Title

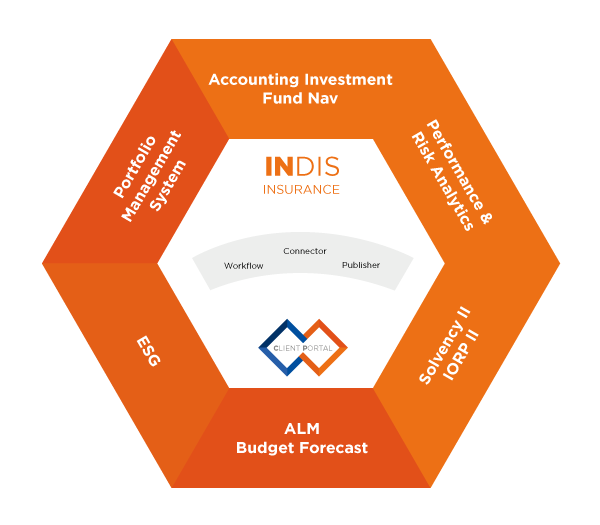

Our target, your business

Image / Video

Image

Title

Portfolio Management System

Body

- User friendly integrated Front to Back Office workflows support users in their day-to-day operations

- Customized classification and large capabilities in valuation of Securities

- Unique Datawarehouse guarantees Data Quality at all steps

- Management of Derivatives, Corporate Actions, Strategy, Collateral,...

- Track holdings in real-time

Title

Accounting investment & fund NAV

Body

- Mono or multi-currency accounting, in Average Cost or FIFO

- Parallel Accounting in various standards IFRS, Local Gaap,...

- Customized Booking Rules, Closing Operations Process,...

- Management of Subscriptions, Withdrawals and Fees

- Net Asset Value Computation

Image / Video

Image

Image / Video

Image

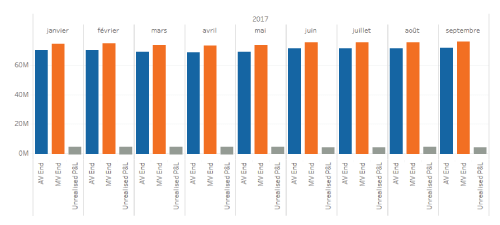

Title

Performance & risk analytics

Body

- Choice of price provider for performance calculation

- Different methodologies of return calculation

- Indicators and ratios of performance

- Flexibility in period and frequency of the calculation

- Accounting Value and Accounting P&L

- Decomposition of returns by currency effect

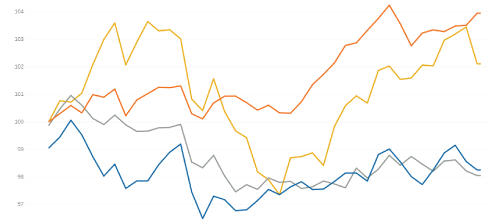

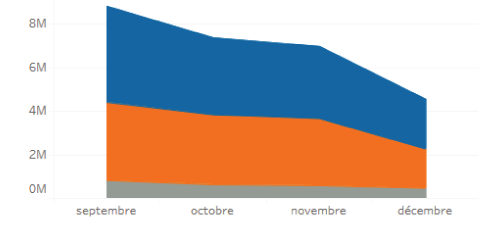

Title

ALM & budget forecast

Body

- Flexibility in definition of Risk Factors: Interest Rates, Spreads, Benchmarks, Inflation, Mortality, Longevity,...

- Monte Carlo Simulations

- Customized Product Evaluation: Bonds, MBS, Stocks, Derivatives, Liabilities Products,...

- Management of various strategies: Asset Allocation, Profit Sharing,...

Image / Video

Image

Image / Video

Image

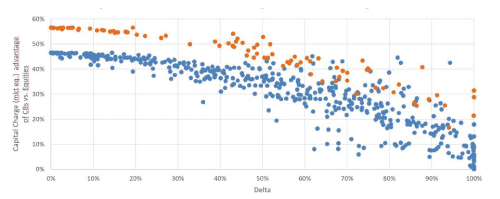

Title

Solvency II

Body

- Harmonised standards for valuation of assets, Criteria eligibility of own funds

- Look-through approach and look-through "proxy"

- Calculation of Solvency Capital Requirement (SCR) Market figure at the asset level

- QRT reports for assets and liabilities

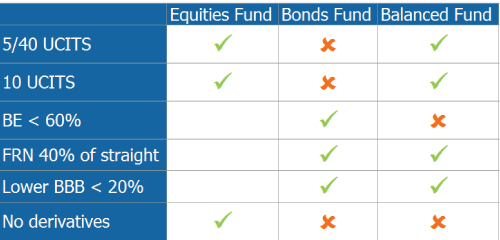

Title

Compliance

Body

- Customisation of management, risk and legal limits

- Definition of straight or conditional rules

- Specific syntax is available to allow for more sophisticated constraints

- Messaging system with different levels of alert

- Post trade compliance on demand for specific limit classes

Image / Video

Image

Image / Video

Image

Title

ESG analytics

Body

- Extensive information at the issuer level

- Connect to every financial and extra-financial metrics on the market

- Combining ESG metrics with performance and risk analytics

- Full comparison with SRI and non-SRI Indices

- Extensive reporting layout to highlight SRI investment method

- Innovative ESG performance attribution methodology integrating ESG investment process

- Best in class

- Negative or positive screening

- Negative or positive screening and best in class