DRIVE YOUR UNIT LINKED FUND BUSINESS AT SCALE

Unlock full automation and control across the entire lifecycle—within a single, unified platform

Unit Linked Fund—referred to as “Branche 23” in Belgium and “Unité de compte” in France—represents a fast-growing business line and a strategic focus for many insurers.

“These insurance funds aim to replicate the performance of one or several underlying funds, while embedding the specific features of an insurance contract.

To follow this trend, insurers must manage increasing operational volumes across thousands of policies. Moving from semi-automated workflows to full automation processes is now essential.

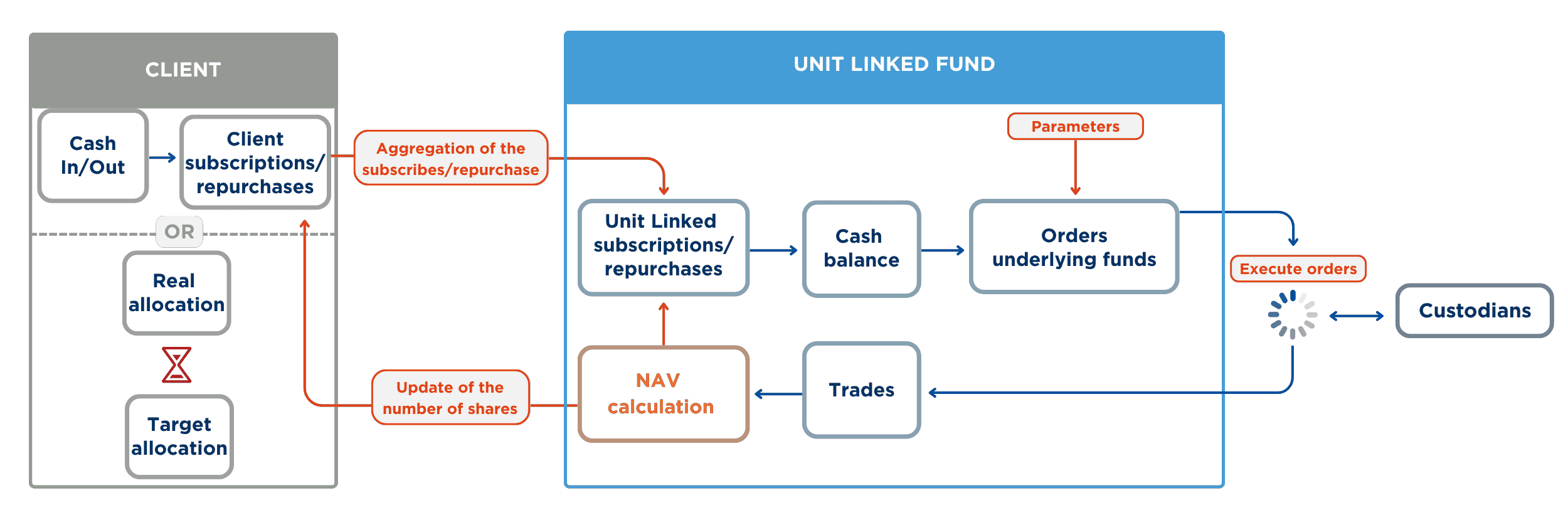

Managing this evolution means handling clients' subscriptions and repurchases from multiple sources, allocating across several underlying funds, executing subscriptions/repurchase orders, and publishing NAVs—all while avoiding costly timing mismatches. In fragmented environments, this leads to increasing operational risks and reduced scalability.

