EU Taxonomy Regulation

New tool to navigate the transition to a low-carbon, resilient and resource-efficient economy

Ambitious green objectives

As other international organizations, such as the United Nations and the OECD, the European Union has developed its own ESG framework.

The main objective is to navigate the transition to a low-carbon, resilient and resource-efficient economy, in accordance with the Agreements of the Paris, SDGs and EU Green Deal. In concrete terms, the taxonomy aims

- Identifying green activities

- Harmonizing green labels

- Preventing green washing

The European Union defines 6 environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

Consistent with the EU Action Plan on Financing Sustainable Growth, finance is a critical enabler of transformative improvements in existing industries in Europe and globally.

Participative development

The European Commission set up a Technical Expert Group (TEG) to assist in the development of the taxonomy. TEG is composed of 35 members from civil society, academia, business and the financial sector, as well as additional members and observers from EU and international public bodies. To ensure transparency, the Commission organised outreaches with a call for public feedback.

In its final report, the EU has decided to apply the new taxonomy in two stages: first by applying it to the first 2 climate objectives; and then by applying it to the 6 objectives.

Note: the first 2 climate objectives are climate change mitigation & adaptation

3 Groups of users

Note:

SDR = Sustainability-Related Disclosures in the Financial Services Sector

NFRD = Non-Financial Reporting Directive

Classification tool

The European Union defines a sustainable activity as an activity which contributes substantially to one environmental objective and avoids significantly undermining other environmental objectives - The EU introduced the original concept of DNSH - Do Not Significant Harm.

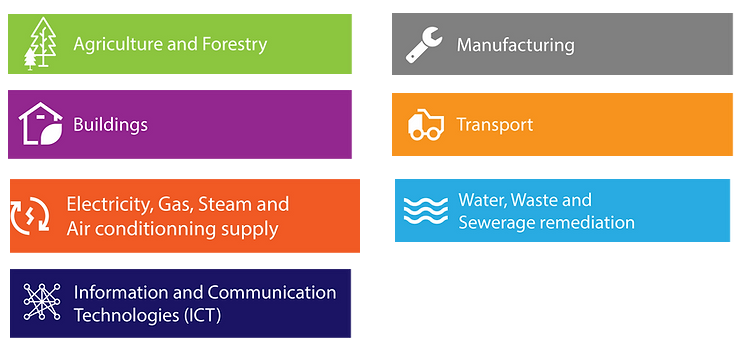

EU Taxonomy identifies 67 activities in 7 different sectors (Code NACE):

- Agriculture and Forestry

- Buildings

- Electricity, Gas, Steam and Air conditioning supply

- Information and Communication Technologies (ICT)

- Manufacturing

- Transport

- Water, Waster and Sewerage remediation

The EU Taxonomy sets performance thresholds, or technical screening criteria for economic activities which:

- substantially contribute (SC) to at least one of the 6 environmental objectives

- do not significant harm (DNSH) to any other five environmental objectives

- comply with minimum safeguards (ILO core labour conventions)

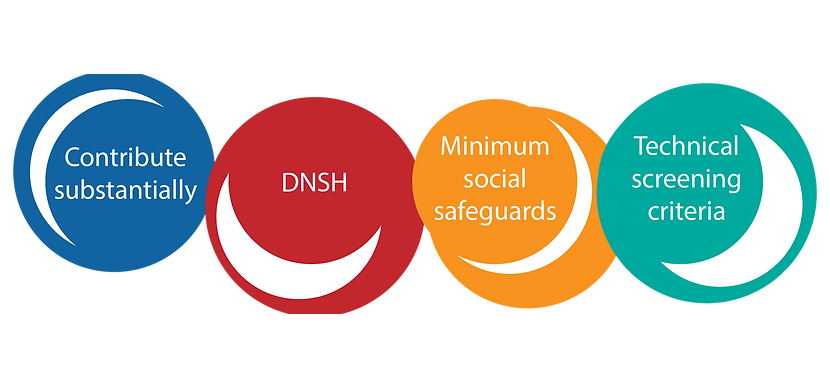

To be taxonomy-eligible, an economic activity must go through 4 steps

Implementation matters

Assessing a company's Taxonomy alignement according to the process above:

- The company's activities need to be broken down by turnover (or revenue, when appropriate) or capex and if relevent, opex.

- For each activity, the company validates if the activity is taxonomy-eligible by going through the 4 steps process (SC - DNSH - minimum social safegards - technical screening critera)

- For each Taxonomy-eligible activity, the company can apply the corresponding turnover as Taxonomy-aligned

Assessing a portfolio's Taxonomy alignement according to the process above:

Once relevant activities are identified in a company's portfolio and the Taxonomy alignement calculated, the overall portfolio's Taxonomy alignement can be calculated by a weighted sum of each company's Taxonomy alignement.

Our solution is ready

With the introduction of the new EU Taxonomy Regulation, we identify 2 major challenges for System Information:

- The management of the data

- Volume

- New data type

- Storage level - by economic activities and not by entity

- The use of data accros all business process

- Reporting to disclose taxonomy eligible or taxonomy-aligned part of portfolio by relevant breakdown

- Front Office to select Taxonomy Eligible Stocks

- Compliance to check Taxonomy Alignement Rules

- Regulatory reporting

The integrated softwares AM-DIS & IN-DIS provide business functions in line with state-of-the art potfolio analysis, including performance, risk and all ESG dimensions. The new EU Taxonomy has been integrated to respond to the disclosure oligations and to be able to be ready to produce new regulatory reporting.