CARBON ATTRIBUTION

Measure your carbon footprint. Reveal your carbon performance.

Global commitments such as COP15 accelerate the shift toward low-carbon investment strategies. Reducing exposure to carbon-intensive issuers, reallocating capital toward credible transition leaders, or integrating carbon costs into valuation models has become a core part of modern portfolio construction.

Yet one essential question remains: How much carbon do these decisions really avoid—and what is their true impact on performance compared with a standard benchmark?

The financial reality of carbon: Carbon is no longer an abstract ESG metric. It has a direct and measurable financial impact.

Companies will need to purchase carbon certificates to cover future emissions, exposing late movers to rising costs.

Decarbonization strategies—aligned with long-term European objectives—aim to progressively reduce CO2.

For investors, the challenge lies in managing both sides of the equation: the future cost of carbon and the measurable financial impact it generates.

Doing so requires a transparent, consistent investment-grade methodology that explicitly link emissions and returns.

AMINDIS turns this complexity into actionable insights through a dual attribution framework: excess carbon & excess return.

A TWO-LAYER ANALYTICAL FRAMEWORK DESIGNED FOR PERFORMANCE-DRIVEN DECARBONIZATION

A clear, investor-ready methodology that connects carbon reduction with financial impact.

CARBON COST – Quantify future carbon emissions today

CARBON COST – Quantify future carbon emissions today

The first layer calculates each company's future financial carbon cost by estimated future expected CO2 emissions by estimated future carbon certificate prices.

Carbon cost modeling

AMINDIS uses discounted carbon methodologies to calculate the current cost using the interest rate curves.

Key inputs

From carbon cost to performance impact

Once the discounted carbon cost is know of each company, the methodology calculates all the effects on return.

