COMPLY WITH CSRD: DISCLOSE IMPACT MATERIALITY FOR YOUR INVESTMENT PORTFOLIO

CSRD is here. Are you ready?

The Corporate Sustainability Reporting Directive (CSRD) is fundamentally changing ESG reporting in Europe. As a key pillar of the European Green Deal, it replaces the NFRD and extends mandatory sustainability disclosures to a much wider range of companies — including asset owners such as insurers and pension funds.

CSRD brings new challenges for institutional investors:

The establishment of a robust methodology to identify the European Sustainability Reporting Standards (ESRS) that require ESG disclosures in the context of investment management,

The calculation of ESG indicators for the ESRS topics that must be disclosed,

The transparency on ESG data.

Many organizations are still asking:

Which ESG topics should we report on? How do we collect data and validate the right data across our portfolios? How can we ensure we're compliant — without slowing down operations or compromising on data quality?

Do you want to better understand how to report on the investment-related aspects of CSRD?

AMINDIS: YOUR PARTNER FOR CSRD COMPLIANCE

AMINDIS helps asset owners navigate CSRD with clarity and confidence.

We offer dedicated support focused on the investment-related components of the directive — specifically within the Strategy (SBM) and Impacts, Risks, and Opportunities (IRO) sections of the ESRS framework.

Our approach is designed around two key steps: identifying materiality of ESG topics and calculating the corresponding indicators — ensuring streamlined, audit-ready compliance.

Identify what matters: impact materiality assessment

Our objective is to help you clearly determine which European Sustainability Reporting Standards (ESRS) apply to your investment portfolio. Through rigorous materiality analysis, we eliminate uncertainty and help you focus on what truly matters.

