PERFORMANCE & RISK MODULE

Unlock insightful, configurable analytics across portfolios.

AMINDIS’ Performance & Risk Module delivers exhaustive, customizable analyses through its unique building block approach, turning data into transparency and smarter decisions.

BENEFITS OF USING AMINDIS' PERFORMANCE & RISK MODULE

PERFORMANCE & RISK FEATURES

The Performance & Risk Module combines exhaustive data, flexible building blocks, and automation to deliver powerful, tailored analytics. Each feature is designed to turn complex information into actionable insights.

Title

Exhaustive data foundation

Analyses rely on a robust and extensible data model covering business accounts, portfolios, bank and custodian accounts, and all security characteristics. Financial and non-financial data—including ESG, ratings, and market information—are natively supported. Transactions such as market trades, corporate actions, cash movements, and OTCs (including collateral) are fully integrated. Advanced classification systems—static, dynamic, historical, or automatically derived—make data intuitive to structure and reuse across any analytics.

Title

The Building Block approach

The module is built on AMINDIS' unique building block concept, combined with the notion of entity. This enables maximum flexibility while keeping one consistent analytical logic. Analyses are configured by combining four components:

Once built, analyses can be executed simply by selecting reference date, entity, and currency instantly delivering all expected results.

Title

From analytics to reporting

Results can be seamlessly integrated into Word, Excel, PowerPoint, or PDF templates, as well as Client Portal dashboards. This makes outputs not only robust, but also highly visual and intuitive for decision-makers and stakeholders.

Title

Automated production

Analyses can be scheduled and executed automatically through the workflow engine. Dedicated monitoring dashboards track production processes in real time, ensuring adherence to strict SLA requirements and guaranteeing timely delivery of results.

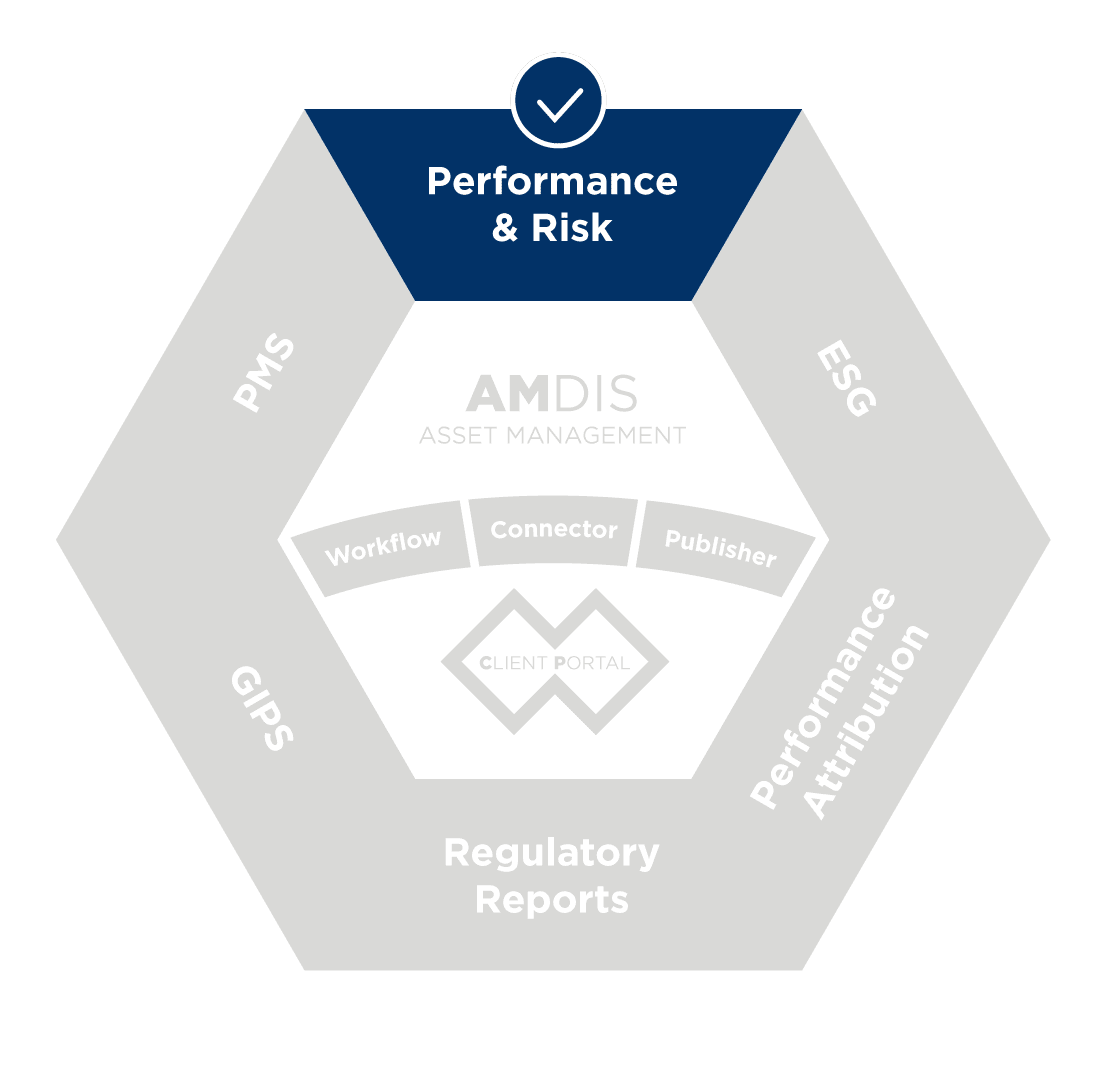

CHECK OUT COMPLEMENTARY SOLUTIONS FOR ASSET MANAGERS

EXPLORE THE BUSINESS RELATED TO OUR PERFORMANCE & RISK MODULE