDIS

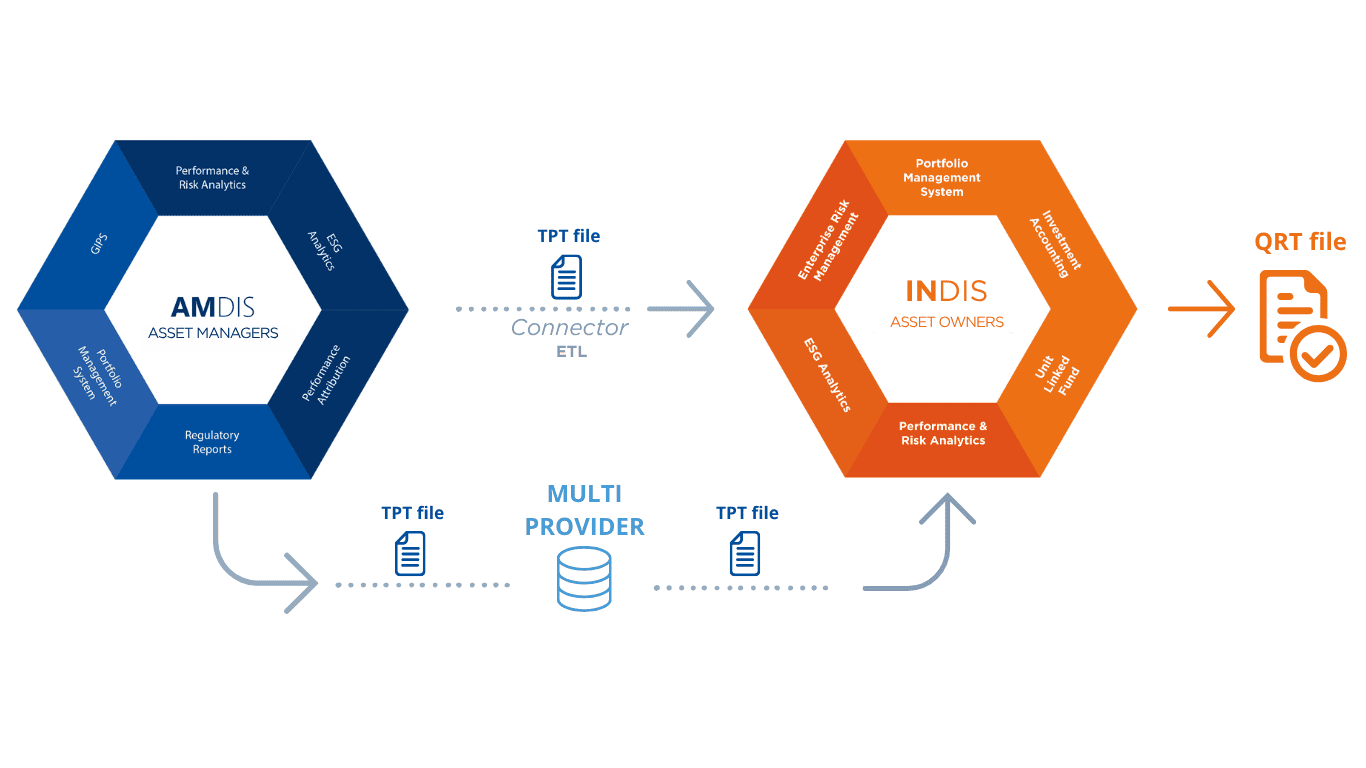

Today’s asset managers and asset owners face growing pressure to deliver full visibility across increasingly complex fund structures. Whether the goal is regulatory compliance or enhanced portfolio insights, transparent fund look-through has become a strategic necessity.