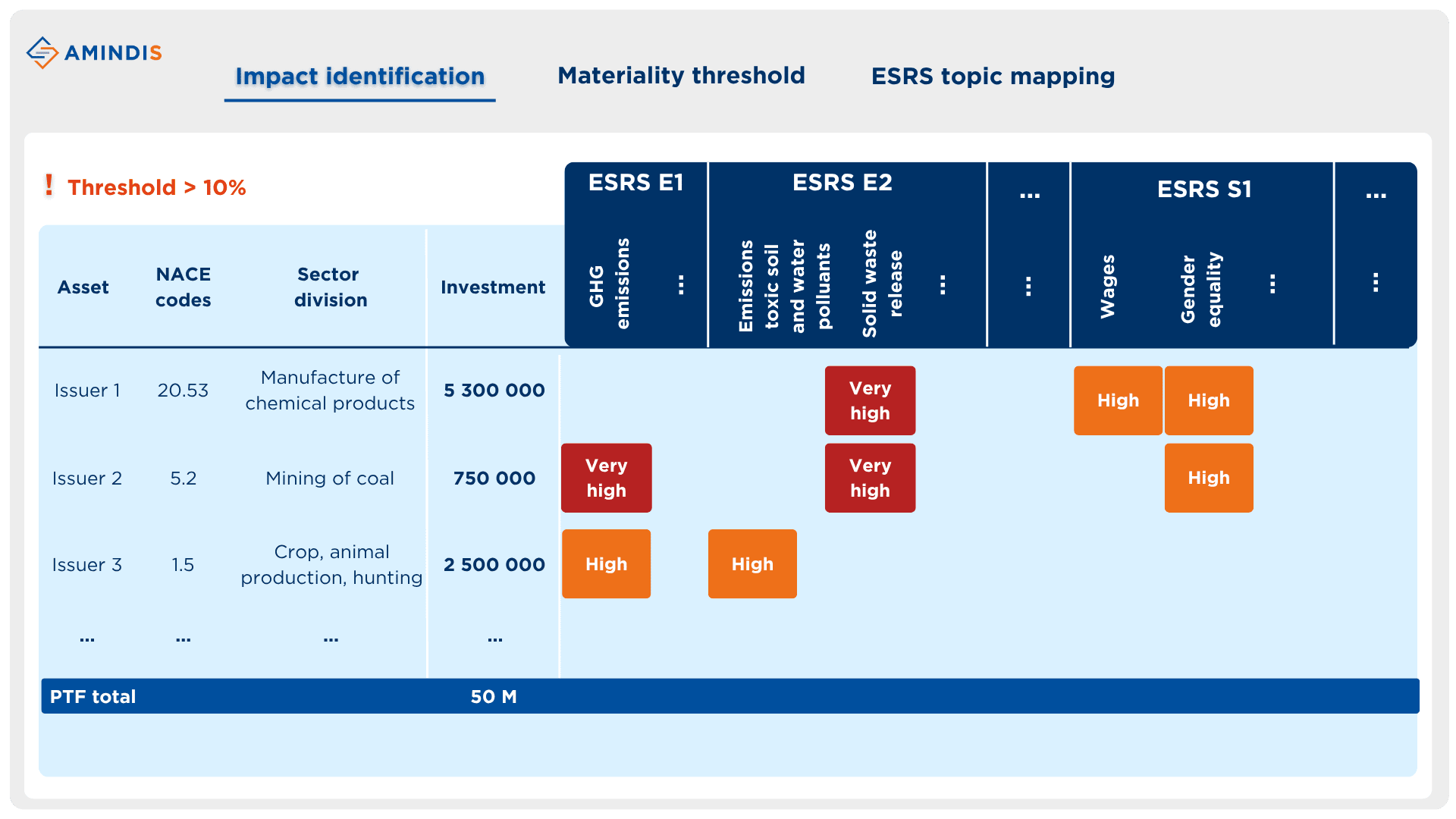

Impact identification

We leverage recognized databases such as ENCORE and UNEP FI to assess the impact dimension of double materiality for your investment portfolio.

By analyzing your asset composition via NACE codes, AMINDIS highlights the ESG themes most significantly affected by your investments.

