LEAVE TRADITIONAL STRUCTURES BEHIND WITH AMINDIS' ENTITY-BASED MODEL

Today's investment landscape is increasingly complex, rendering traditional portfolio management approaches insufficient. Conventional structures are too rigid to adapt to dynamic operational conditions, evolving regulations, and specialized investment scenarios. Asset managers and asset owners often struggle with restrictive categorizations and fragmented portfolio visibility, hindering their ability to make timely and effective decisions.

Furthermore, inflexible analytical frameworks complicate specialized operations such as consolidations or carve-outs, leading to limited precision in stakeholder reporting. The inability to adequately customize for portfolio-specific requirements—such as different fund types or unit-linked structures—further compounds these challenges. Addressing these issues demands an adaptive and automated management approach tailored to diverse and evolving investment contexts.

Feeling restricted by traditional investment structures?

AMINDIS' ENTITY-BASED SOLUTION : CUSTOMIZED, FLEXIBLE, PRECISE

AMINDIS introduces a unique concept known as "entities," specifically developed to provide asset managers and asset owners with unparalleled flexibility and adaptability.

An entity in the AMINDIS' system represents a customizable aggregation of portfolios, business accounts, mathematical reserves, instruments, benchmarks, funds, or composites, tailored precisely to operational, analytical, and reporting needs.

Through AMINDIS' entities, asset managers and asset owners can freely combine or segment assets based on specific objectives. This solution enables:

These entities significantly enhance operational flexibility by facilitating dynamic and precise reporting, seamless regulatory compliance, and accurate accounting practices tailored to each unique scenario.

Ultimately, AMINDIS' entities empower asset managers and asset owners to precisely align their management structures with strategic, analytical, and operational realities, maximizing both efficiency and stakeholder satisfaction.

STRATEGIC ADVANTAGES OF THE ENTITY-BASED MODEL

Leverage the AMINDIS' entity-based solution to significantly enhance your portfolio management:

FLEXIBILITY

Freely consolidate or segment portfolios, tailoring structures precisely to your operational and analytical needs.

PRECISION

Accurately define portfolio scope and analytical criteria, providing more relevant and actionable insights.

CLARITY

Simplify portfolio management structures significantly, reducing complexity and enhancing clarity in portfolio management.

CUSTOMIZATION

Easily adapt entity configurations according to specific regulatory and operational demands.

