MARKET INDICATORS

Seamlessly integrate and leverage market indicators across your investment process

Market indicators are more than reference values—they’re essential inputs for valuations, risk assessments, performance attribution, and regulatory reporting.

From exchange rates to interest curves, inflation data to default probabilities, these figures shape every aspect of the investment lifecycle. Yet behind their apparent simplicity lies real complexity: multiple providers, varying formats, maturity levels, and the need to link each data point to the right instrument context.

Centralize your market data and effortlessly connect it to your financial instruments with AMINDIS.

BRING CONTROL AND CLARITY TO YOUR MARKET DATA

AMINDIS offers a powerful framework to manage, link, and operationalize market indicators across your entire investment process. Whether you work with multiple data providers, build complex models, or need to align data with your instruments and calculations—we’ve got to covered.

SIMPLIFYING YOUR MARKET DATA

Whether you are running a performance engine, a bond attribution model, or a regulatory report—your market indicators are ready, trusted, and in sync with your ecosystem.

WHAT YOU GAIN WITH AMINDIS

READY FOR MARKET DATA:

Instant access to all market indicators, ready for use across all your investment processes.

SEAMLESS WORKFLOW INTEGRATION:

Link each indicator to relevant instruments to ensure consistent application throughout your operations.

AUTOMATED DATA FLOW:

Streamline the ingestion, validation, and matching of market data to reduce manual work and speed up delivery.