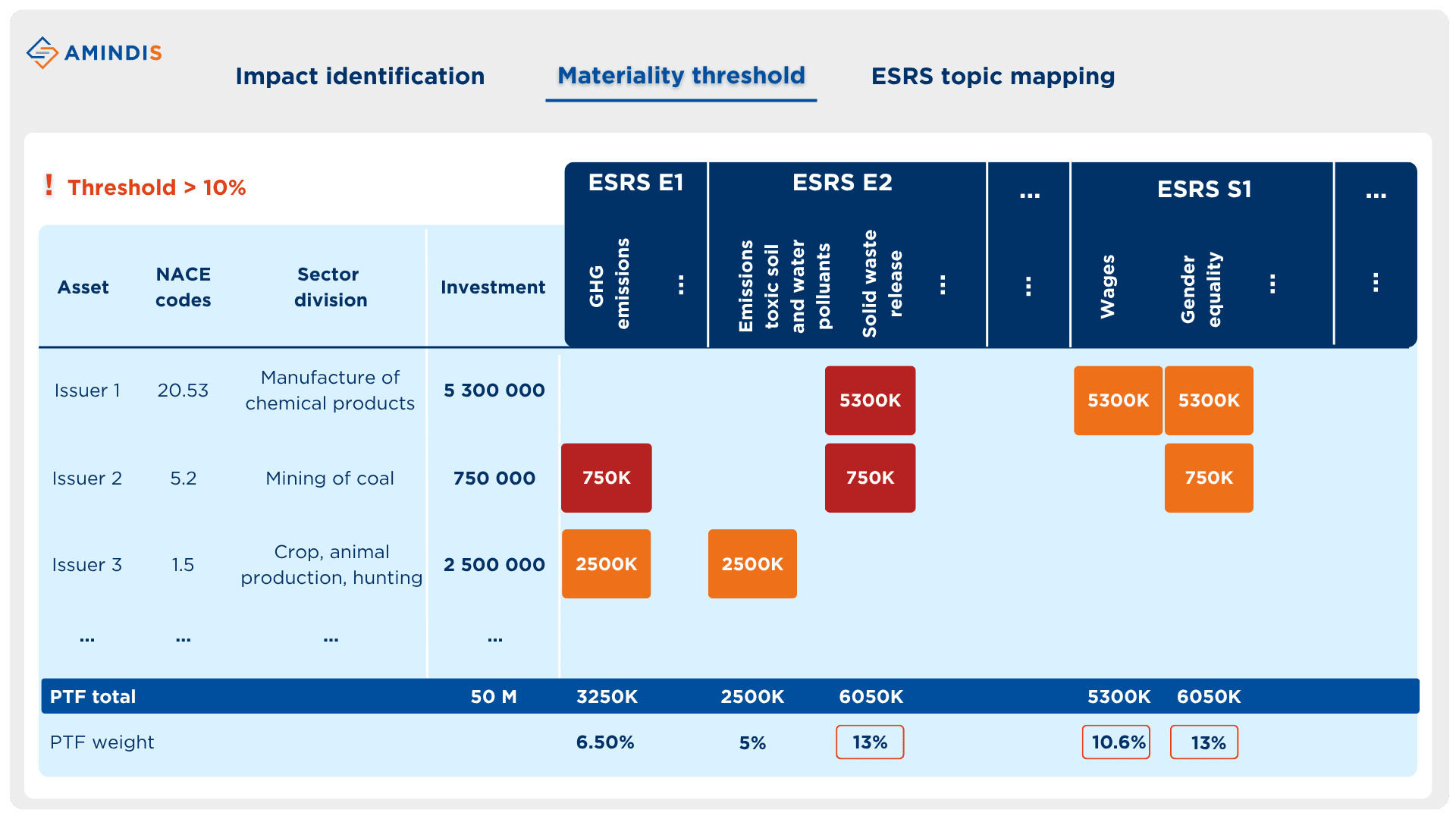

Materiality threshold definition

You define a materiality threshold. AMINDIS aggregates your portfolio’s exposure to each ESG theme. If the aggregated exposure exceeds the threshold, the full corresponding ESRS must be disclosed — even if some sub-topics fall below it.

