BRINSON PERFORMANCE ATTRIBUTION

Uncover the true drivers of your excess returns with precision

In a competitive investment landscape, asset managers must not only generate performance—they must explain where it comes from. The Brinson attribution methodology, introduced by Brinson, Hood & Beebower and redefined by Brinson & Fachler, remains the global standard to decompose excess return into allocation and selection effects.

By identifying how sector weights, security choices, and market exposure contribute to performance, Brison attribution provides a powerful framework for transparency, accountability, and strategic insight. However, traditional tools often lack the flexibility to reflect today’s complex portfolios—multi-asset structures, derivatives, cash positions, or client-specific benchmarks.

With AMINDIS, you gain full control over your attribution process, ensuring your performance story is both accurate and aligned with your investment strategy.

MIRROR YOUR INVESTMENT STRATEGY WITH PRECISION ATTRIBUTION

AMINDIS brings a new level of flexibility and precision to Brinson attribution, allowing asset managers to tailor every element of the analysis to their unique portfolio structures.

WANT TO DEEPEN YOUR EXPERTISE IN PERFORMANCE ATTRIBUTION?

Explore our AMINDIS Academy training on Master performance attribution models: concepts, methods and advanced practices. Learn how to analyze and explain active return, apply Brinson, Brinson-Fachler, and other attribution methodologies, and turn portfolio data into clear, actionable insights.

Whether you're a portfolio manager, performance analyst, or risk managers, this training equips you with the tools to accurately interpret performance drivers and communicate the impact of investment decisions.

WHY CHOOSE AMINDIS

Explain your investment strategy with the most accurate performance attribution methods, thanks to:

FLEXIBLE CRITERIA

Use the same criteria as your investment strategy to ensure your attribution reflects reality.

ROBUST METHODOLOGIES

Apply Brinson, Brinson-Fachler, or hybrid frameworks fully aligned with your management process for precise and consistent performance analysis.

ADVANCED CHAINING & EFFECT ANALYSIS

Configure effect chaining, including currency, Futures, and interactions adjustments, to mirror real portfolio outcomes accurately.

EXPLORE MORE: RELATED TOPICS

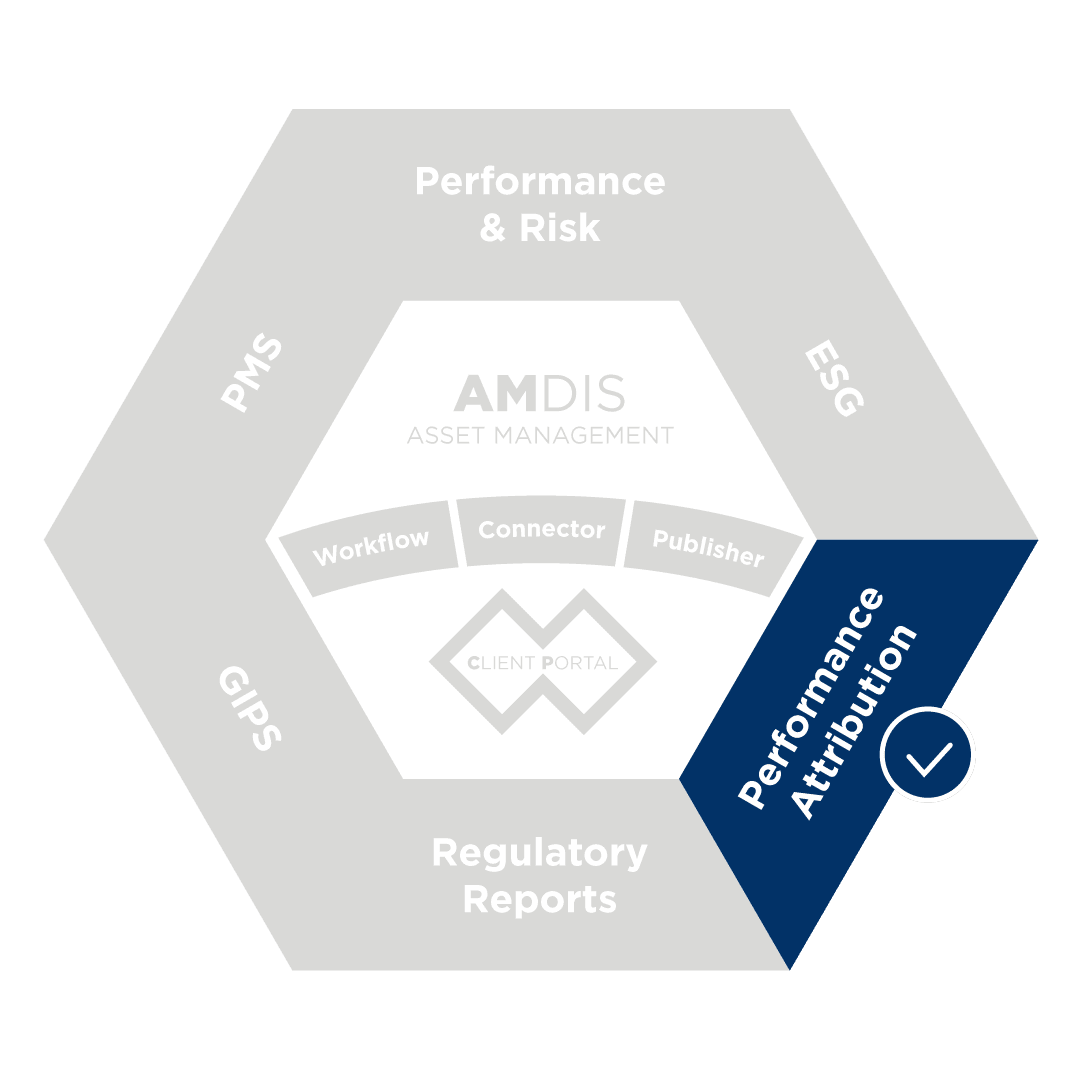

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision

TAKE CONTROL OF YOUR PERFORMANCE ATTRIBUTION

With AMINDIS, turn complex performance attribution data into clear insights. Understand precisely how your allocation and selection decisions contribute to active return—across all asset classes, benchmarks, and strategies. Deliver transparent reporting, enhance portfolio analysis, and strengthen decision-making with a flexible and reliable Brinson attribution framework design for asset managers.

Request a personalized demo and see how AMINDIS redefines performance attribution.