KEEP YOUR RISK MANAGEMENT UNDER CONTROL

One unified view of risk—from historical performance to real-time exposure and ex-ante simulation.

Risk management is getting more complex. Your tools should keep up.

Markets move faster. Correlations shift overnight. Regulatory expectations keep rising. Today, asset managers and asset owners need a consistent, reliable and transparent view of risk across every portfolio and time horizon.

From market and credit exposure to liquidity or counterparty constraints, each dimension must be measured with precision. Indicators such as VaR, volatility, or tracking error are part of daily operations—but turning numbers into insight is what truly drives performance and trust.

The real challenge lies in coherence. Ex-post analyses, ex-ante simulations, and real-time exposures often run on different tools and data sources, each with its own logic and timing. Modern risk management demands one coherent environment — from historical analysis to real-time exposure and ex-ante simulation.

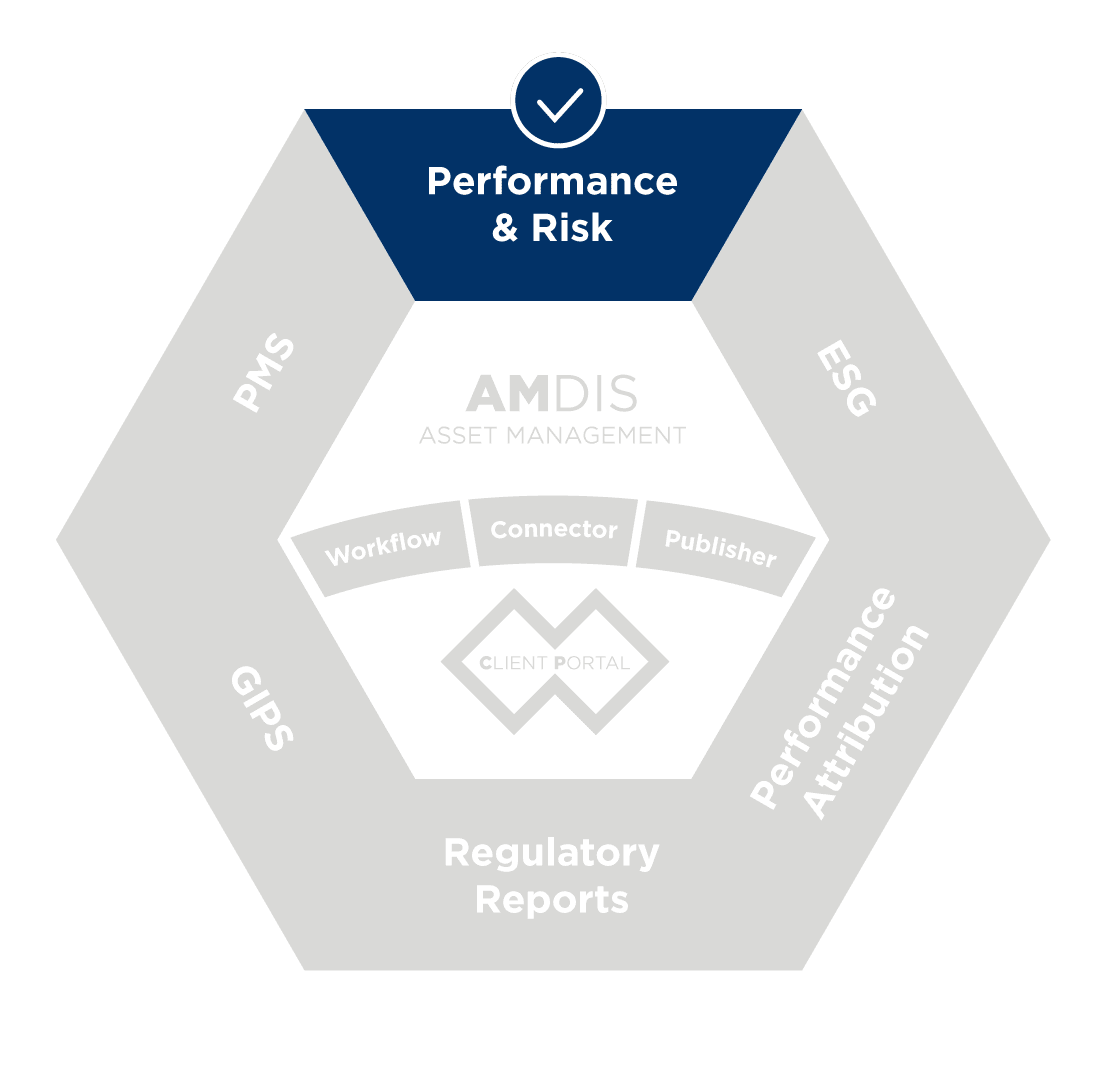

THE AMINDIS' APPROACH: ONE FRAMEWORK, FULL RISK CONTROL

AMINDIS brings every dimension of risk into one transparent, configurable and fully integrated environment—designed to deliver both analytical depth and operational simplicity.

From ex-post to ex-ante analysis, every perspective aligns in one coherent environment, ensuring consistency across teams and time horizons.

KEY BENEFITS AT A GLANCE

ONE INTEGRATED VIEW

Unify ex-post, exposure, and ex-ante analyses within a single, consistent framework.

SMARTER VISUALIZATION

Turn complex calculations into clear, decision-ready insights.

BUILT FOR EVERY ROLE

Provide a versatile risk framework for all stakeholders—from risk management and portfolio managers to clients.

EXPLORE MORE: RELATED TOPICS

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

Bring consistency, clarity, and transparency to your risk management process.

With AMINDIS, monitor today's exposures, simulate tomorrow's scenarios, and communicate your results with confidence.

Discover how our integrated platform helps you see risk from every angle—past, present, and future.