Title

Our target, your business

Image / Video

Image

Title

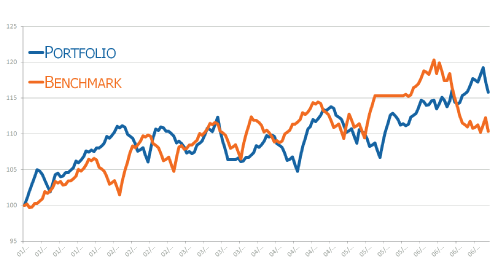

Performance & Risk Analytics

Body

- Choice of price providers for performance calculations

- Different methodologies of return calculations

- Indicators and ratios of performance

- Flexibility in period and frequency of calculation

- Comparison to ad hoc benchmarks or model portfolios

- Multi level fund transparency

- Risk attribution to identify which decisions have contributed to overall volatility

Title

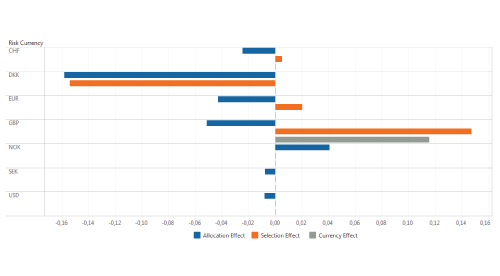

Performance Attribution

Body

- Auto integration of changes in the benchmark’s weight

- Including interaction, currency effects and chaining algorithms

- Brinson style models for equities and balanced portfolios

- Specific fixed income attribution models, such as

- successive spreads models or successive portfolio models

- Singer and Karnoski for international portfolios

Image / Video

Image

Image / Video

Image

Title

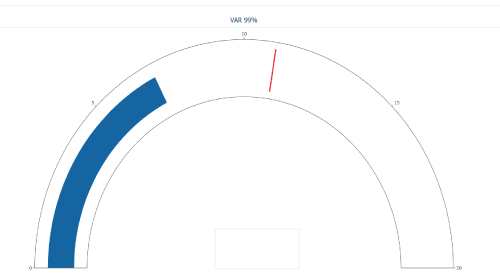

Risk Ex-ante

Body

- Calculation of key risk indicators for alternative investments, maximum drawdown, downside risk, recovery period, Sortino ratio,…

- Calculation of tracking errors and the contribution to tracking errors

- Calculation of Var and CVar under different hypotheses

- Risk models and security models customizations

Title

GIPS

Body

- Definition of firm(s) and composites

- Functionality to manage movement and events in composite

- Associate one or several benchmarks to a composite

- Wide range of standard GIPS compliance reports: Assets Under Management, Composite Performance Review, Composite Analytics, Information for RFP,...

CTAs

Image / Video

Image

Image / Video

Image

Title

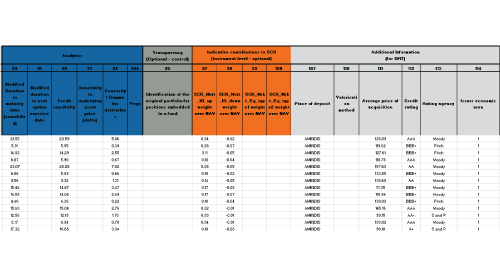

Solvency II

Body

- Generation of the Standard tripartite files and upgrades proposed by the "Club Ampère"

- Position based, by Share classes, management of Derivatives (Forwards, Forex, Futures,...)

- Harmonised standards for valuation of assets, own funds criteria eligibility

- Look-through approach and look-through "proxy"

- Calculation of Solvency Capital Requirements (SCR) Market figures at the asset level

Title

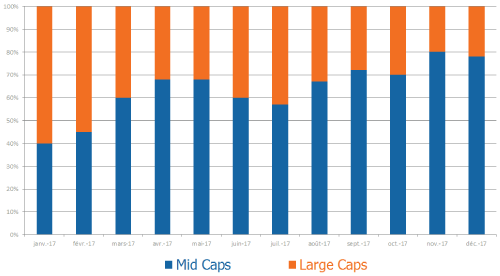

ESG Analytics

Body

- Extensive information at the issuer level

- Connect to every financial and extra-financial metrics on the market

- Combining ESG metrics with performance and risk analytics

- Full comparison with SRI and non-SRI Indices

- Extensive reporting layout to highlight SRI investment method

- Innovative ESG performance attribution methodology integrating ESG investment process

- Best in class

- Negative or positive screening

- Negative or positive screening and best in class

CTAs

Image / Video

Image