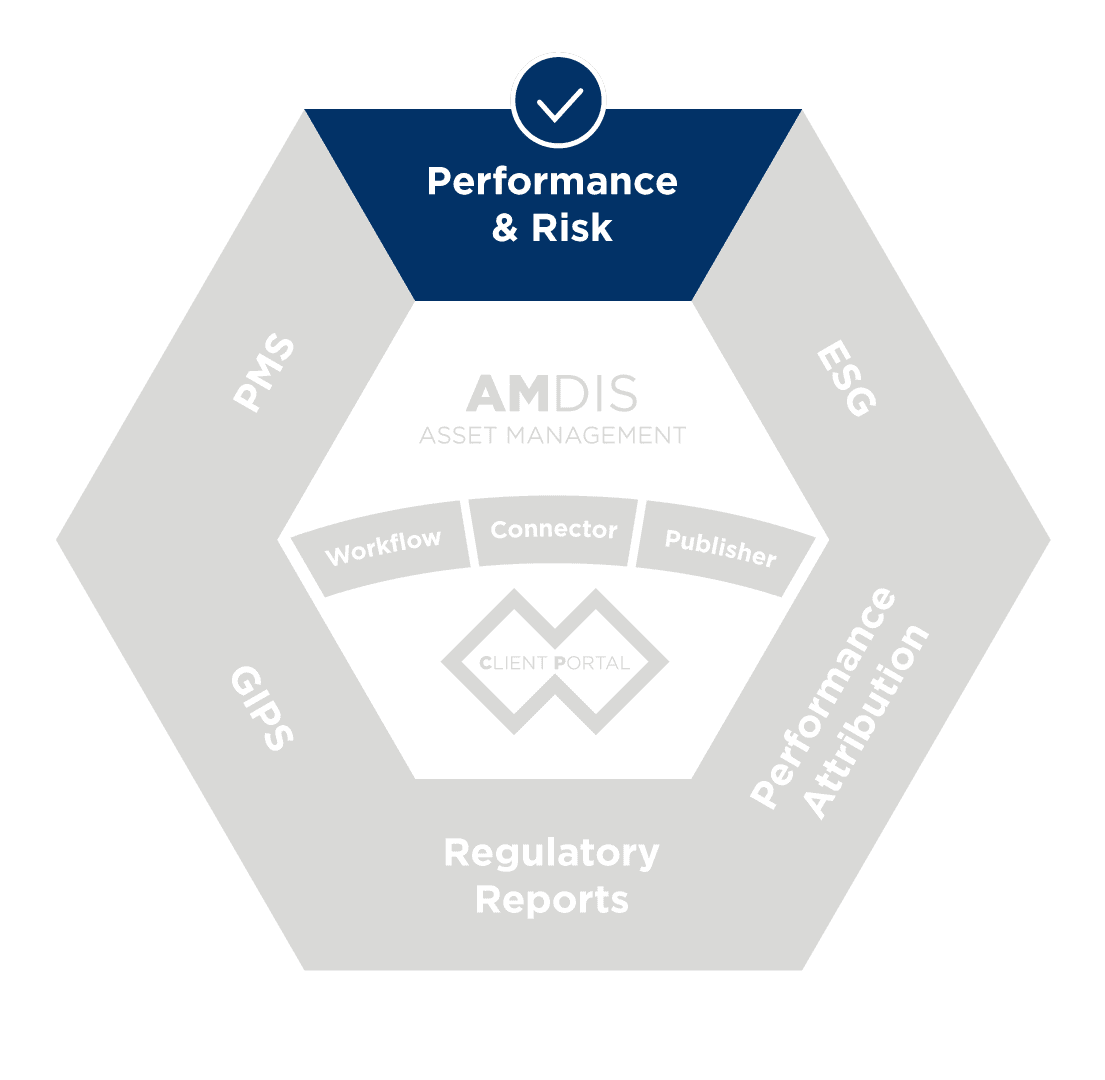

For asset managers

Fund transparency supports two core objectives:

Provide clients with high-quality services through complete or partial fund look-through reporting—such as TPT files.

