NEW IRR: AMINDIS' INNOVATIVE APPROACH TO IMPACT, RISK & RETURN

Asset managers and asset owners face growing pressure to simultaneously analyze financial performance, risk, and ESG factors. However, many still rely on fragmented tools that silo these critical dimensions, creating inefficiencies and making it difficult to gain a unified view of any risk, performance and ESG indicator.

To make informed investment decisions, professionals need the ability to analyze Impact, Risk, and Return in multiple ways—whether individually, in pairs, or as fully integrated view. Combining these perspectives dynamically within a single system is essential to building robust, strikethrough investment strategies.

At AMINDIS, we bridge this gap with our native New IRR approach—a seamless integration of performance, risk, and ESG indicators in a single solution. This empowers decision-makers to drive sustainable investment strategies with confidence measuring impact on risk and performance.

OVERCOMING COMPLEXITY IN INVESTMENT ANALYSIS

The challenge for investors today is not just managing risk and return—it’s understanding how ESG factors correlate with financial indicators and risk exposure. The traditional approach, with disconnected tools and manual processes, creates:

Fragmented analysis, increasing operational costs, decision-making delays, and the risk of errors. The lack of a unified framework forces analysts to reconcile multiple data sources manually, leading to inefficiencies.

Limited integration, making it difficult to combine sustainability and financial indicators in the same aggregated view. Investors struggle to assess trade-offs clearly when these dimensions are analyzed separately.

Challenges in communication and adaptation across different investement portfolio. Without a flexible system, tailoring ESG and financial insights to each portfolio's unique characteristics becomes complex.

Without an integrated approach, gaining a holistic and adaptable view of your portfolio remains nearly impossible.

Is your current system limiting your ability to analyze impact, risk and return together?

AMINDIS AND ITS NATIVE VISION OF THE NEW IRR

AMINDIS introduces the New IRR (Impact, Risk, Return)—a revolutionary solution designed to streamline investment analysis through an integrated, fully customizable platform. By consolidating these critical dimensions into a single system, the New IRR empowers asset managers and asset owners to make strategic decisions with confidence.

The New IRR bridges the gap between ESG, risk, and performance indicators, ensuring a truly holistic and tailored investment analysis.

New IRR enables seven different analysis combinations: separately, in pairs, or all together—providing complete flexibility in portfolio analysis:

With AMINDIS' New IRR, asset managers and asset owners can:

Unify financial, risk and ESG indicators in a single, seamless framework.

Customize analysis dynamically based on our Building Block approach, allowing users to structure their analysis not only by asset class, region, or time horizon, but also by any combination of indicators and criteria that align with the investement policy. This enables the selection of any ESG axis or indicator, providing complete analytical freedom.

