New IRR

Impact | Risk | Return – The new equation to solve

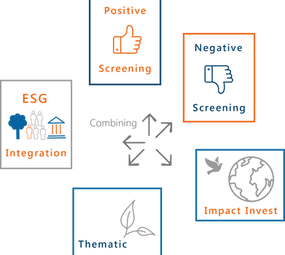

AMINDIS offers a new approach to address the challenges of responsible investment strategies. We developed integrated platforms to solve the NEW IRR equation by combining impact, risk, and return. AMINDIS software solutions support you to maximise your portfolio's overall financial and ESG performance. Our fully integrated systems offers a foundation to develop the most informed investment strategies. The New IRR approach measures the cross-effects between sustainability, risk and return.

ADVANTAGES OF THE NEW APPROACH

To combine Impact, Return and Risk in your investment strategies, you need an integrated information system with sufficient functional richness to develop your most complex investment strategies.

From philosophy to SRI

The first socially responsible fund was created 50 years ago. At this time, the growth of Sustainable Investing was perceptible, but until the first decade of the 2000s, sustainable finance seemed to develop as a "niche". Following the Kyoto Protocol, the environmental concerns of the 2000s boosted this new trend promoting Sustainable, Responsible Investment (SRI).

From SRI to Impact Investing

In the last ten years, sustainable finance has become an unavoidable topic. The driving force behind this acceleration is, on top of regulatory obligations, the pressure from clients/investors.

ESG investing has progressed from being an alternative offer to a mainstream product. Beyond SRI, the latest strategies seek to generate a financial return and create a positive social/environmental impact.

From Impact Investing to New IRR

The EY study shows a shift from investors to a more rigorous evaluation of ESG criteria and a perceptible tendency to use non-financial performance in investment decision-making.

The challenge is to connect non-financial disclosures and financial information and ensure effective collaboration between finance and ESG teams. The future of sustainability in investment management for the CFA is to consider impact investing as an additive to investment theory and not a rejection of foundational concepts: Risk and Return.

By combining Impact, Risk, and Return, AMINDIS offer the only solution allowing you to solve the equation with a holistic view across all business functions for premium investment decisions!