Improve portfolio analysis by breaking down exposures across sectors, currencies, instruments, and regions, whether at the mandate, fund, or manager level.

Yet challenges persist: data is often received from external providers in inconsistent formats (TPT, Excel, XML), and most systems lack the recursive logic needed to fully deconstruct nested fund structures.

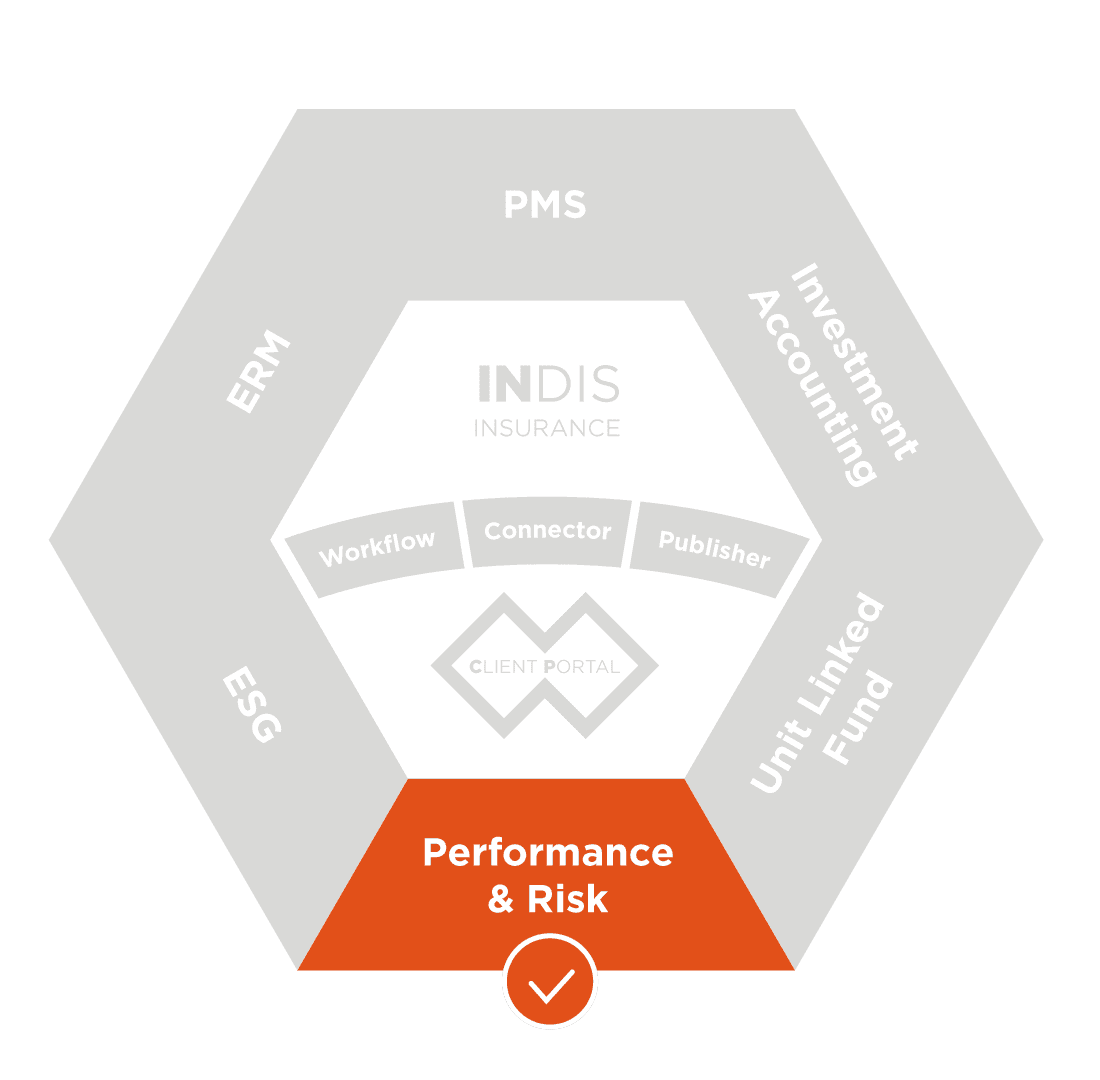

For asset owners

Transparency plays a vital role in:

Solvency II compliance: TPT files serve as input for QRT production and help optimize SCR (Solvency Capital Requirement).

