ENHANCED MANAGEMENT OF FINANCIAL INSTRUMENTS

Financial instruments have evolved significantly in an increasingly complex investment landscape. Asset managers and asset owners must not only oversee traditional instruments such as equities and bonds but also navigate a broad spectrum of asset classes—including derivatives, structured products, mortgage loans, private equity, and infrastructure investments. At the same time, rising transaction complexity and data management challenges, including ESG and financial data, require robust and flexible solutions.

To maximize professional efficiency, investment professionals must consider a multitude of factors such as dividends, shareholder rights, yield to maturity, risk exposure, liquidity, and interest rate impact. Integrating these instruments into diversified portfolios requires a structured, adaptive approach tailored to the unique needs of each investor, tailored to each client and the specific nature of their financial instruments.

This is where AMINDIS comes in—delivering a powerful, integrated solution to efficiently structure, manage, and optimize financial instruments with unmatched flexibility and accuracy.

THE CHALLENGE OF EFFECTIVE FINANCIAL INSTRUMENTS MANAGEMENT

Rigid and fragmented classification systems

Classifications are too often limited to static, predefined categories that fail to reflect the full complexity of financial instruments, portfolios, or transactions. Many institutions face systems that lack flexibility, multilingual support, historical tracking, and integration with operational workflows. This rigidity hinders the ability to align classifications with evolving business needs, regulatory frameworks, or analytical models—ultimately limiting operational efficiency and strategic decision-making.Growing complexity across asset classes

Even seemingly straightforward instruments require sophisticated management. Advanced calculations for yield-to-maturity (YTM), early redemption options, interest rate fluctuations, derivatives pricing, and risk modelling depend on a precise and structured definition of financial instruments. A robust setup is essential to ensure that the calculation engine and operational processes deliver reliable results. This includes a detailed and precise definition of all instrument features and full support for managing corporate actions.Explosion of data volume and diversity

Managing financial instruments involves handling vast amounts of data—ESG factors, financial metrics, pricing, and market data. Efficient and evolving data governance is critical to ensuring seamless processing, maintaining consistency across multiple providers, and ensuring compliance with stringent industry regulations.Regulatory compliance & transparency

Regulations such as Solvency II, IFRS 9, and MiFID II, alongside growing issuer transparency requirements, require strong data management practices to ensure compliance and accurate regulatory reporting.Adaptability and scalability

The financial landscape is rapidly evolving, requiring:

- Integration of new asset classes such as structured products, private equity, and infrastructure assets,

- Advanced cash, currency, and collateral management,

- Automated corporate actions and transaction processing.

Are you equipped to meet these challenges with your current setup?