EXPLORE MORE TOPICS

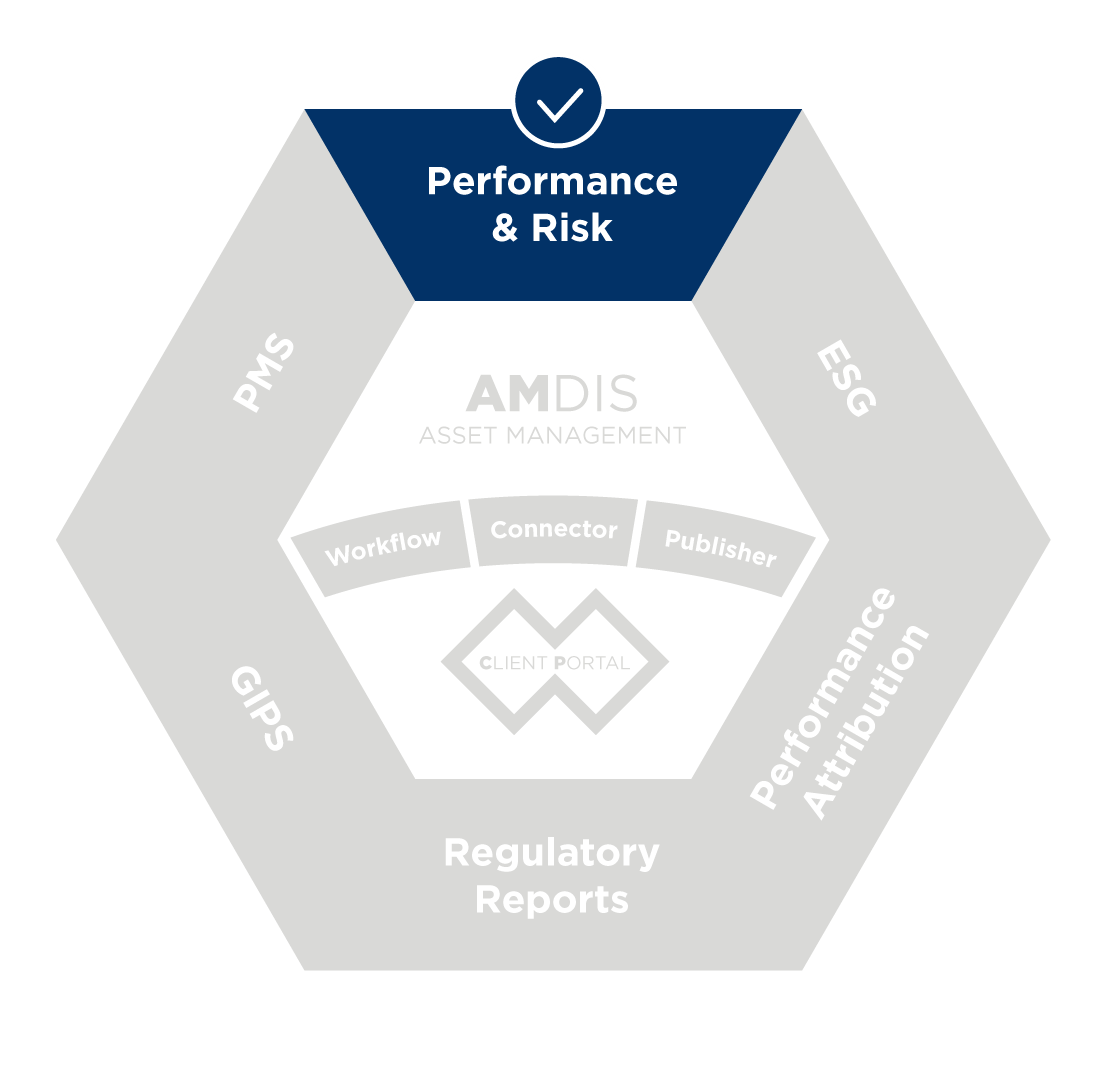

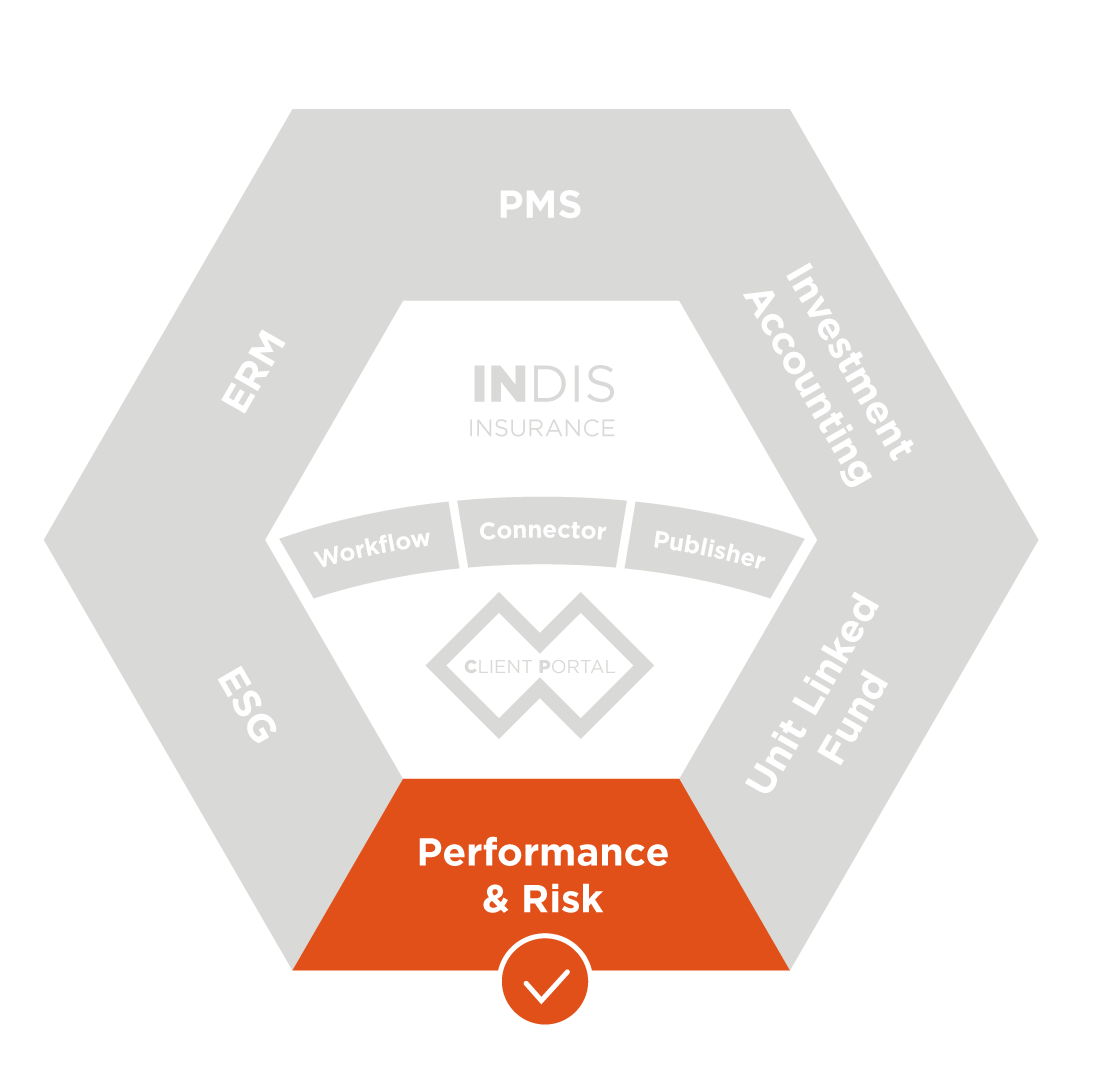

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

EASILY MARKET INDICATORS MANAGEMENT

Manage your market data transparently and effortlessly within a single platform. From automated ingestion to cross-process integration, gain accuracy and control across your investment workflows.

Trusted by asset owners and managers for reliable, agile market data.

Book your personalized demo and discover the difference.