Portfolio analytics: enabling the same detailed exposure breakdowns as asset managers, especially for owners engaged in direct portfolio management.

Additional use cases include:

Unit-linked portfolios (Branch 23): full look-through of underlying funds is essential for regulatory and client reporting.

Fund of funds: asset managers require transparency into underlying holdings to assess real exposures and risks.

WHY FUND TRANSPARENCY REMAINS A CHALLENGE - AND HOW TO SOLVE IT

While transparency is essential, many firms still face significant barriers. Data inconsistencies across providers, complex multi-layer fund hierarchies, and the lack of recursive processing tools make it difficult to obtain a clear and accurate view of underlying holdings. Manual data reconciliation slows down operations and increases costs, while producing regulatory reports such as QRT, TPT, or Ampère files remains burdensome.

Without a flexible and scalable system that serves both business and regulatory goals, fund transparency remains fragmented and inefficient.

AMINDIS closes this gap—automating multi-level fund look-through, enhancing data quality, and delivering reliable, auditable outputs for compliance and decision-making.

SCALABLE LOOK-THROUGH WITH INDIS & AMDIS

To meet the distinct needs of asset managers and owners, AMINDIS offers two tailored solutions:

Our platforms automate the collection, normalization, enrichment, and recursive breakdown of fund composition data. From Solvency II compliance to client reporting, they ensure consistent, auditable, and high-quality look-through across every layer of your portfolio.

KEY FEATURES

- Full and partial transparency by instrument, sector, region, or currency

- Built-in data gateways for TPT, Ampère, and FE Fundinfo

- Automated regulatory deliverables: QRT S.06.03, client transparency reports

- Recursive logic for deep fund-of-funds breakdown

- Seamless integration with upstream and downstream systems

THE BENEFITS OF INTELLINGENT FUND LOOK THROUGH

FASTER TRANSPARENCY DELIVERY

Achieve up to 70% faster processing through automation and flexible data ingestion.

MULTI-LEVEL TRANSPARENCY

Drill down across all fund layers—no matter the depth—using embedded recursive tools.

REGULATORY COMPLIANCE MADE EASY

Produce compliant TPT, QRT, and Ampère files aligned with Solvency II and FSMA.

SIMPLIFIED FUND-OF-FUNDS REPORTING

Reveal real underlying holdings to enhance ESG, risk, and sector analysis.

IMPROVED INVESTMENT DECISION-MAKING

Gain accurate exposure data to support better portfolio oversight and performance.

HISTORICAL TRANSPARENCY FOR TREND ANALYSIS

Access fund look-through over time to monitor changes in exposures and improve reporting consistency.

MAKE FUND TRANSPARENCY WORK FOR YOU

Today, generating TPT files is a strategic priority for asset managers. For asset owners, delivering QRT reports and optimizing SCR are key regulatory imperatives. Yet most firms lack the tools, systems, and recursive logic needed to meet these demands efficiently.

AMINDIS empowers you to:

- Enhance exposure visibility and portfolio control

- Meet evolving regulatory requirements

- Deliver consistent, reliable reporting for unit-linked and fund-of-fund structures—whether in full or partial transparency

EXPLORE MORE: RELATED TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

Discover how AMINDIS can help you unlock real fund transparency—accurate, scalable, and built to evolve with your needs.

Empowering asset managers and asset owners across Europe with smart, end-to-end fund look-through solutions.

See it in action—request your demo today.