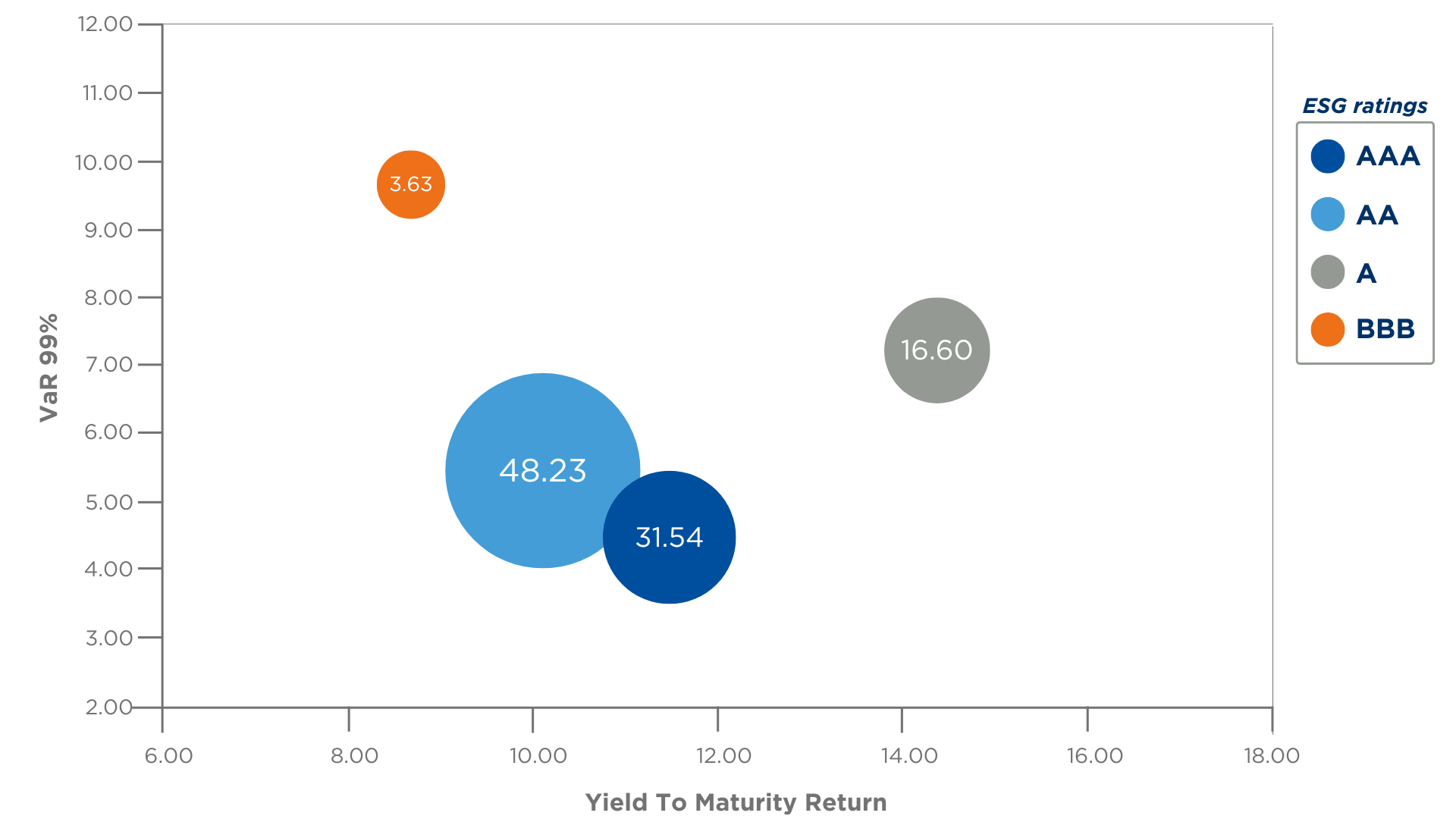

Leverage advanced visualization tools to explore how indicators interact, gaining insights into ESG, performance and risk correlations. Wether understanding cause-effect relationships between different ESG indicators or identifying potential risk exposure, users can visualize data in multiple formats to optimize decision-making. Our solution provides an intuitive view, allowing you to analyze your investments from multiple perspectives with IRR matrices:

IRR absolue matrix

IRR relative matrix

Ensure full consistency and flexibility by working with a single source of truth, where all data is interconnected.

Enable automatic benchmark comparison across multiple dimensions. Investors can assess risk, return, and ESG metrics against different benchmarks and portfolios, facilitating deeper market positioning insights.

Download a sample of our ESG, risk, and performance report and see how New IRR transforms investment analysis.

KEY BENEFITS OF THE NEW IRR

ALL-IN-ON SYSTEM:

reduce operational costs by 25% by eliminating inefficiencies from fragmented tools.

STRATEGIC DECISION-MAKING:

improve decision-making with a unified view of portfolio data.

FULL CONSISTENCY & FLEXIBILITY:

investors can define and compare any ESG, Risk and Return indicators across multiple dimensions.

ADVANCED PORTFOLIO ANALYSIS:

gain deeper insights by comparing portfolios against benchmarks to assess risk, return, and ESG alignement more effectively.