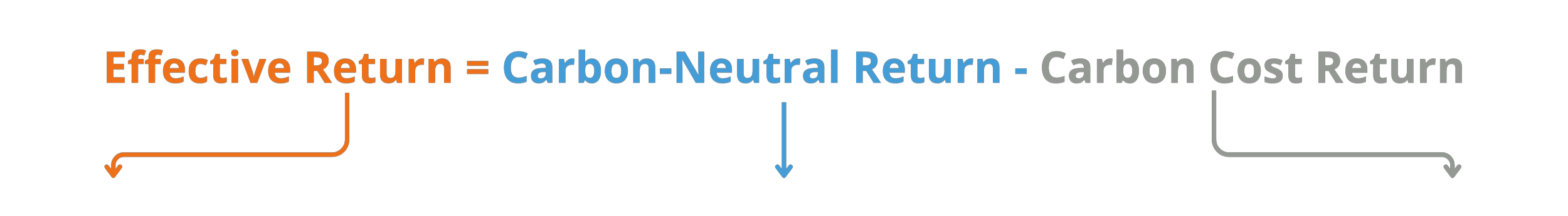

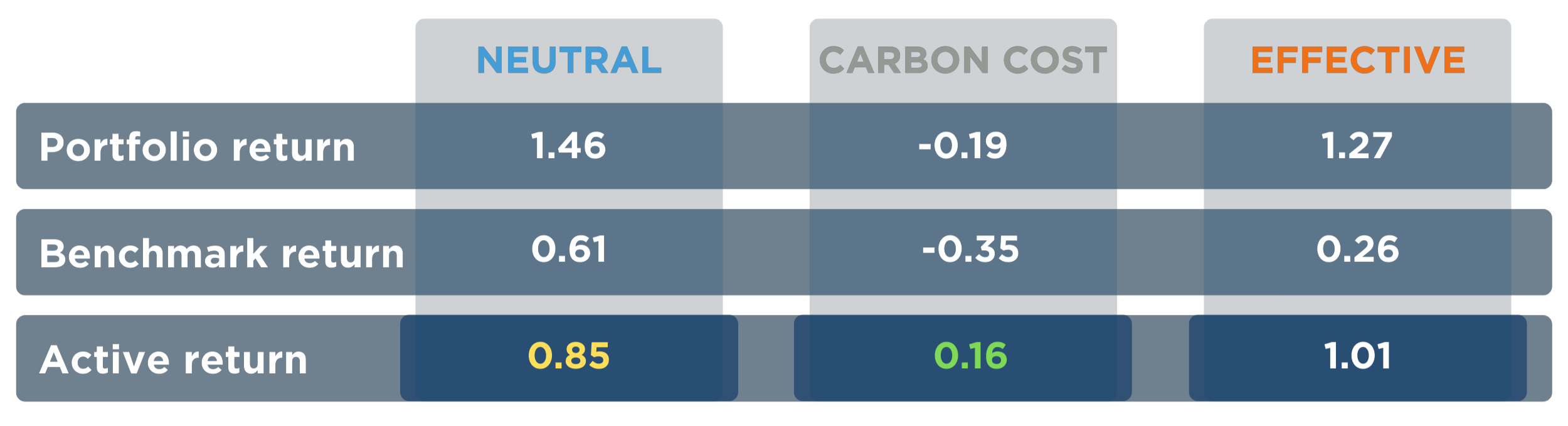

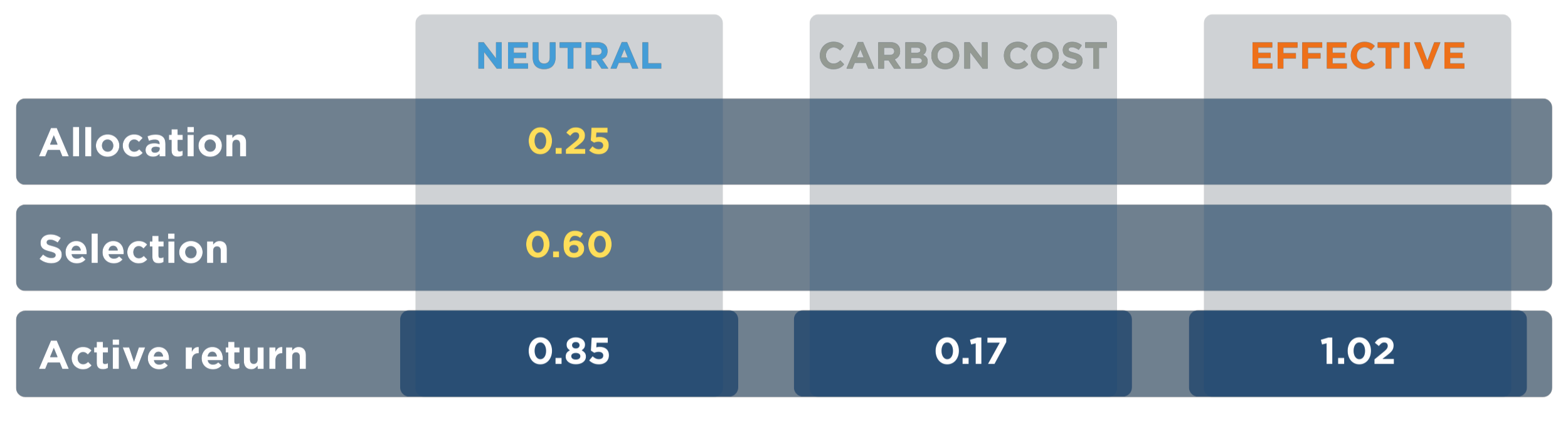

Effective Return:

The portfolio's final measured performance.

Carbon-Neutral Return:

Performance without the impact of future carbon costs.

Carbon Cost Return:

The isolated negative impact of future carbon certificates.

This approach is applied consistently across portfolios and benchmarks, ensuring a balanced and fully comparable view of both performance and carbon exposure.

CARBON ATTRIBUTION – See your strategy’s impact, side-by-side

CARBON ATTRIBUTION – See your strategy’s impact, side-by-side

The second layer makes decarbonization strategie measurable—both environmentally and financially.

Carbon perspective

Excess Carbon (Environnemental impact)

Quantify the carbon you truly avoid.

Compare your portfolio's adjusted carbon footprint against the benchmark (in tonnes of CO₂). Instantly identify the real carbon savings generated by your investment decisions, and clearly assess their environmental impact.

Performance perspective

Excess return (Financial impact)

Reveal the true value of Alpha

By neutralizing all future carbon costs in both portfolio and benchmark returns, the model isolates pure performance in a carbon-neutral world.

Performance attribution

Granular attribution, carbon-neutral world

Clear attribution without noise.

Pure alpha is decomposed into security selection and allocation effects, with full granularity available across sectors, countries, etc., providing your a complete, transparent view of value generation.

WHAT THIS BRINGS TO ASSET MANAGERS

CARBON COMMUNICATION

Quantify your carbon reduction achievements and demonstrate their tangible effects on performance. Turn your strategy into a clear, client-ready narrative.

GRANULAR INSIGHTS

Pinpoint the sectors and securities driving excess carbon and excess return.