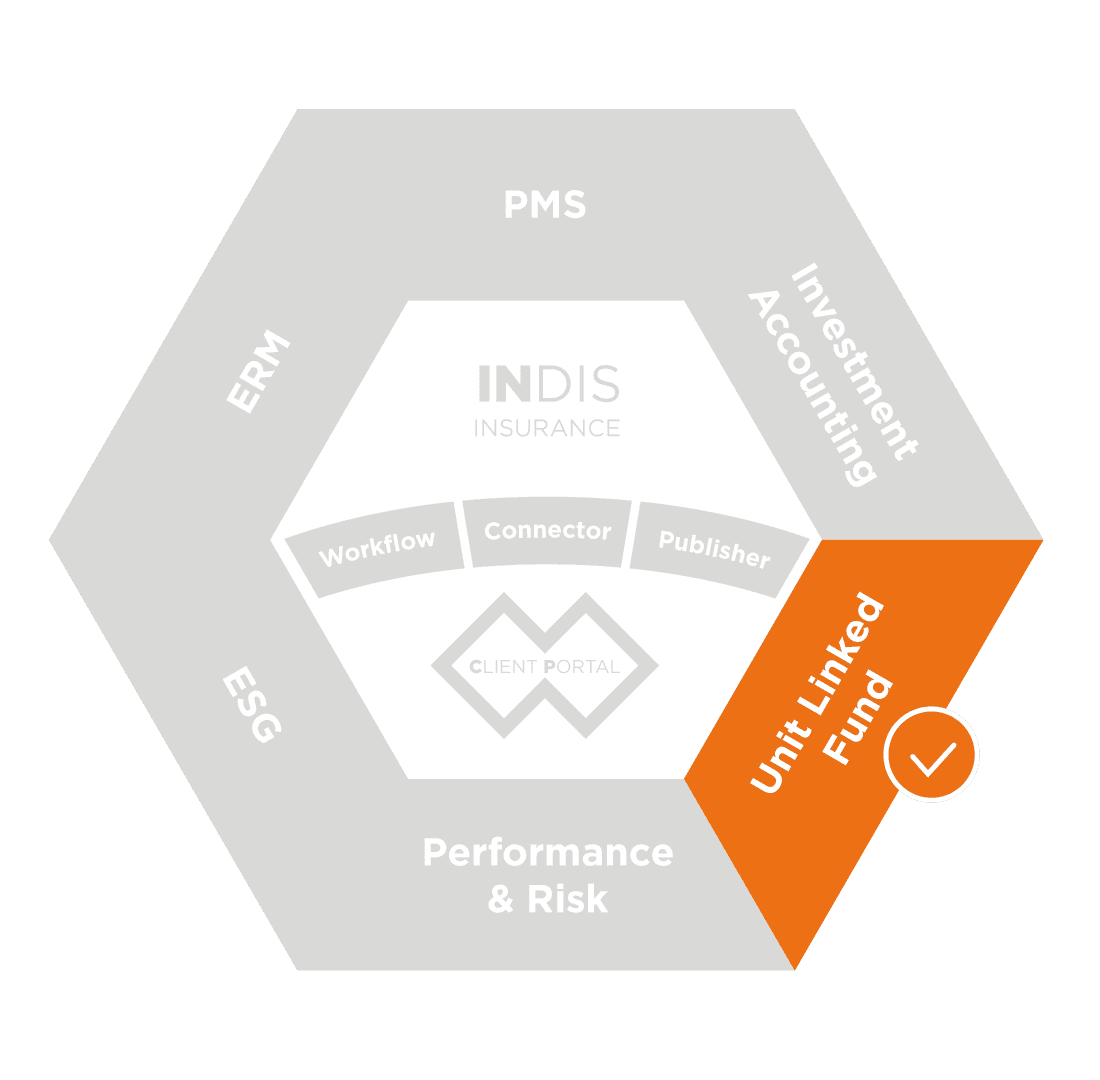

AMINDIS offers an all-in-one platform to support the entire Unit Linked fund lifecycle—from data intake to client factsheet.

CORE PROCESSES.

CORE PROCESSES.  SINGLE PLATFORM.

SINGLE PLATFORM.

AMINDIS consolidates the full Unit Linked Fund value chain into one powerful system—covering:

Subscription & repurchase aggregation

Subscription & repurchase aggregation

Automatic consolidation of client flows from multiple sources

- Support both unit-based and value-based client instructions.

- Dynamic allocation strategies and glide paths.

- Internal buffer options to limit transaction costs.

- Configurable thresholds: cash availability, minimum orders size, % allocations.

