ESG PERFORMANCE ATTRIBUTION

Measure the real impact of your ESG strategy

Responsible investing has reshaped the way portfolios are managed and how performance must be explained. Asset managers and asset owners now face a crucial question: what is the tangible impact of ESG objectives and constraints on financial performance?

Today the challenge is no longer about adopting ESG — but measuring its influence. How do you isolate the impact of each ESG constraint on your performance objective ? How do you assess active return when your investable universe is restricted by ethical or sustainability criteria?

ESG strategies are also highly diverse—criteria, metrics and data vary from one portfolio to another—which requires a methodology that can adapt to each ESG approach.

With AMINDIS, you finally get a precise, explainable view of your ESG impact.

A PRECISE AND FLEXIBLE APPROACH

AMINDIS extends the classic Brinson performance attribution with an ESG adjusted methodology that accurately reflects your investment universe and ESG criteria.

HOW IT WORKS CONCRETELY?

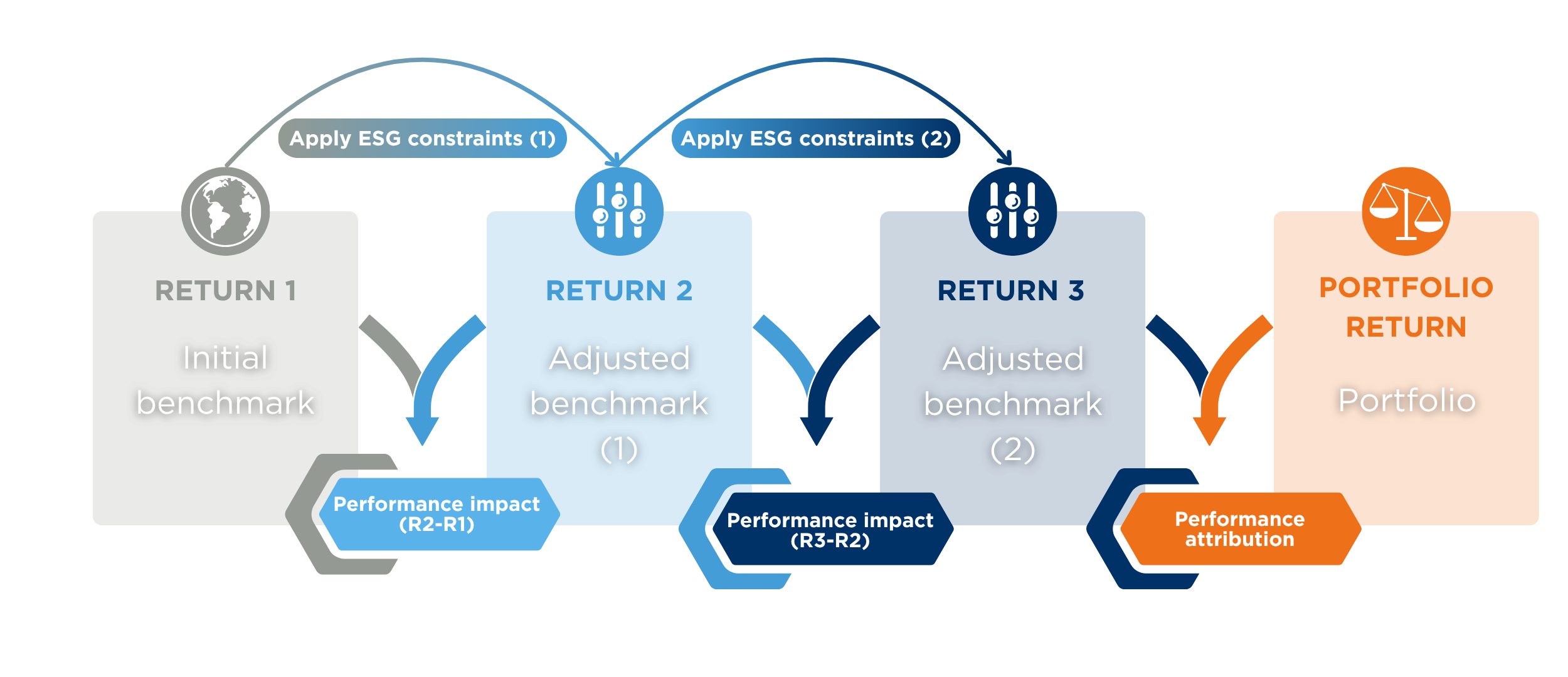

Our solution relies on successive constrained benchmarks and is organised around key axes:

ESG performance attribution: step-by-step workflow

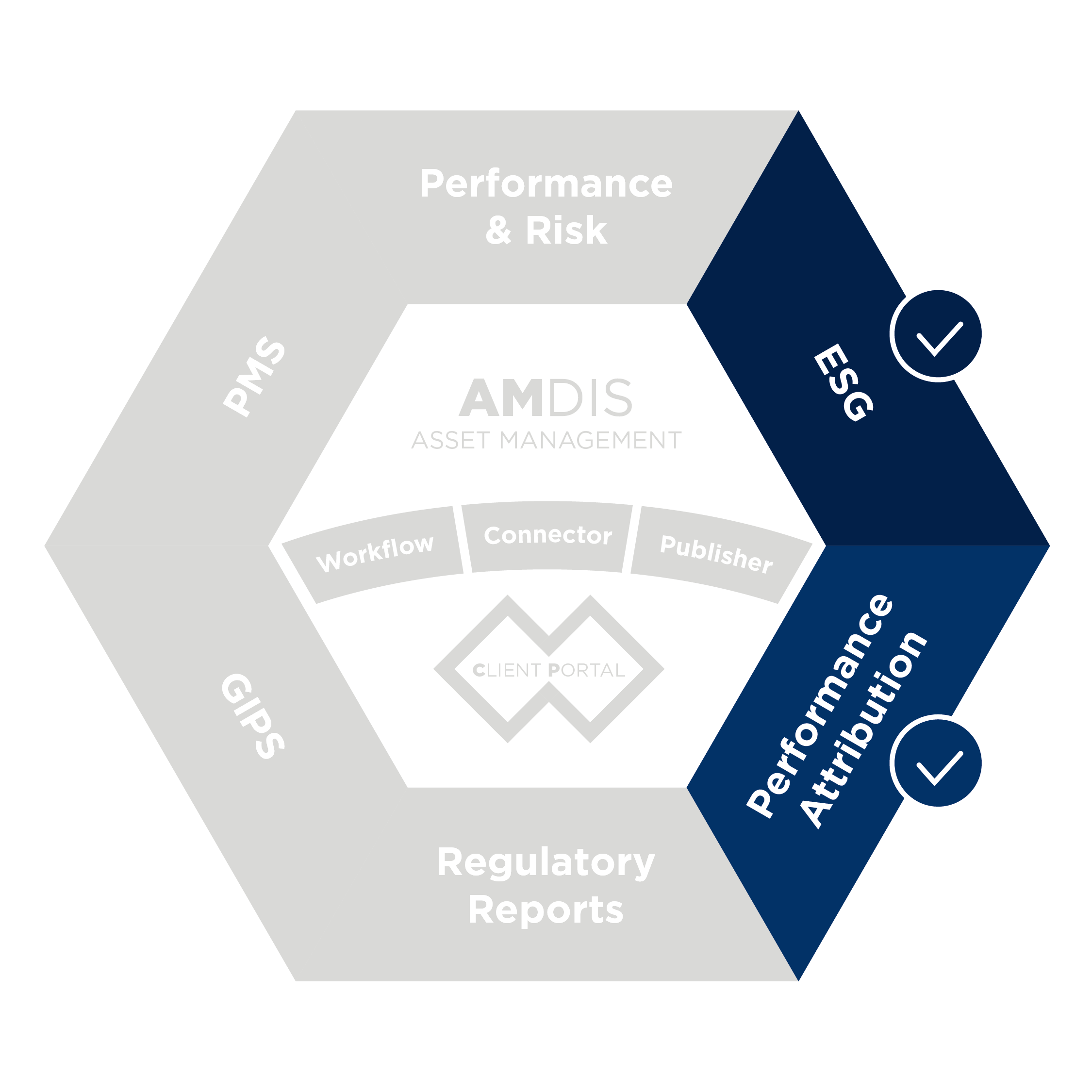

A UNIFIED PLATFORM FOR ESG-READY PERFORMANCE ANALYSIS

With AMINDIS, ESG attribution becomes a natural extension of your performance reporting.

Consistent and reproducible results

Enhanced reporting visuals highlighting ESG effects

A clear narrative for investor communication

Seamless integration with your existing analytical processes

Demonstrate, with facts and figures, how ESG constraints shape your performance — and how your management creates value.

WANT TO DEEPEN YOUR EXPERTISE IN PERFORMANCE ATTRIBUTION?

Explore our AMINDIS Academy training on Master performance attribution models: concepts, methods and advanced practices. Learn how to analyze and explain the impact of ESG objectives and constraints on portfolio returns, integrate ESG criteria into performance attribution, and turn portfolio data into clear, actionable insights.

Whether you're a portfolio manager, performance analyst, or risk manager, this training equips you with the tools to accurately interpret the drivers of ESG-adjusted performance and communicate the impact of sustainable investment decisions.

KEY BENEFITS

CONSISTENT FRAMEWORK

Use ESG indicators aligned with your investment process and key sustainability factors (rating thresholds, CO2 scores, water consumption, etc.).

SUCCESSIVE CONSTRAINT HANDLING

Easily manage multiple ESG filters applied in cascade, with automate cumulative constraint handling.

EXPLAINABLE, TRANSPARENT RESULTS

Provide clients with a clear, structured breakdown of the drivers behind ESG-adjusted performance.

EXPLORE MORE: RELATED TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision

TAKE CONTROL OF YOUR ESG PERFORMANCE

With AMINDIS, gain full visibility on how ESG objectives and constraints impact your portfolio returns—through a robust, transparent, and flexible attribution methodology.

Join the asset managers and asset owners already enhancing credibility, communication, and decision-making with clear ESG performance insights.

Book your personalized demo and discover the power of ESG attribution.