AMINDIS: A COMPREHENSIVE AND FLEXIBLE SOLUTION FOR FINANCIAL INSTRUMENTS

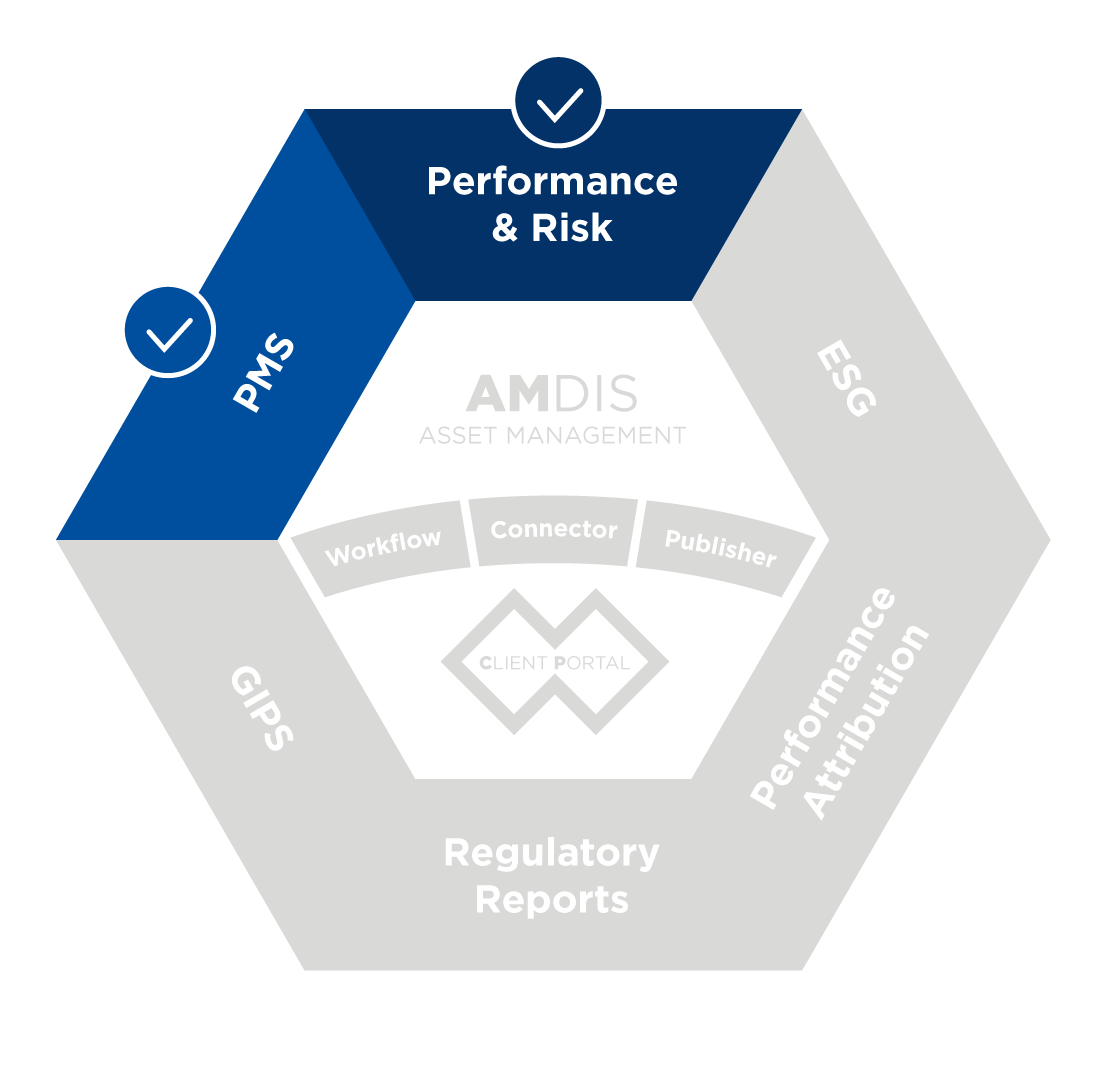

AMINDIS provides a robust, end-to-end solution to manage the full lifecycle of financial instruments, from data structuring to transaction execution. Designed for both asset managers and asset owners, our solutions enhance efficiency, flexibility, and regulatory compliance through four core principles.

These principles are key to our solution's flexibility and precision. Explore each in detail:

WHY CHOOSE AMINDIS?

AMINDIS provides asset managers and asset owners a comprehensive, adaptable solution for managing a wide range of financial instruments. From equities and bonds to structured products, derivatives, and private equity, our solution ensures smooth integration across asset classes, enabling effortless management of all instruments within a unified ecosystem. With a focus on flexibility and precision, we empower investment professionals to optimize operations, mitigate risks, and enhance portfolio performance. [Explore the full list of instruments we manage.]

Our solution guarantees data quality through clear and precise definitions of financial instruments. This clarity enables accurate management of corporate actions, transactions, and accounting processes. With advanced transaction modelling, automated corporate actions, collateral management, and detailed cash flow monitoring, AMINDIS optimizes efficiency and minimizes errors in managing complex, multi-party transactions.

With a strong emphasis on data integrity, AMINDIS structures issuer and counterparty information hierarchically to ensure greater transparency. This issuer-centric approach—focusing on managing and tracking issuer relationships—extends to ESG and financial indicators. By applying dynamic classification rules to issuer criteria, AMINDIS enhances not only compliance and reporting but also analysis, ensuring ESG factors are smoothly integrated into investment decisions.

KEY BENEFITS

CENTRALIZED INTEGRATION:

Manage all your financial instruments seamlessly within a single platform, ensuring smooth and consistent integration across a wide range of asset classes.

SCALABLE TO EVOLVING MARKETS:

As new asset classes and market trends emerge, easily adapt to manage increasingly complex instruments.

ENHANCED DATA ACCURACY:

Benefit from advanced data validation processes that ensure the highest level of accuracy and consistency across all your financial data.

EXPLORE MORE: RELATED TOPICS

LOOKING FOR MORE INSIGHTS? DISCOVER HOW OUR SOLUTIONS CAN TRANSFORM YOUR INVESTMENT MANAGEMENT PROCESS:

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

At AMINDIS, we believe that an efficient portfolio starts with a solid foundation. Our solution for financial instruments enables you to streamline data management, automate transactions, and ensure full compliance—allowing you to focus on optimizing performance, mitigating risks, and conducting trust analysis for accurate and reliable decision-making.

Ready to enhance your operational efficiency? Discover how AMINDIS empowers asset managers and asset owners with a flexible, fully integrated platform for seamless instrument management.

Trusted by Europe’s leading asset managers and asset owners.