NAV calculation

NAV calculation

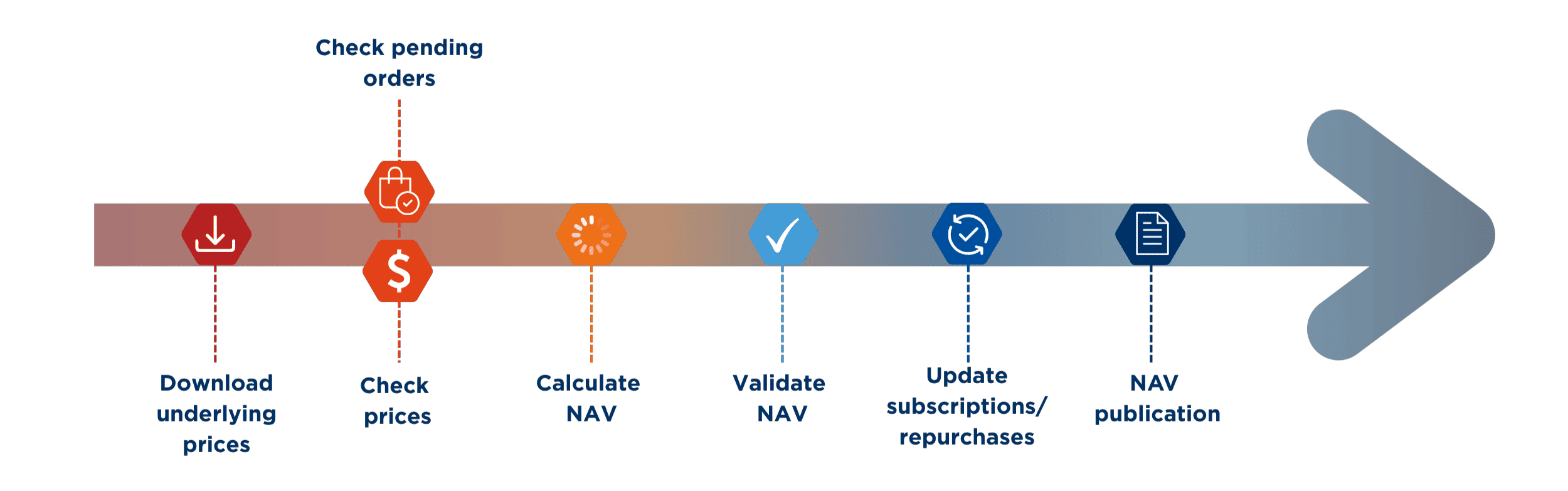

AMINDIS automates NAV calculation at the required frequency.

- Automatic import of the underlying funds' prices via our Connector.

- Advanced fee rule management with full NAV calculation auditability, supporting all pro-rata methods and the historization of rules and amounts.

- Automatic update of subscriptions/redemptions in standby with new NAV.

- Once calculated, NAVs are automatically shared with internal tools and external systems.