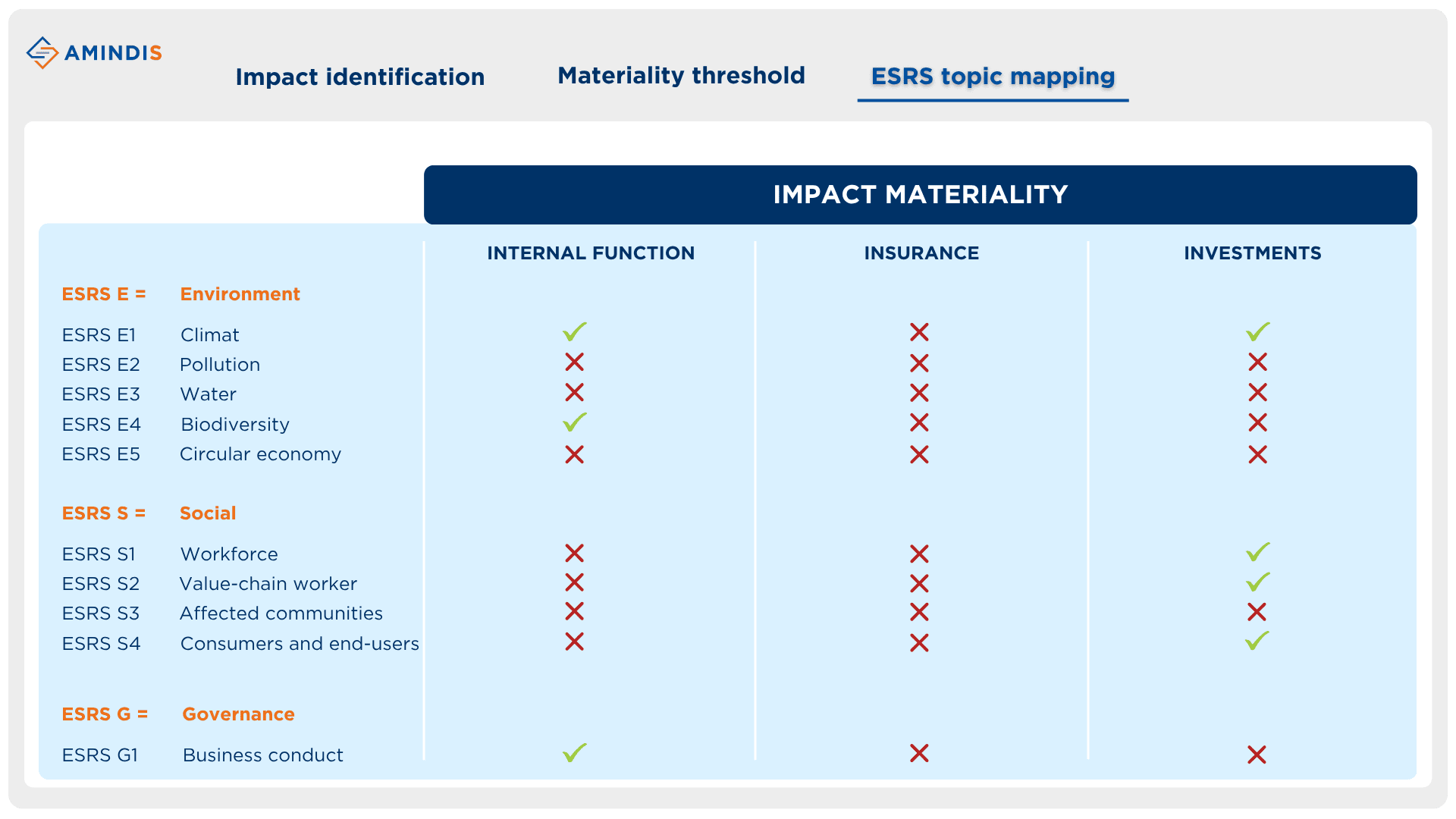

ESRS topic mapping

Once material topics are confirmed, AMINDIS automatically maps them to the corresponding ESRS disclosure requirements.

This creates a clear, auditable link between your investments and regulatory obligations — and gives you confidence in your reporting scope.

Step 1

Step 2

Step 3

ESG indicator calculation

Once material topics are confirmed, the next challenge is turning them into actionable data. AMINDIS supports asset owners by calculating the relevant ESG indicators for each required disclosure — delivering consistent, portfolio-level insights.

Depending on data availability, our platform enables two complementary approaches:

Direct data calculation

When ESG data is available, AMINDIS aggregates them according to each asset's relative weight in the portfolio.Proxy calculation

AMINDIS also uses proxies when data is not directly available.

Our solution doesn't aim to produce your CSRD report — but it powers it with robust, audit-ready ESG analytics tailored to your investment reality.

Because our methodology aligns with the Sustainable Finance Disclosure Regulation (SFDR), you ensure consistency across reporting frameworks — while avoiding duplication of effort.

KEY BENEFITS FOR INSTITUTIONAL INVESTORS

OPERATIONAL EFFICIENCY

Save time and reduce complexity by streamlining the identification of materiality of ESG topics and calculating ESG indicators across your portfolios.

REGULATORY CONFIDENCE

Rely on transparent, traceable methodologies aligned with CSRD and SFDR, ensuring your disclosures stand up to audit.

ONE UNIFIED ESG SOLUTION

Centralize ESG metrics across teams, portfolios and reports — with one shared source of truth to eliminate discrepancies and support confident decision-making.