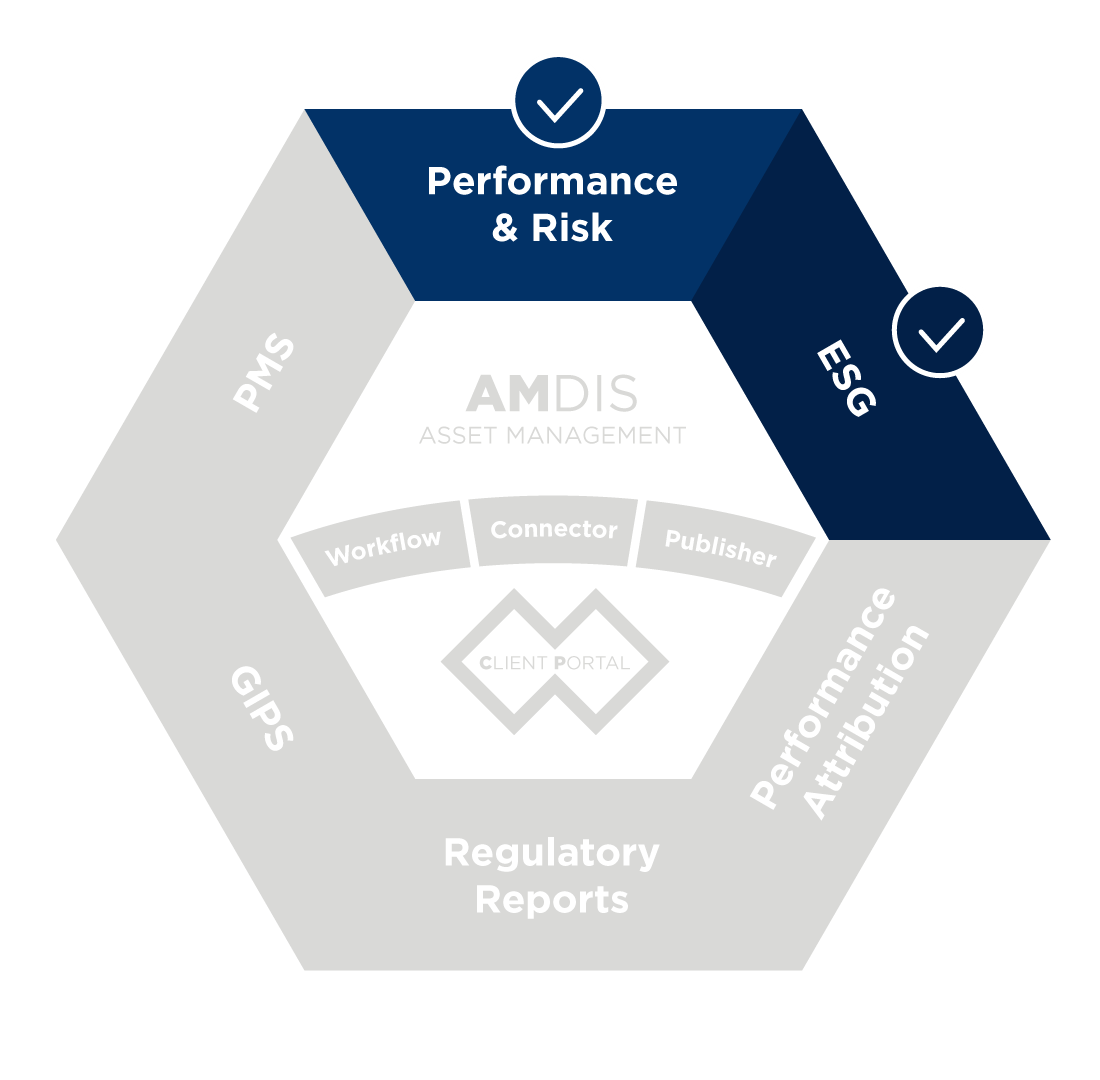

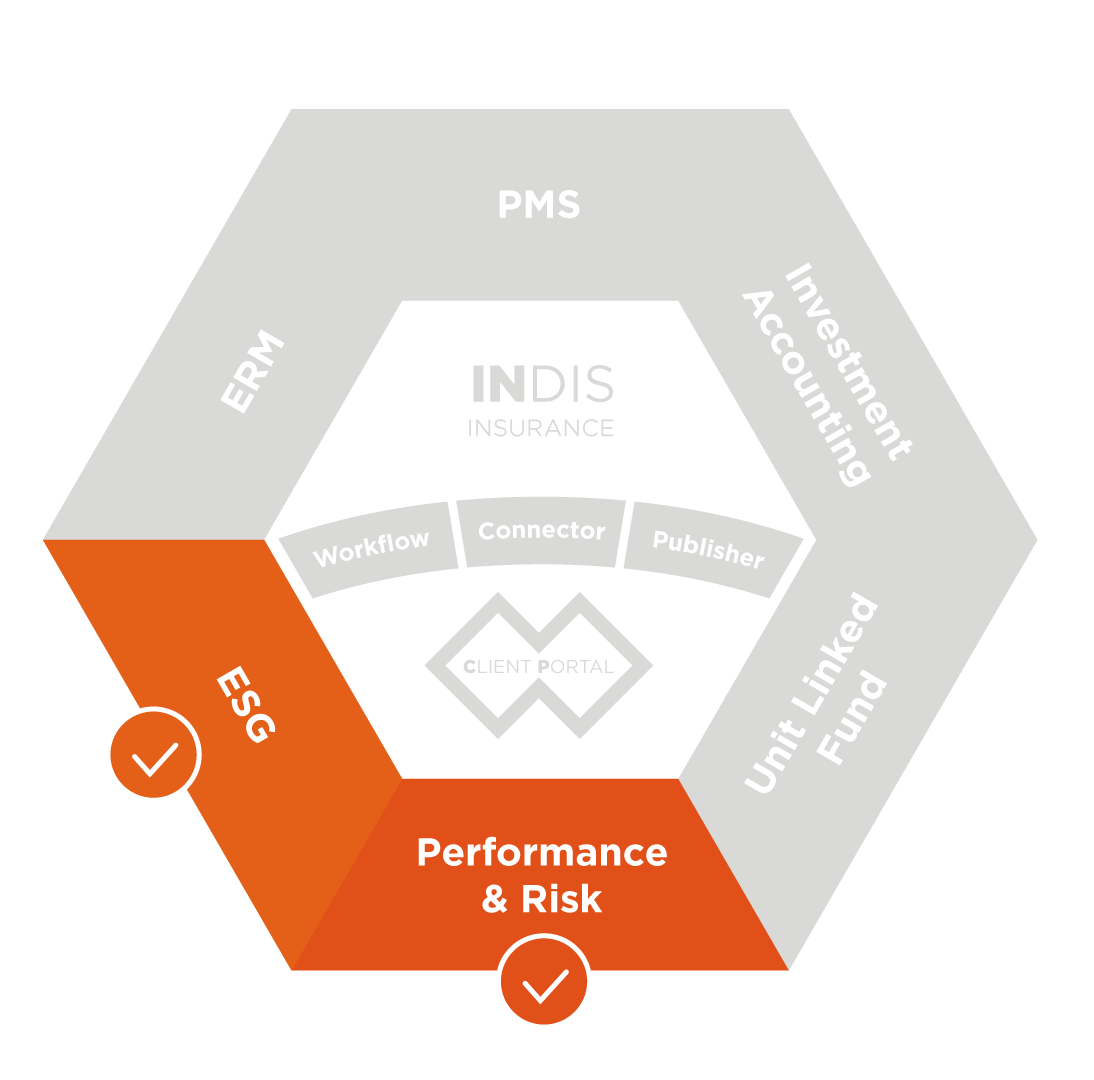

FROM INSIGHT TO IMPLEMENTATION: EXPLORE THE RIGHT MODULE

These modules form the core foundation to help you implement your processes efficiently and with precision.

TAKE THE NEXT STEP

At AMINDIS, we believe that true investment intelligence comes from a fully integrated approach. Our New IRR approach enables you to align impact, risk, and return seamlessly—so you can optimize performance, enhance sustainability, and ensure regulatory compliance.

Ready to elevate your investment strategies? Discover how the New IRR empowers portfolio analysis with a unified, customizable platform. Schedule your tailored demo today!

Experienced by Europe’s leading asset managers and asset owners.