CARBON-NEUTRAL RETURNS

Get a carbon-neutral view of returns to instantly identify which companies truly create value in a decarbonizing market.

EXPLORE MORE: RELATED TOPICS

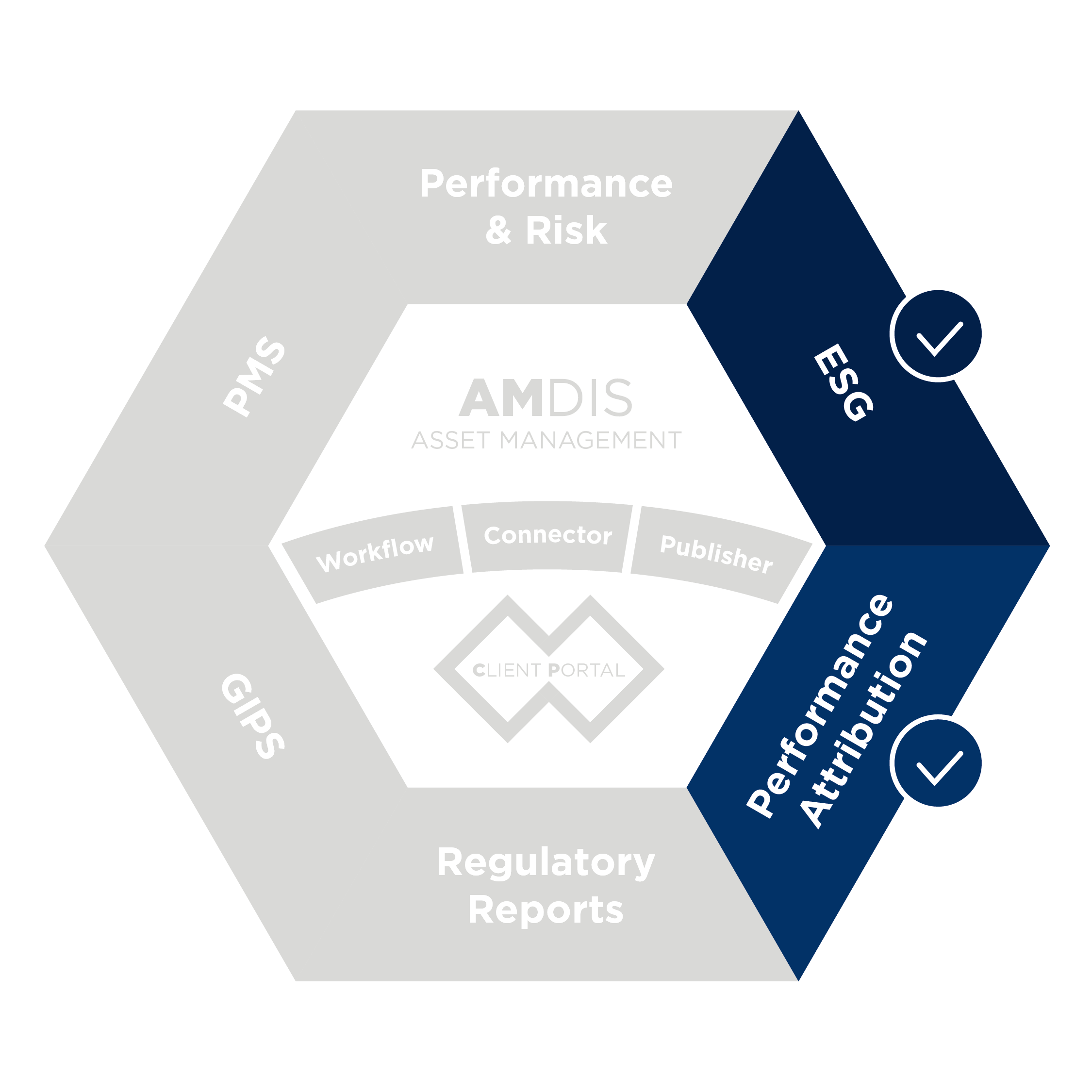

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision

TAKE CONTROL OF YOUR CARBON IMPACT

With AMINDIS, gain a clear, quantified view of how your decarbonization choices influence both carbon exposure and portfolio performance — through a transparent and investment-grade carbon attribution methodology.

Join the asset managers who are already strengthening their allocation decisions, proving the value of their carbon strategy, and enhancing client communication with reliable carbon-neutral insights.

Book your personalized demo and experience the power of carbon attribution.