EXPLORE MORE: RELATED TOPICS

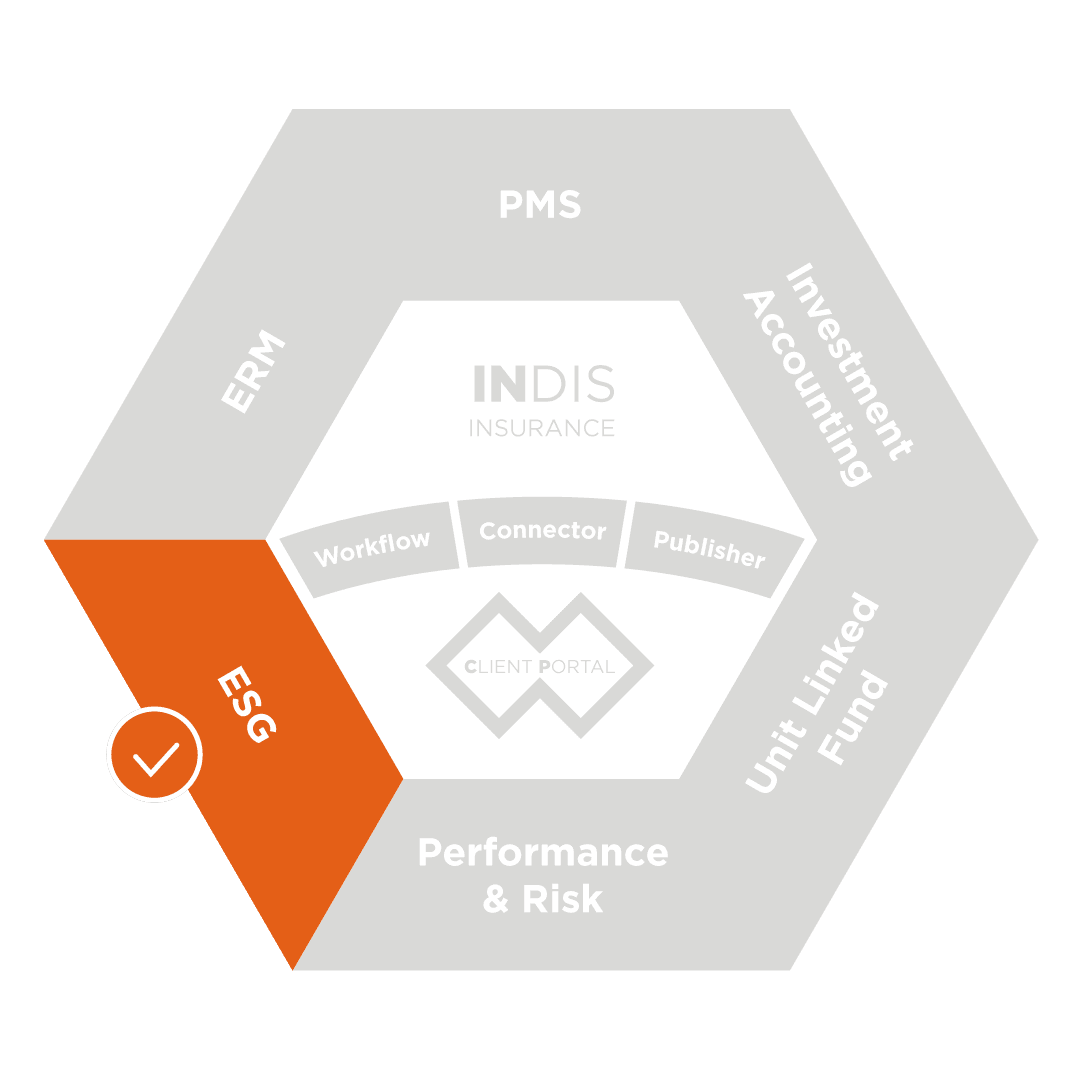

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

At AMINDIS, we understand the complexity of ESG reporting under CSRD framework. Our platform provides specialized tools and calculations specifically designed to support and simplify your investment sustainability disclosures, enabling accurate assessments and informed strategic decisions.

Ready to simplify your CSRD compliance journey? Request your personalized demonstration today and experience how AMINDIS can elevate your sustainability reporting process.

Trusted by leading asset owners across Europe.