Factsheet & digital publication

Factsheet & digital publication

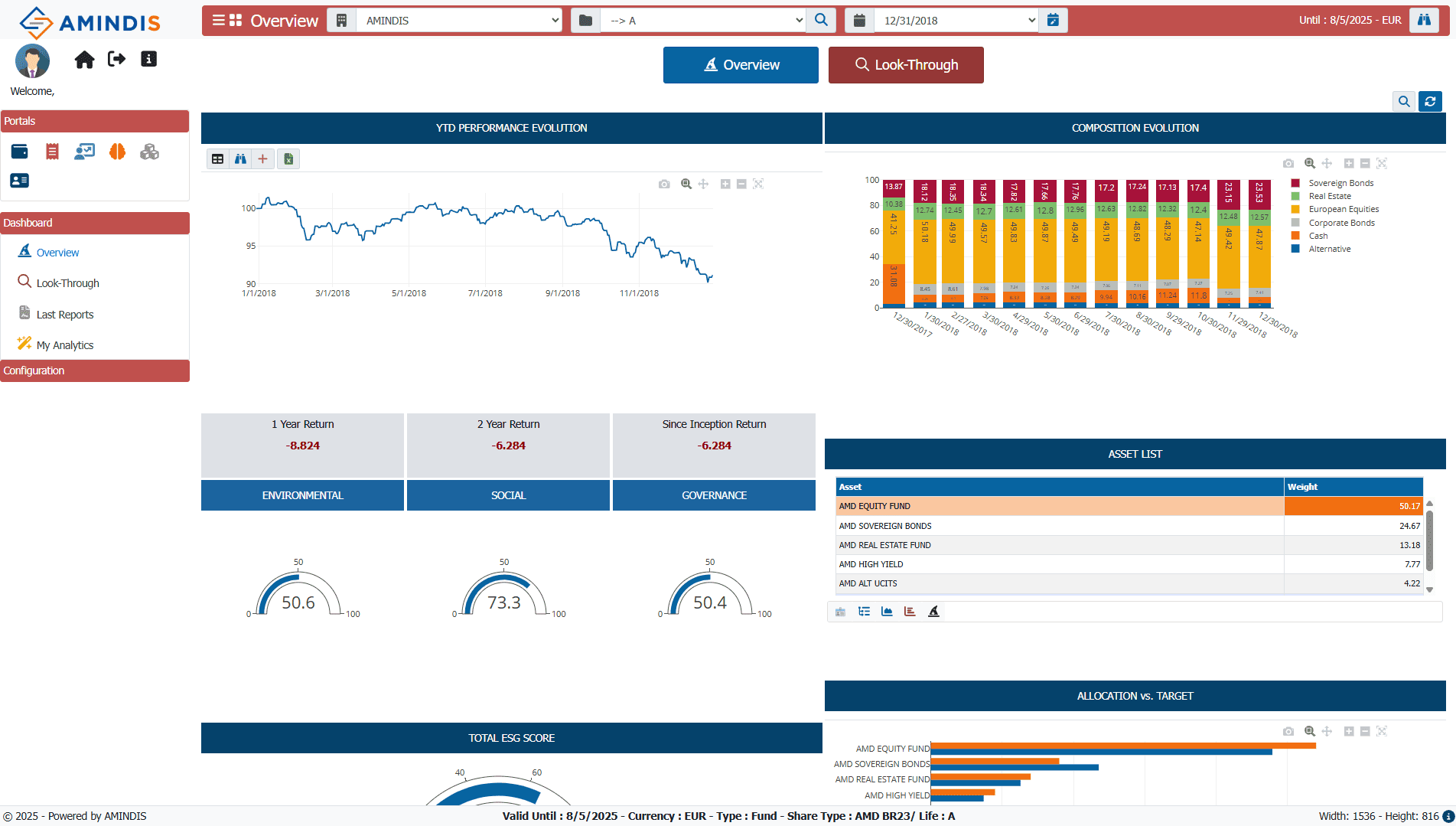

Generate periodic factsheets and them across digital channels, including the AMINDIS Client Portal.

- Comprehensive factsheet generation with all standard fund indicators—beyond unit-linked specifics—powered by our Publisher and Performance & Risk modules.

- Look-through on underlying holdings, fully supported and configurable.

- Dynamic data integration with the Client Portal module: a secure and branded interface offering clients personalized views, live portfolio insights, and document access.

- Customizable formats aligned with your corporate identity.

![]() Download a sample factsheet template.

Download a sample factsheet template.

INTEGRATED WITH INVESTMENT ACCOUNTING MODULE

All accounting processes are natively covered within the Unit Linked Fund module.

WHAT SETS AMINDIS APART

ONE CORE, FULL CONSISTENCY:

From subscriptions to final reporting, every process is managed within a single, integrated solution. No more system switching, no more cross-platform reconciliation.

LIFECYCLE AUTOMATION:

The entire fund lifecycle is automated: price import, NAV calculation, fee management, validation, and updates. Your team moves from execution to supervision.

INTREGATED REPORTING MODULE:

Branded factsheets with look-through data are auto-generated and distributed to internal and external systems, including the Client Portal for live client access.

EXPLORE MORE TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

MANAGE ALL THE UNIT LINKED FUND LIFECYCLE

With AMINDIS, every step of your Unit Linked Fund lifecycle is streamlined—from initial subscription to reporting—within a single platform. Dynamic allocation, NAV automation, factsheet generation, and publication are all seamlessly integrated to ensure full control.

Trusted by asset owners to manage their insurance life funds with agility, consistency, and confidence.

Book your personalized demo!