TAILORED CLASSIFICATION

As a strategic lever for your operational processes

In finance, classification is more than categorization—it’s a strategic lever that integrates seamlessly into business processes, accounting, reporting, and operational workflows.

Yet, many classification systems remain rigid and constrained, limited to predefined financial instruments and lacking the flexibility to associate classifications with portfolios, business accounts, or transactions. Users often cannot configure their own classification, and historical tracking is rarely available, making retrospective analysis difficult. Instead of serving as a lever for optimizing operational processes, classification is too often confined to reporting and analyses.

AMINDIS offers an innovative and flexible solution, enabling financial institutions to structure classifications dynamically, customize them, and ensure advanced automation and seamless integration into business processes and portfolio analysis.

Is your classification system limiting your adaptability?

TAILORED CLASSIFICATION: ENABLING FLEXIBILITY ACROSS ALL BUSINESS FUNCTIONS

AMINDIS transforms classification by providing a highly flexible, fully integrated solution that adapts effortlessly to business and analytics processes. Thanks to our low-code/no-code capabilities, financial institutions can structure, automate, and customize classifications without complex development.

Tailor-made classifications: define and configure classification criteria entirely based on your needs, with full multilingual support and customizable display order of multiple classification standards for optimized data presentation.

Industry-standard classifications: access multiple market standards with full compatibility with industry-standard definitions, ensuring seamless alignment with regulatory and reporting frameworks.

Dynamic classification linked to financial indicators: classifications automatically update based on predefined thresholds and financial indicators, ensuring full alignment with market conditions. The module supports a dynamic range of classifications, allowing users to group and organize data flexibly to match evolving financial strategies and business needs.

Hierarchical deduction classification: a rule-based hierarchical classification module enabling automatic deduction of classification criteria based on logical conditions. Users can adopt standard models or create customized configurations tailored to business requirements.

Historical tracking: reproduce past classification states exactly as they were at the time of calculation. Maintain a clear audit trail for accurate reporting and retrospective analysis.

Seamless integration across business processes: classification goes beyond reporting and analysis; it extends to accounting rules, workflows, and all operational processes–without limitations. As the foundation of a scope-based approach, classification criteria are essential, ensuring consistency and efficiency across systems.

With AMINDIS, classification becomes a powerful tool for analyses and operational efficiency, providing full adaptability to the evolving needs of asset managers and asset owners.

FOUR CLASSIFICATION BEHAVIORS TO SUIT YOUR NEEDS

At AMINDIS, classifications are not just static labels—they adapt dynamically to financial data and business rules. You can associate classification criteria with any data point in the system, giving you complete flexibility in structuring and organizing information.

Each classification follows one of four distinct behaviors, allowing you to define exactly how your classifications function within your operational and analytical processes.

KEY BENEFITS

TIME EFFICIENCY:

Hierarchical classification eliminates manual tasks and guarantees consistency.

MAXIMUM FLEXIBILITY:

Create custom or standard classifications tailored to your firm’s needs, offering full adaptability.

CONSISTENCY & QUALITY:

Ensure consistent, accurate data across systems, as classifications are based on the same source, eliminating discrepancies.

MULTILINGUAL SUPPORT:

Fully multilingual, making it ideal for global institutions and seamless operation across regions.

EXPLORE MORE: RELATED TOPICS

LOOKING FOR MORE INSIGHTS? DISCOVER HOW OUR SOLUTIONS CAN TRANSFORM YOUR INVESTMENT MANAGEMENT PROCESS:

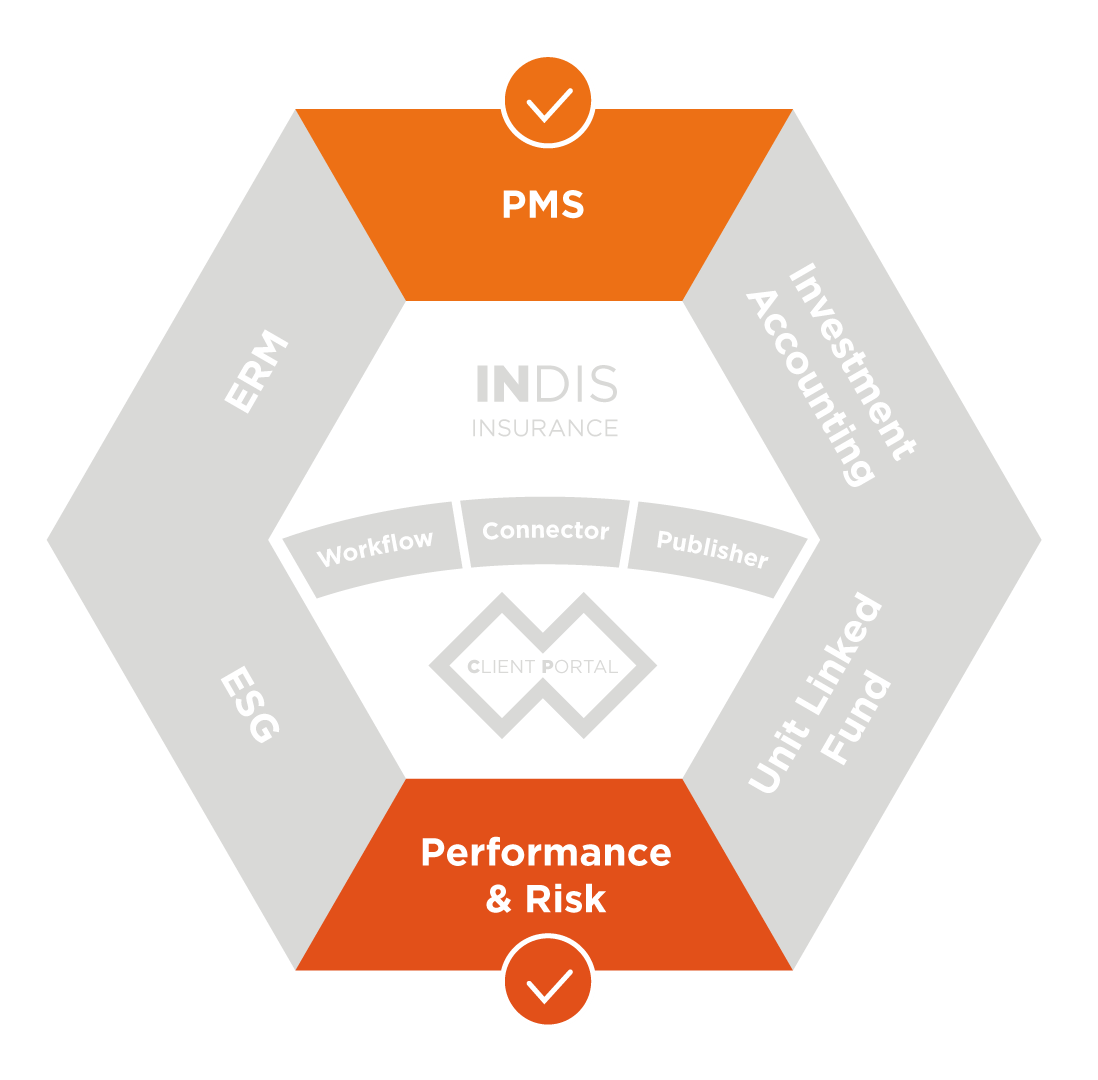

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

At AMINDIS, we understand that effective asset management relies on precise and flexible classification systems. Our advanced solutions empower you to automate classifications, ensure data consistency, and integrate them seamlessly into your processes–ultimately optimizing efficiency and driving better decisions.

Ready to transform your asset classification strategy? See how AMINIDS can enhance your workflows with a fully customizable platform designed to meet your unique needs. Book your personalized demo today!

Preferred by leading asset managers and asset owners across Europe.