ESAs suggest a new SFDR classification system

In 2019, the European Commission (EC) adopted the Sustainable Finance Disclosure Regulation (SFDR) to empower consumers to assess the ESG objectives of financial products. Amendments followed in 2020, with Regulatory Technical Standards (RTS) clarified in 2022. In 2023, the EC sought stakeholder input on these updates.

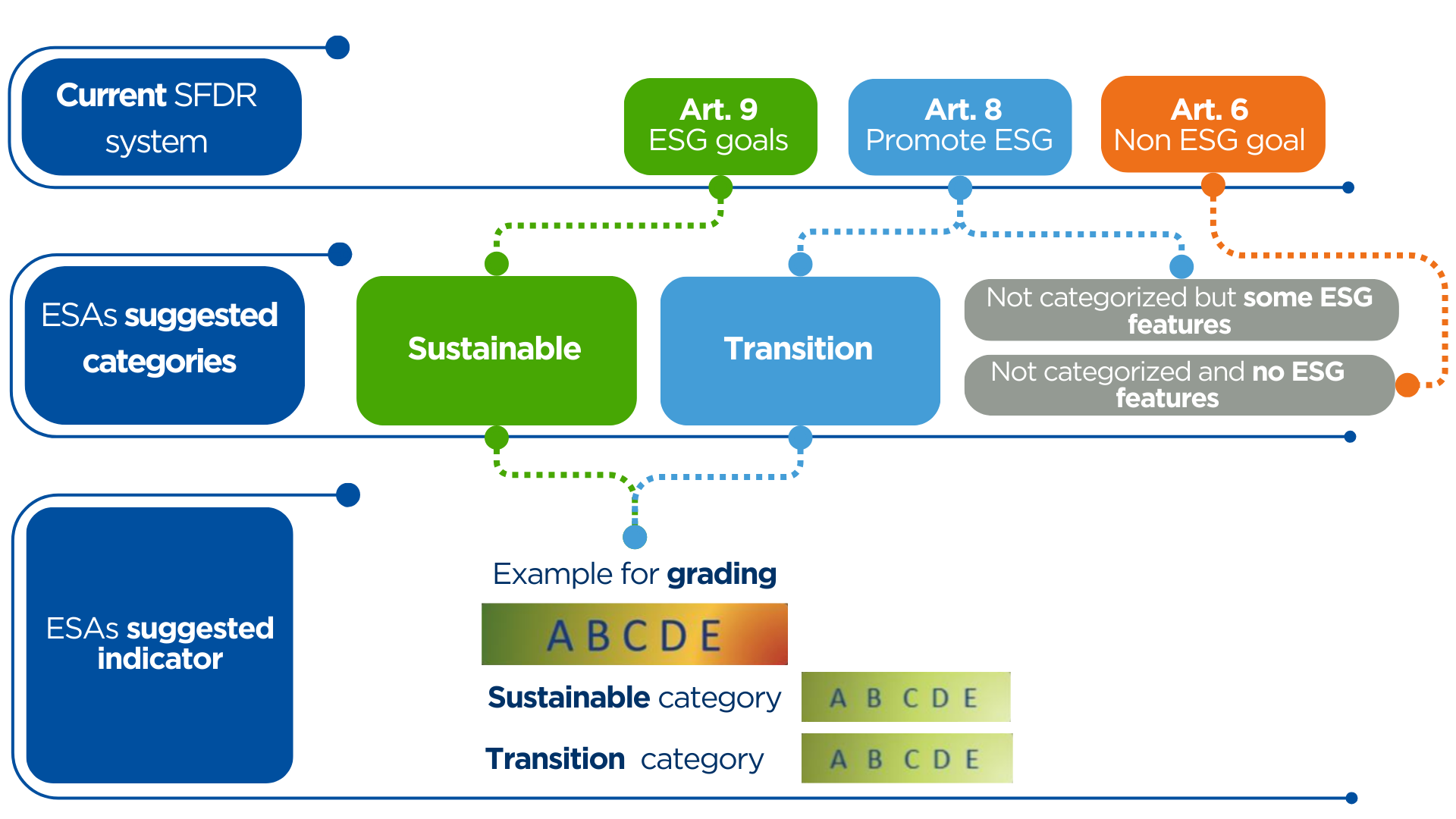

Following the publication of public consultation results in late December 2023, the European Supervisory Authorities (ESAs) have shared their perspective, aligning with stakeholders' views. The ESAs urge the EC to overhaul the current SFDR disclosure framework and consider implementing a robust labeling system.

Significant changes in the new SFDR system

The proposed changes suggest streamlining these classifications into two broader categories: "Sustainability" and "Transition."

1) Sustainability category: includes products that significantly contribute to sustainable development objectives, aligned with specific, detailed criteria rather than broad principles.

2) Transition category: encompasses products in the process of moving towards sustainability but may not fully meet the criteria for the Sustainability category yet. These products are evaluated based on their ongoing efforts to enhance environmental and social characteristics over time.

Additionally, there is a proposal for a new indicator grading system to assess and communicate the sustainability of financial products more effectively. This system aims to provide more transparent information to consumers and investors about how well products align with sustainable development goals and environmental standards.

Overall, these changes aim to simplify and enhance the clarity and effectiveness of the SFDR framework, ensuring that financial products are accurately classified and transparently communicated to consumers regarding their sustainability credentials.

What are the concrete implications for financial actors?

These improvements aim to clarify, refine, and synchronize ESG regulations and disclosure frameworks, enhancing consumers' understanding of the ESG goals of financial products. For asset managers, insurance companies, pension funds, financial advisors, and others, this will require flexibility, speed, and accuracy in processing ESG data, along with ongoing regulatory monitoring that AMINDIS can provide.

Benefit from Olivier van Elmbt's thorough study of the regulation, ensuring you save time and gain valuable insights tailored to your needs.

The word of our expert

As the SFDR framework evolves, ensuring compliance and optimizing your processes for current and upcoming regulations is crucial. At AMINDIS, we optimize these processes to align effectively with the ESA's latest guidelines. Our innovative fintech solutions offer advanced automation, comprehensive data aggregation, and unparalleled accuracy.

Our proactive regulatory monitoring keeps you ahead of changes, ensuring your processes stay up-to-date. Additionally, AMINDIS's team of regulatory experts provides advisory services to navigate complex environments and develop personalized compliance strategies.

Once your data is verified, our state-of-the-art tools seamlessly integrate and automate your ESG reporting processes. We use advanced technologies to enhance data processing, improve reporting accuracy, and boost operational efficiency. This approach ensures better compliance and significantly reduces the time and effort required from your team. Additionally, our solutions help you assess financial product performance, and our training programs and ongoing support keep you informed about regulatory requirements.

Our customizable solutions align with your compliance and reporting needs. Dedicated project managers work closely with your team from initial assessment to deployment, ensuring successful implementation. This approach ensures timely delivery, seamless integration, and efficient operation, minimizing disruption while maximizing value.

"With AMINDIS, you gain a partner bringing deep regulatory expertise, cutting-edge technology, and a collaborative project management approach. Trust us to help you navigate SFDR changes efficiently and effectively." — Olivier van Elmbt, Expert Financial R&D at AMINDIS.

Stay informed and ensure compliance with the latest SFDR requirements with AMINDIS by your side. Contact Olivier now to get started.