EXPLORE MORE: RELATED TOPICS

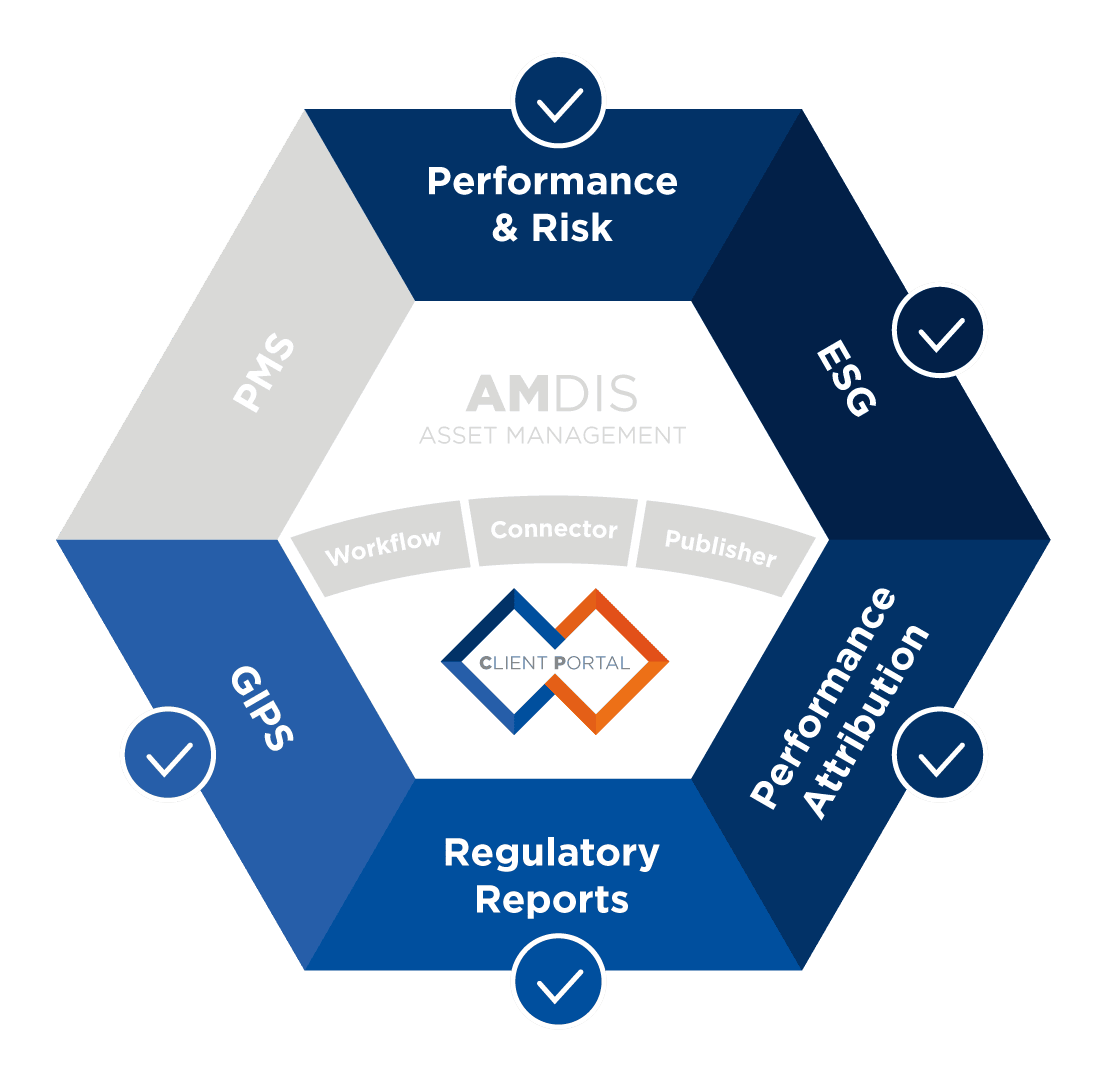

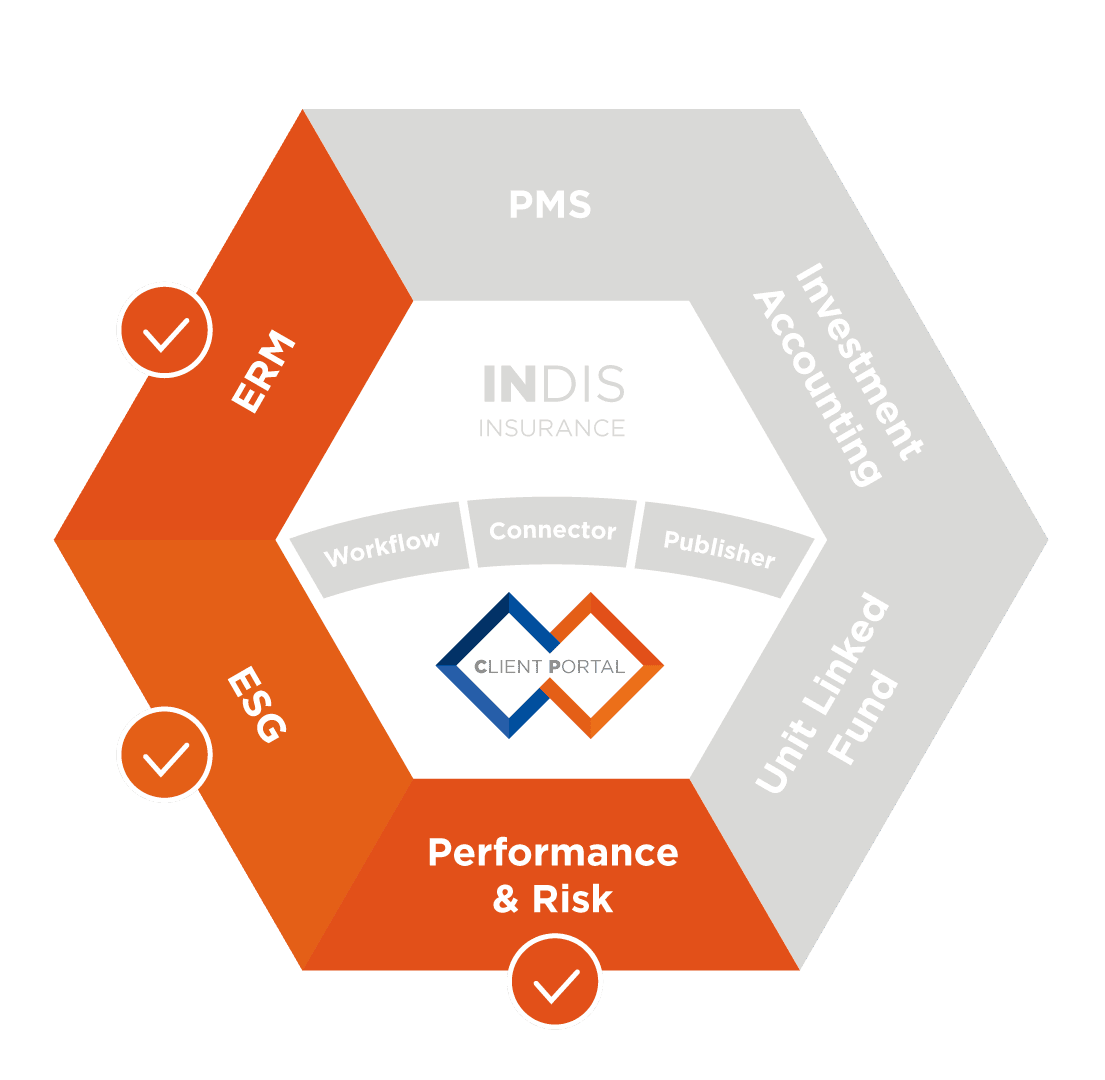

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

Don't let rigid portfolio structures and fragmented insights limit your investment potential.

Discover how AMINDIS' entity-based model can transform your processes, providing the flexibility, accuracy, and compliance necessary to excel in today’s complex environment. Request a demo !

Trusted by leading asset managers and asset owners across Europe.